Billionaire investor Mark Cuban: Our place in the world depends on our ability to invest in AI

Summary

TLDRIn a dynamic discussion, panelists debate the implications of corporate tax policies, the national debt, and inflation, highlighting the impact of stock buybacks on revenue generation. They also address the necessity for industrial policy in the face of global competition, particularly in AI and manufacturing. The conversation touches on immigration and its economic effects, emphasizing the need for strategic governmental approaches. Throughout, the importance of accountability in corporate pricing practices and the broader economic landscape is underscored, reflecting deep concerns about fiscal responsibility and national security.

Takeaways

- 😀 Candidates are not addressing the national debt or deficit in their campaigns.

- 😀 There is a competition among candidates regarding tax policies and revenue generation.

- 😀 Taxing corporate stock buybacks could generate significant revenue and alter corporate behavior.

- 😀 A strong focus on AI investment is crucial for maintaining military dominance and economic competitiveness.

- 😀 The manufacturing sector has faced challenges post-pandemic, with many companies being small and less competitive.

- 😀 There is a discussion about the impact of tariffs on inflation and corporate behavior.

- 😀 Immigration and illegal immigration are seen as factors affecting job growth and economic stability.

- 😀 Strategies for corporate tax rates and dividends could stimulate economic growth and investment.

- 😀 Price gouging and inflation are contentious issues, with differing views on their causes.

- 😀 Candidates' differing approaches to manufacturing policies reflect broader economic strategies.

Q & A

What is the primary belief of the candidate discussed in the transcript?

-The candidate believes that the country needs to come together to address its challenges.

Why do the candidates not talk about the debt or deficit?

-The discussion suggests that it's seen as a giveaway, with a competition on who can promise more without addressing these issues.

What tax rate is mentioned for corporate taxes, and how does it compare to tariffs?

-A corporate tax rate of 28% is mentioned, which is still cheaper than a tariff of 20%.

What alternative revenue sources are proposed to address the deficit?

-Taxing stock buybacks is suggested as a way to generate more revenue and reduce the deficit.

How do stock buybacks affect corporate behavior according to the discussion?

-Taxing buybacks could change corporate behavior by pushing companies towards dividends instead of merely repurchasing shares.

What is the concern regarding U.S. military dominance?

-There's a belief that the U.S. must invest in AI technology to maintain its military superiority.

What is the discussion around manufacturing and tariffs?

-The conversation highlights the challenges of U.S. manufacturing and questions the effectiveness of tariffs as a tool to improve competitiveness.

Is price gouging linked to the recent inflation discussed?

-No, the discussion argues that supermarket gouging is not a factor, suggesting that inflation is more related to stimulus and supply constraints.

What is the stance on immigration mentioned in the transcript?

-The discussion indicates that illegal immigration is viewed as a drain on jobs added in the economy.

How does the role of a CEO relate to the policies discussed?

-It’s mentioned that a new CEO can implement different policies than their predecessor, affecting the overall direction of the administration.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

⚠️ Apple Just Issued a TERRIFYING Warning – Here's Why the Unthinkable Is Coming!

Presidential Candidate Kamala Harris' Economic Policies - Douglas Holtz Eakin (Fox News)

New Share Buyback Tax Rules Explained: How Will Shareholders Be Taxed? | Math Decoded

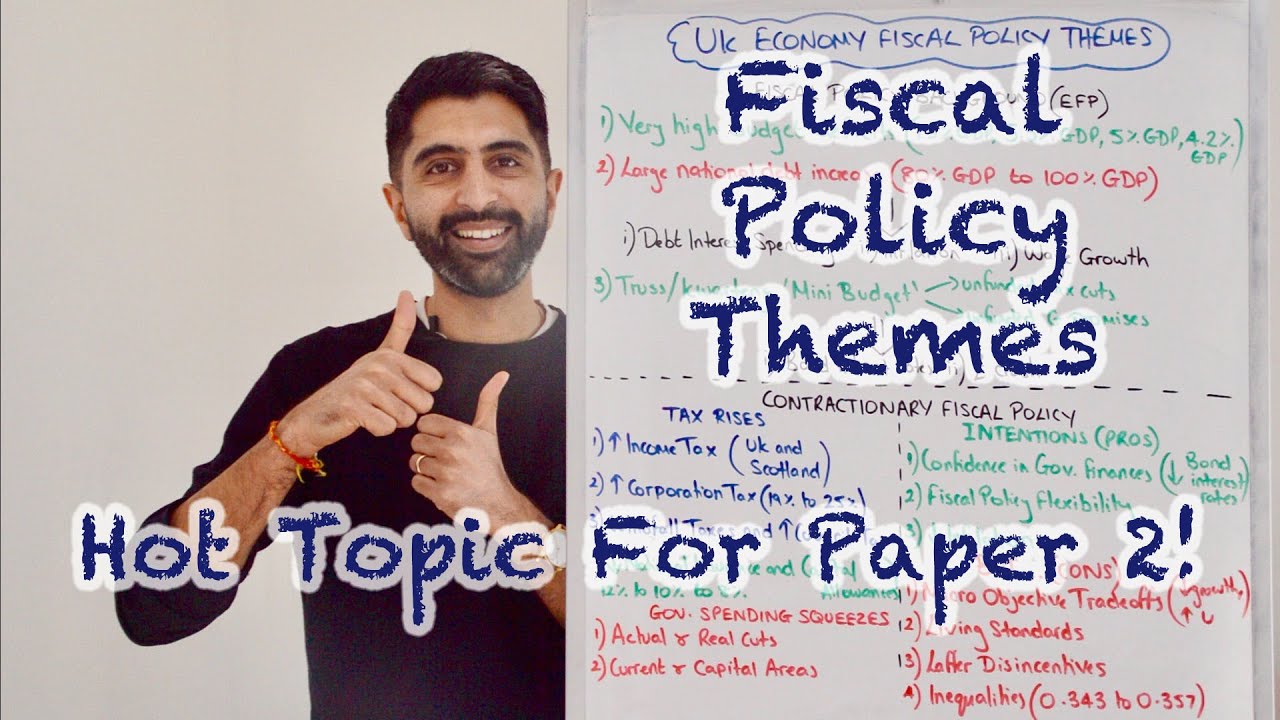

UK Fiscal Policy Themes - HOT TOPIC for Paper 2! Must Watch 🔥

هل تُنقذ البنوك المركزية الأسواق أم تُغرقها؟

The Market Selloff & Government Shutdown | A Warning to All.

5.0 / 5 (0 votes)