Everything you need to know to become a quant trader (top 5 books)

Summary

TLDRIn this video, 'Coding Jesus' shares essential book recommendations for anyone aiming to break into quantitative trading. Drawing insights from his own experience as a quantitative developer and his network of traders, he emphasizes practical knowledge over dense, complex concepts. The top books include titles on option volatility, interview prep, Python programming, and linear algebra. He also highlights a bonus book for those transitioning from day trading, debunking technical analysis. This guide provides a clear path to mastering the key skills needed to succeed in quantitative trading.

Takeaways

- 📘 If you can retain 25-40% of the information from the recommended books, you're capable of becoming a quantitative trader.

- 👨💻 The speaker, Coding Jesus, is a quantitative developer with a network of quantitative researchers and traders from firms like Jump Trading and Citadel.

- 📖 The first recommended book is 'Option Volatility and Pricing' by Sheldon Natenberg, which is a reference guide for key financial concepts with minimal complex math.

- 📚 An alternative to the first book is 'Dynamic Hedging' by Nassim Taleb, which is considered interchangeable with Natenberg's book.

- 🧠 The second recommended book is 'Frequently Asked Questions in Quantitative Finance' by Paul Wilmott, which is designed for interview prep and provides concise explanations of key concepts.

- 💻 To stand out in the field, learning programming is beneficial. The recommended book for programming is 'Python for Data Analysis' by Wes McKinney, which covers Python fundamentals and data manipulation tools like Pandas.

- 🔢 For mathematics, 'Linear Algebra' by Gilbert Strang is suggested as it covers essential math for quantitative trading, including linear algebra and probability.

- 📊 For advanced traders, the book 'Advances in Portfolio Management' by Grinold and Kahn is recommended for those interested in portfolio management and more in-depth quantitative strategies.

- 📈 The speaker emphasizes that a coin flip is a better strategy than technical analysis for day trading and recommends reading 'Why a Coin Flip is Better than Technical Analysis' by Tim Morris for those transitioning from day trading.

- 📂 The speaker concludes by offering additional resources, including links to the books, his Discord, Patreon, and contact information for further guidance.

Q & A

What qualifications does the speaker, Coding Jesus, have to recommend books on quantitative trading?

-Coding Jesus is a quantitative developer at a proprietary trading firm, where he writes server and client-side applications for traders. While he is not a trader himself, he has a network of quantitative researchers and traders from top firms like Jump Trading and Citadel, and he consulted them for book recommendations.

Why does Coding Jesus not recommend certain dense financial books?

-He avoids recommending dense books because they are hard to read, not practical for interviews, and not used in day-to-day quantitative trading. He compares these books to being part of a 'CIA torture program' and prefers to recommend books that are practical and useful for breaking into the field.

What is the first book Coding Jesus recommends, and why?

-The first book he recommends is 'Option Volatility and Pricing' by Sheldon Natenberg. This book is valuable because it covers key financial concepts in an easy-to-understand way, without complex math. It's often used as a reference book by interns and traders, covering topics like the binomial pricing model, option Greeks, volatility smile, and real-world applications.

What is a good alternative to 'Option Volatility and Pricing' by Sheldon Natenberg?

-An alternative book is 'Dynamic Hedging' by Nassim Taleb. Both books cover similar financial concepts, and the choice between them depends on personal preference and the author you prefer to read from.

What is the second book recommendation, and how does it differ from the first?

-The second book recommendation is 'Frequently Asked Questions in Quantitative Finance' by Paul Wilmott. Unlike the first book, this one is more of an interview prep and refresher guide, summarizing key financial concepts in 2-3 page sections. It’s particularly useful for those preparing for interviews and includes sections on brain teasers and tips for landing a quant job.

Why does Coding Jesus recommend learning programming for quantitative trading?

-Although programming is not a strict requirement for becoming a quantitative trader, it helps candidates stand out. Knowing how to program can make you more competitive, as some traders do not code but it can give you an edge.

What book does Coding Jesus recommend for learning programming for quantitative trading?

-He recommends 'Python for Data Analysis' by Wes McKinney. The author is the founder of the pandas library in Python, and the book teaches essential programming concepts in Python, such as data manipulation with pandas, time series, and NumPy, all in a practical manner.

