Kotak 811 Zero Balance Account Opening Online 2022 - All Hidden Fees and Charges | Full Review

Summary

TLDRThe script discusses opening a Kotak 811 account, explaining the zero balance feature and associated costs. It covers various account types like Kotak 811 Lite and Full Kevaai, and how to avoid annual fees. The video also details interest rates, fund transfers, unlimited transaction usage, and international ATM withdrawal fees. Additionally, it mentions debit card facilities, virtual cards, and transaction charges, providing a comprehensive guide to managing finances with Kotak 811.

Takeaways

- 😀 The video discusses the process and costs associated with opening a zero balance account.

- 💼 If you have opened a zero balance account or are planning to, there are no charges involved in my case, meaning no need to keep money in the account or worry about balance-related tensions.

- 📈 The video mentions different types of Kotak 811 accounts: Kotak 811 Cutting, Minimum Kotak 811, and Kotak 811 Full. It advises caution as certain accounts may be closed after a year if not used.

- 🏦 It is possible to open a Kotak 811 account from home, and the video provides instructions on how to do so.

- 📊 The account offers an interest rate of up to 3.5 to 4%, which is not common for zero balance accounts.

- 💡 The video explains how to avoid charges and suggests using the 'Free' option for transactions to avoid fees.

- 🔄 There is no limit on fund transfers using NEFT, IMPS, and UPI, and they can be used unlimited times.

- 💳 A virtual debit card is provided upon account creation, and it can be used for both online and offline transactions. A physical debit card can also be ordered online.

- 💵 International transaction fees are discussed, including charges for using international ATMs and the fees for transactions in foreign currencies.

- 📄 The account allows for free checking of balance and transaction elements, but physical bank statements incur a charge.

- 📞 The video mentions a single customer support number that can be used for all banking needs, emphasizing its convenience.

Q & A

What is the main topic discussed in the video script?

-The main topic discussed in the video script is about opening a zero balance account and the associated charges, features, and benefits of the Kotak 811 account.

What is a zero balance account and why might someone choose to open one?

-A zero balance account is a type of bank account that does not require the account holder to maintain a minimum balance. People might choose to open one to avoid minimum balance charges and to enjoy the convenience of banking without the pressure of maintaining a certain balance.

What are the different types of Kotak 811 accounts mentioned in the script?

-The script mentions three types of Kotak 811 accounts: Kotak 811 Cutting, Kotak 811 Minimum, and Kotak 811 Full Kavya.

What is the consequence of not using the Kotak 811 Cutting and Kotak 811 Minimum accounts for a year?

-If the Kotak 811 Cutting and Kotak 811 Minimum accounts are not used for a year, they will be closed automatically.

How can one avoid charges on a zero balance account in the script's case?

-In the script's case, the presenter mentions that there are no charges for not maintaining a balance in the account, thus avoiding any maintenance fees.

What is the interest rate offered on the Kotak 811 Full Kavya account, and is it fixed?

-The interest rate offered on the Kotak 811 Full Kavya account is between 3.5 to 4%, and it is not fixed, implying that it may vary.

What are the transaction limits for fund transfers in the Kotak 811 account?

-The script mentions that there are no limits for fund transfers via NEFT, IMPS, and UPI transactions in the Kotak 811 account.

What is the transaction fee for using an international ATM with the Kotak 811 account?

-The transaction fee for using an international ATM with the Kotak 811 account is 3 USD or 25 INR for a peaceful transaction.

What is the virtual debit card feature provided with the Kotak 811 account, and how can it be used?

-The virtual debit card feature allows users to make online and offline transactions using the Kotak 811 account. It is provided instantly when the account is created and can be used for both online and offline purchases.

What are the charges for using the physical debit card at an ATM for withdrawals?

-The charges for using the physical debit card at an ATM for withdrawals are five free transactions, after which a charge of INR 20 per transaction applies.

How can one get a physical debit card for the Kotak 811 account, and what are the associated charges?

-To get a physical debit card for the Kotak 811 account, one can order a Visa Classic Debit Card online. The associated charges include a nominal fee of INR 119 for the card and a transaction fee of INR 20 for each transaction beyond the free limit.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Kotak 811 Super Account Full Explanation | Kotak 811 Super account Benefits, Features, Charges

Dhan App Brokerage Charges | Dhan App Delivery, Intraday, Future & Options And DP Charge,

Best Bank For Regular Savings Account Opening

1. Obbligo di Aprire Partita Iva - Corso con Studio Allievi

State Bank Lotus Savings Account Charges & features 2024 : finance banking

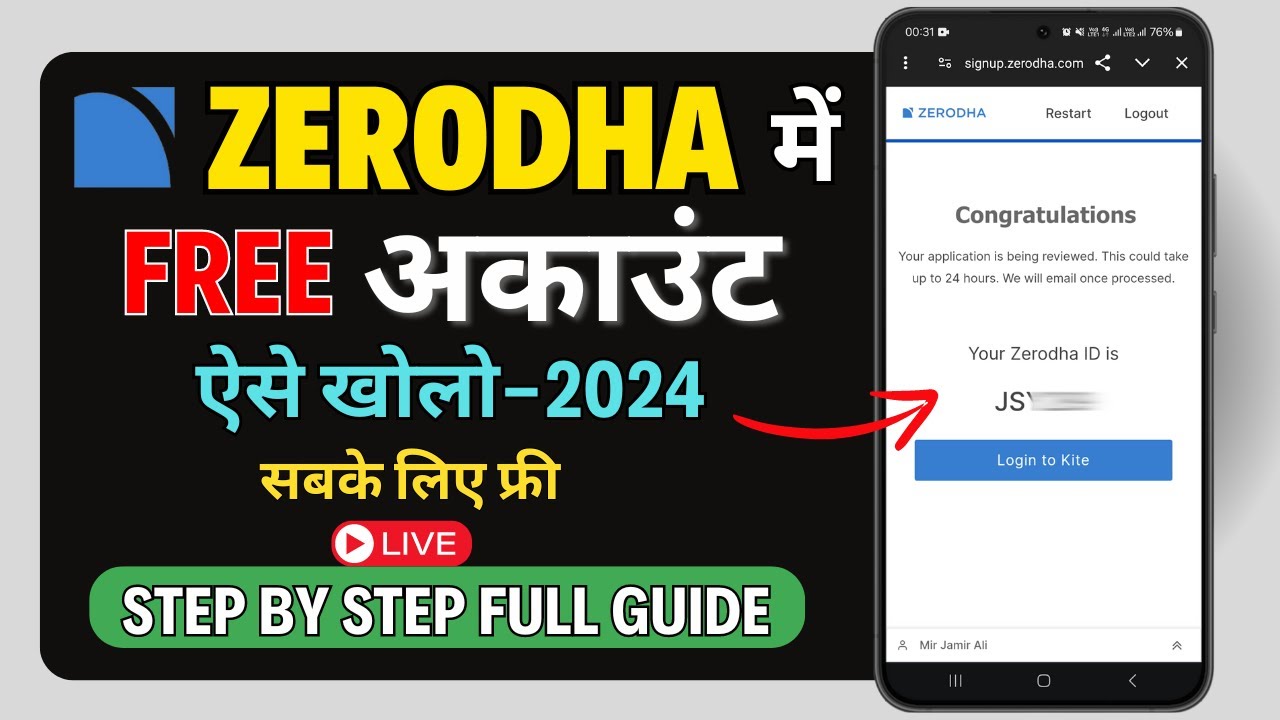

ZERODHA Account Opening | How to Open Free Account in ZERODHA | Step by Step Full Guide-2024

5.0 / 5 (0 votes)