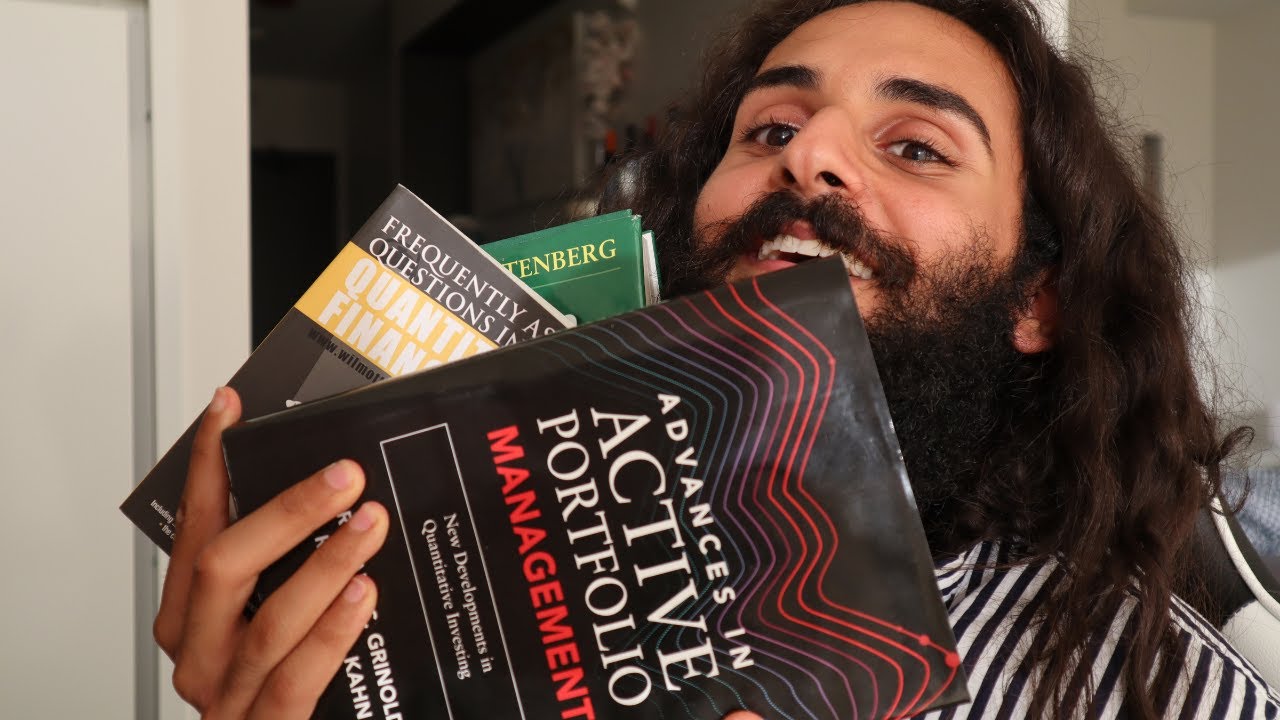

What is a quant? (explained by a quant developer)

Summary

TLDRIn this informative video, Coding Jesus explains the role of quantitative analysts, or quants, highlighting their responsibilities in developing and trading strategies based on data analysis. He distinguishes between quants and quantitative developers, emphasizing the importance of technical skills like programming, mathematical proficiency, and understanding trading concepts. Additionally, he discusses the soft skills necessary for success, such as risk-taking and the ability to learn from failures. The video also covers the earning potential of quants, which ranges from $125,000 to $500,000 annually, providing a comprehensive overview for anyone interested in this field.

Takeaways

- 😀 A quant, short for quantitative analyst, works with numbers to create and backtest profitable trading strategies.

- 📊 Quants do not only crunch numbers; they also engage in trading based on the models they develop.

- 🖥️ A quantitative developer, like Coding Jesus, focuses on implementing the models created by quants into trading applications.

- 🔢 Strong mathematical skills are essential for quants, as they analyze vast amounts of data and build statistical models.

- 🎓 Educational backgrounds in mathematics, financial engineering, or data analytics are beneficial for aspiring quants.

- 💻 Proficiency in programming languages, especially Python, is crucial for both quants and quantitative developers.

- 📈 Understanding various trading concepts, including option pricing models, is an important skill for quants.

- 🧠 Soft skills such as risk-taking, innovative thinking, and the ability to work under pressure are vital for success in the quantitative field.

- 💸 Quants can earn between $125,000 to $500,000 annually, with bonuses tied to the performance of their trading strategies.

- 🔄 The workflow involves quants generating trading strategies, which quantitative developers implement for traders to use in their daily operations.

Q & A

What is a quant?

-A quant, short for quantitative analyst, works with numbers to backtest strategies aimed at generating profits for a firm. They not only analyze data but also engage in trading based on the models they create.

How does a quant differ from a quantitative developer?

-While a quant focuses on creating and analyzing models and strategies, a quantitative developer implements these models into algorithms and applications for trading, often requiring software engineering skills.

What are the primary technical skills required to become a quant?

-Key technical skills include strong mathematical understanding, proficiency in programming languages (especially Python), familiarity with trading concepts, and comfort with data analysis tools like Excel and Bloomberg Terminal.

What educational background is beneficial for a quant?

-Typically, quants have advanced degrees in fields focusing on mathematics, finance, or financial engineering. However, experience in data analytics can also be valuable.

What programming languages are commonly used by quants?

-Most quants primarily use Python due to its simplicity and efficiency in handling data analysis. Other languages like R and MATLAB are also used, but Python is the most popular.

What soft skills are important for a quant?

-Important soft skills include having a trader's temperament, risk-taking abilities, an innovative mindset, and comfort with failure, as quants must adapt to market changes and learn from their models.

How do quants approach trading?

-Quants not only build models but also engage in trading, spending a portion of their time executing trades based on the strategies they have developed and tested.

What is the typical salary range for a quant?

-Quants typically earn between $125,000 and $500,000 annually, with bonuses based on the performance of their models and contributions to the firm's profitability.

Why is an innovative mindset important for quants?

-An innovative mindset allows quants to learn from past mistakes, iterate on their models, and develop improved strategies rather than becoming anchored to previous designs.

What kind of challenges do quants face in their work?

-Quants must handle pressure when trading, adapt to market dynamics, and be prepared for the possibility of failure, as they constantly seek to refine their models based on changing market conditions.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

Everything you need to know to become a quant trader (in 2024) + sample interview problem

What is a Quant? Rise of the Millionaire Nerds of Wall Street

What do Wall Street quants actually do?

3 things day traders refuse to understand about quant trading

Everything you need to know to become a quant trader (top 5 books)

Perbedaan antara penelitian kualitatif dan kuantitatif

5.0 / 5 (0 votes)