Myob Accounting Perusahaan Jasa - Laporan Keuangan, Backup & Restore

Summary

TLDRThis video tutorial covers the essential steps of creating financial reports for service companies using Mayob Accounting. It introduces various financial statements, including the Profit and Loss Statement, Balance Sheet, Cash Flow Statement, and Owner's Equity Changes. The video explains how to generate and customize these reports within Mayob Accounting, save them as PDFs, and print them for official use. Additionally, it emphasizes the importance of creating backups to safeguard financial data and demonstrates how to back up and restore files effectively. This guide is useful for users aiming to manage and protect financial records efficiently.

Takeaways

- 😀 Mayo Accounting is used to prepare financial reports for service companies.

- 😀 The main types of financial reports are Profit and Loss (P&L), Balance Sheet, Cash Flow, and Owner’s Equity.

- 😀 The Profit and Loss report summarizes the company’s income and expenses for a specified period.

- 😀 The Balance Sheet lists the company's assets, liabilities, and equity at a given time.

- 😀 The Cash Flow Statement shows the cash inflows and outflows during a period of operations, financing, and investing.

- 😀 The Owner's Equity Report tracks changes in the owner’s equity over a specific period.

- 😀 Reports in Mayo Accounting can be customized to fit specific date ranges (e.g., January 1st to January 31st).

- 😀 Financial reports generated in Mayo Accounting can be saved or printed in PDF format for further use.

- 😀 Backups of accounting files are crucial to protect data from corruption or loss.

- 😀 Backups in Mayo Accounting can be saved in a zip file format and restored when needed.

- 😀 The process of restoring data involves selecting the backup file and specifying a storage location for recovery.

Q & A

What is the purpose of preparing financial reports for service companies?

-The purpose of preparing financial reports for service companies is to provide information about the company's financial position, performance, and cash flows, which is useful for decision-making and accountability.

What are the types of financial reports discussed in the script?

-The types of financial reports discussed in the script are: Profit and Loss Statement, Balance Sheet, Statement of Changes in Equity, Cash Flow Statement, and Notes to the Financial Statements.

What is the Profit and Loss Statement, and what does it show?

-The Profit and Loss Statement is a summary of a company's revenues and expenses over a specific period. It shows the company's financial performance, including its net profit or loss.

How is the Balance Sheet defined and what does it include?

-The Balance Sheet is a financial statement that lists all the company's assets, liabilities, and owner's equity at a specific point in time. It shows the company's financial position.

What is the Cash Flow Statement, and why is it important?

-The Cash Flow Statement is a report that shows the impact of operating, financing, and investing activities on a company's cash position during a specific period. It is important for understanding the company’s liquidity and cash management.

What role do the Notes to the Financial Statements play?

-The Notes to the Financial Statements provide additional information that supports the main financial reports, offering context and explanations about the company's financial performance.

What is the process of generating a financial report using the Mayo accounting system?

-To generate a financial report in the Mayo accounting system, you need to access the appropriate menu (such as 'Report' for Profit and Loss), set the date range, customize the report, and then print or save it as a PDF.

How can a user save a financial report generated in Mayo accounting software?

-A user can save a financial report by selecting the 'Print' option, choosing the printer, selecting 'PDF' as the format, and then choosing the folder where the report will be saved.

What is the function of creating a backup file in accounting software?

-The function of creating a backup file is to safeguard important data from loss due to system errors, viruses, or other risks. It ensures that the company's accounting data can be restored if necessary.

What is the procedure to create a backup in Mayo accounting software?

-To create a backup in Mayo accounting software, select 'File' and then 'Backup', check for errors, choose a location for saving the backup, and click 'Save' to complete the process.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

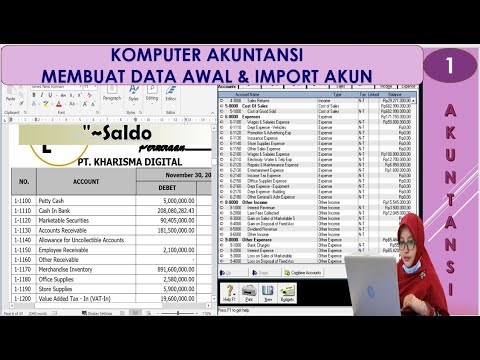

PT Kharisma Digital - Cara Membuat data Awal Perusahaan dan Import Daftar Akun

UNNES Laporan Keuangan Konsolidasi pada Akuisisi : Metode Ekuitas 2

Cara Input Bukti Memorial (Adjusment) || Myob PT. SEJAHTERA || Part. 7

Tutorial Zahir Accounting 6 - Perusahaan dagang

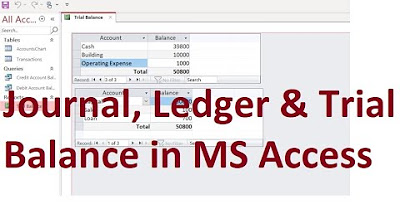

MS Access; Journal, Ledger & Trial Balance Database from scratch (File Available); Urdu/Hindi

"CARA MUDAH MEMAHAMI SIKLUS AKUNTANSI PERUSAHAAN DAGANG "

5.0 / 5 (0 votes)