Where Did My Profit Go?

Summary

TLDRIn this tutorial, Penny Lane explains how small business owners can connect their bottom-line profit to cash flow using two essential reports in QuickBooks: the Profit and Loss Report and the Balance Sheet. She walks through how to analyze these reports by modifying date ranges and adding sub-columns for previous periods and dollar changes. Penny emphasizes how cash flow can differ from profits, highlighting key factors like accounts receivable, debt repayment, and asset changes. She also explains how distributions or shareholder dividends can impact cash flow, offering a practical guide to better understanding QuickBooks financial data.

Takeaways

- 😀 The Profit and Loss (P&L) report is a basic and useful financial report that shows a company's bottom-line profit, but it doesn't explain how that profit relates to cash flow.

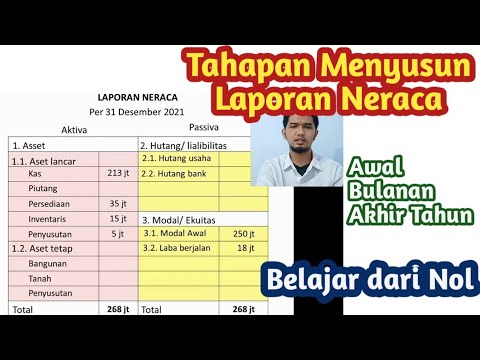

- 😀 To understand how your profit translates to cash flow, you'll need to analyze both the Profit and Loss report and the Balance Sheet together.

- 😀 The Balance Sheet can be customized in QuickBooks to show changes in assets and liabilities over a specific period, helping you understand what happened to your profit.

- 😀 Cash flow can be affected by changes in accounts receivable (money owed by customers) or changes in the value of assets such as savings accounts or inventories.

- 😀 The Profit and Loss report records income based on accrual accounting, meaning that sales made on credit (accounts receivable) are counted as income even though cash hasn't been received yet.

- 😀 The Balance Sheet report allows you to track changes in assets like checking accounts, savings, and receivables, and liabilities like accounts payable and loans.

- 😀 Changes in liabilities, such as paying off debt or reducing accounts payable, can affect cash flow, even if there’s no direct income being generated.

- 😀 The increase in assets (such as more cash in savings) and the reduction in liabilities (such as paying off loans) can reflect the flow of profits within the business.

- 😀 Understanding both the Profit and Loss report and the Balance Sheet is essential for a complete picture of your financial situation and cash flow.

- 😀 If there are discrepancies in how your financial reports are presenting data, it may indicate that there are errors in your QuickBooks setup that need to be addressed for accurate reporting.

Q & A

What is the main objective of this tutorial?

-The main objective of this tutorial is to teach small business owners how to relate their bottom-line profit to cash flow, using a profit and loss report and a modified balance sheet report.

What report is most commonly used by small business owners to track financial performance?

-The profit and loss report is the most commonly used financial report by small business owners due to its straightforwardness and ease of understanding.

Why is it important to compare the profit and loss report with the balance sheet?

-It is important to compare the profit and loss report with the balance sheet to understand how your bottom-line profit translates into actual cash flow, showing how profit is either retained in the business, paid out as liabilities, or remains as assets.

How do you modify the balance sheet report to analyze cash flow?

-To modify the balance sheet report, you select the date range (the same as the profit and loss report), click 'Customize Report' (or 'Modify Report' in older versions), and then add sub-columns for the previous period and dollar change.

What does the 'dollar change' column in the balance sheet report show?

-The 'dollar change' column shows the difference in amounts from one period to the next, helping to track how specific items, such as cash and liabilities, have changed over time.

Why might a business show a higher profit but have limited cash flow?

-A business might show a higher profit but have limited cash flow due to accounts receivable, where sales have been made but the payments are still pending, meaning the business has earned money on paper but not yet received it.

What does an increase in accounts receivable indicate?

-An increase in accounts receivable indicates that the business has earned income, but customers still owe money. This income is included in the profit and loss report but has not yet turned into actual cash.

How can liabilities affect cash flow?

-Liabilities can affect cash flow in two ways: if a business pays off debts, it uses cash that could have otherwise increased its available funds; conversely, taking on new liabilities can increase available cash, even if it doesn't directly contribute to profit.

What is the significance of 'retentions receivable' in understanding cash flow?

-'Retentions receivable' represents money owed to the business that has already been counted as income, but it is not yet in the bank, meaning it can impact the cash flow despite being considered as earned profit.

How does paying off liabilities impact the profit and loss report and cash flow?

-Paying off liabilities, such as loans or accounts payable, uses cash from the business but reduces the overall debt, improving the balance sheet by decreasing liabilities. This transaction doesn’t affect profit directly but affects cash flow.

How does the equity section in a balance sheet relate to cash flow?

-The equity section reflects changes in the business's ownership, including shareholder distributions or personal withdrawals. If the owner takes money out, it reduces cash but may not affect profit, thus impacting cash flow.

Why is it important to ensure that your QuickBooks reports are accurate?

-It is crucial to ensure that QuickBooks reports are accurate because discrepancies in the books could lead to incorrect financial analysis, making it difficult to properly relate profit to cash flow or to understand the true financial health of the business.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

5.0 / 5 (0 votes)