What kind of math is necessary for breaking into quantitative trading, according to Coding Jesus?

-The necessary math includes linear algebra, stochastic calculus, and probability and statistics. While traders don't spend most of their time doing math, a basic competency in these areas is required to pass interviews and enter the field.

Which book does Coding Jesus recommend for learning the math needed for quantitative trading?

-He recommends 'Linear Algebra' by Gilbert Strang. This book covers everything from solving linear equations to complex vectors and matrices and includes problems and solutions. For those looking for a more advanced math book, he also mentions 'Linear Algebra Done Right.'

What is the fifth book recommendation, and who is it for?

-The fifth book is 'Advances in Portfolio Management' by Grinold and Kahn. This is more suited for advanced traders or researchers who want to move beyond trading and into portfolio management. The book contains essays on advanced financial concepts like active management and risk management strategies.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Everything you need to know to become a quant trader (in 2024) + sample interview problem

3 SOFT SKILLS you need to master to break into quant trading

What is a quant? (explained by a quant developer)

read these 5 books to break into quant trading as a software engineer

3 things day traders refuse to understand about quant trading

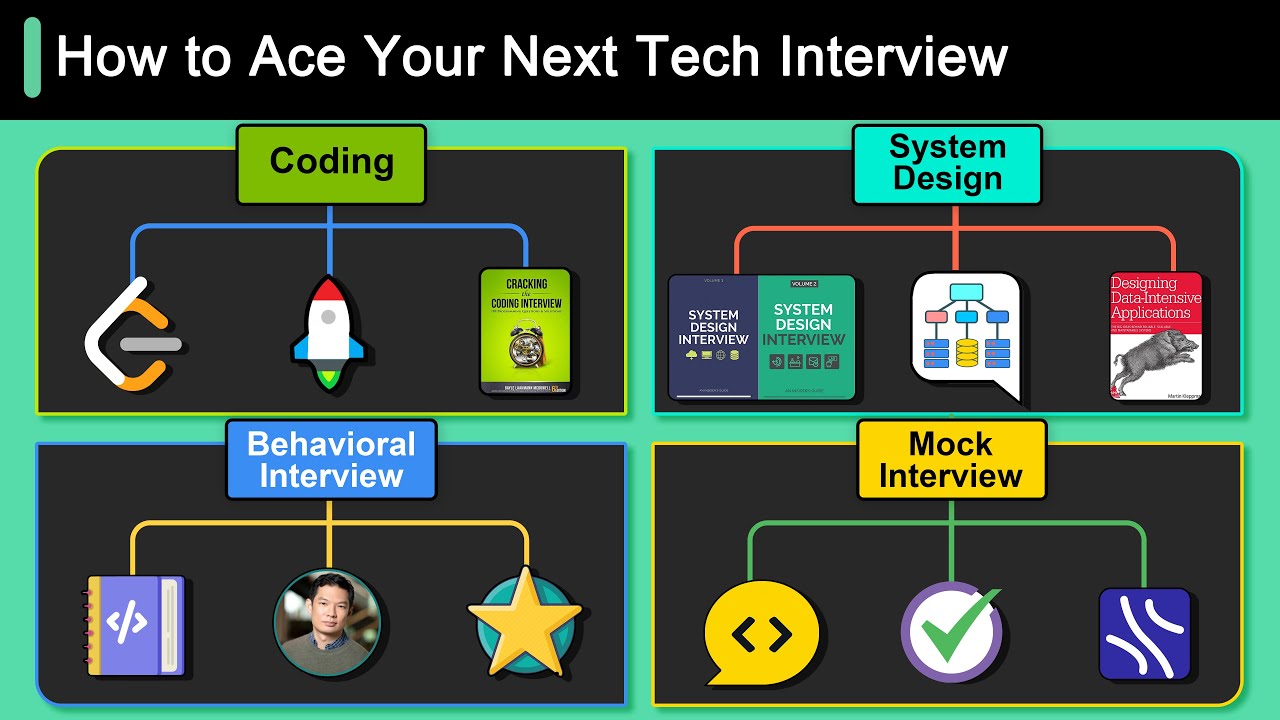

Our Recommended Materials For Cracking Your Next Tech Interview

5.0 / 5 (0 votes)