Cara Membuat Laporan Neraca dan laporan akhir tahun

Summary

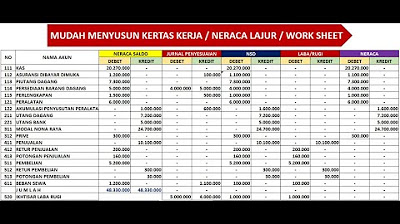

TLDRThis video provides a detailed tutorial on how to create a financial report, specifically focusing on the balance sheet (Laporan Raja). It covers key components such as assets, liabilities, and equity, and demonstrates how to generate a balance sheet using examples, including an analysis of a business venture like a cooperative. The video also explains how to calculate profit and loss, as well as how to adjust figures monthly and annually. The tutorial is aimed at helping users understand financial reporting for small businesses and cooperatives, using clear, practical examples and step-by-step instructions.

Takeaways

- 😀 The script introduces the concept of financial reports, specifically focusing on the 'Laporan Raja' or balance sheet.

- 😀 Laporan Raja is a financial report that provides an overview of the financial position of a business, including the inflow of funds and how they are distributed across the business operations.

- 😀 The three main components of Laporan Raja are assets (Aset), liabilities (Hutang), and equity (Modal).

- 😀 Understanding the accounting equation is crucial, where assets = liabilities + equity.

- 😀 The balance sheet can be presented in two formats: either as a side-by-side comparison (Aktiva vs Pasiva) or in a top-to-bottom layout.

- 😀 The script illustrates how to create a Laporan Raja using an example of a Bumdes (village-owned business) that sells fertilizer.

- 😀 Initial operations involve assessing the business, determining the unit of business, calculating purchase and sales prices, and securing funding.

- 😀 The balance sheet format includes both current assets (e.g., cash, receivables, inventory) and fixed assets (e.g., land, machinery).

- 😀 Monthly income statements and financial adjustments are demonstrated, showing how changes in sales and expenses affect cash flow and profitability.

- 😀 The balance sheet at the end of the year is used to summarize the financial performance of the business, showing how the profit (laba) is distributed and managed within the company.

Q & A

What is the purpose of a financial statement?

-A financial statement, specifically a balance sheet (laporan raja), shows the financial position of a business, detailing where the money is in the operations and how the capital invested has grown or developed.

What are the main components of a balance sheet?

-A balance sheet consists of three main components: assets, liabilities, and equity. These elements help determine the financial position of a business.

How is accounting equation related to the balance sheet?

-The accounting equation, which states that assets equal liabilities plus equity, is fundamental to a balance sheet. This equation ensures that both sides of the balance sheet are equal.

What are the two sides of a balance sheet?

-The two sides of a balance sheet are the asset side (on the left) and the liability and equity side (on the right). Both sides must balance, meaning the total value of assets equals the sum of liabilities and equity.

What is the difference between current and non-current assets?

-Current assets are assets that can be easily converted into cash or used within one year, such as cash, accounts receivable, and inventories. Non-current assets are long-term investments, such as land and equipment.

Can you provide an example of a business scenario for creating a balance sheet?

-For example, a village-owned cooperative (bumdes) could decide to sell fertilizer as its business unit. It would need to analyze the potential profits, invest in necessary supplies like inventory and equipment, and then create a balance sheet based on the initial capital, inventory purchases, and remaining cash.

How do you calculate the profit or loss for a business in a given month?

-The profit or loss is calculated by subtracting the operational costs (like the cost of goods sold and operational expenses) from the total revenue. For instance, if a cooperative sells 250 bags of fertilizer at a price of 140,000 each, their revenue is 35 million. Then, subtracting the costs like the cost of goods sold and operational costs gives the net profit or loss.

What factors affect the balance sheet of a business?

-Several factors affect a balance sheet, including inventory purchases, sales revenue, operational expenses, and capital invested. These elements directly influence both the asset and liability sides of the balance sheet.

How do you create a monthly balance sheet for a business?

-To create a monthly balance sheet, you need to record the business activities of the month, such as sales, expenses, inventory changes, and revenue. For example, if the business earns 21 million in revenue and incurs operational expenses of 4 million, the remaining amount is considered the profit or loss, which will then be added or subtracted from the balance sheet.

What happens at the end of the fiscal year in the balance sheet?

-At the end of the fiscal year, the balance sheet reflects the year-end figures, including total revenue, expenses, profit or loss, and changes in assets, liabilities, and equity. Additionally, any retained earnings or reinvested profits from the year are recorded as part of the equity section in the balance sheet.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

LAPORAN HARGA POKOK PRODUKSI

KERTAS KERJA - NERACA LAJUR - WORK SHEET - PERUSAHAAN DAGANG

The BALANCE SHEET for BEGINNERS (Full Example)

Giải thích BẢNG CÂN ĐỐI KẾ TOÁN - Ví dụ BCĐKT của Vinamilk và Vingroup

BAB 4 Aktivitas Berbasis Riset Pencatatan Laporan Keuangan (Penilaian SMK - Akuntansi 11)

NGERTI AKUNTANSI TANPA MENGHAPAL [PART 3]: Logika Utama Membuat & Membaca Laporan Keuangan.

5.0 / 5 (0 votes)