FA15 - Adjusting Journal Entries - MORE EXAMPLES

Summary

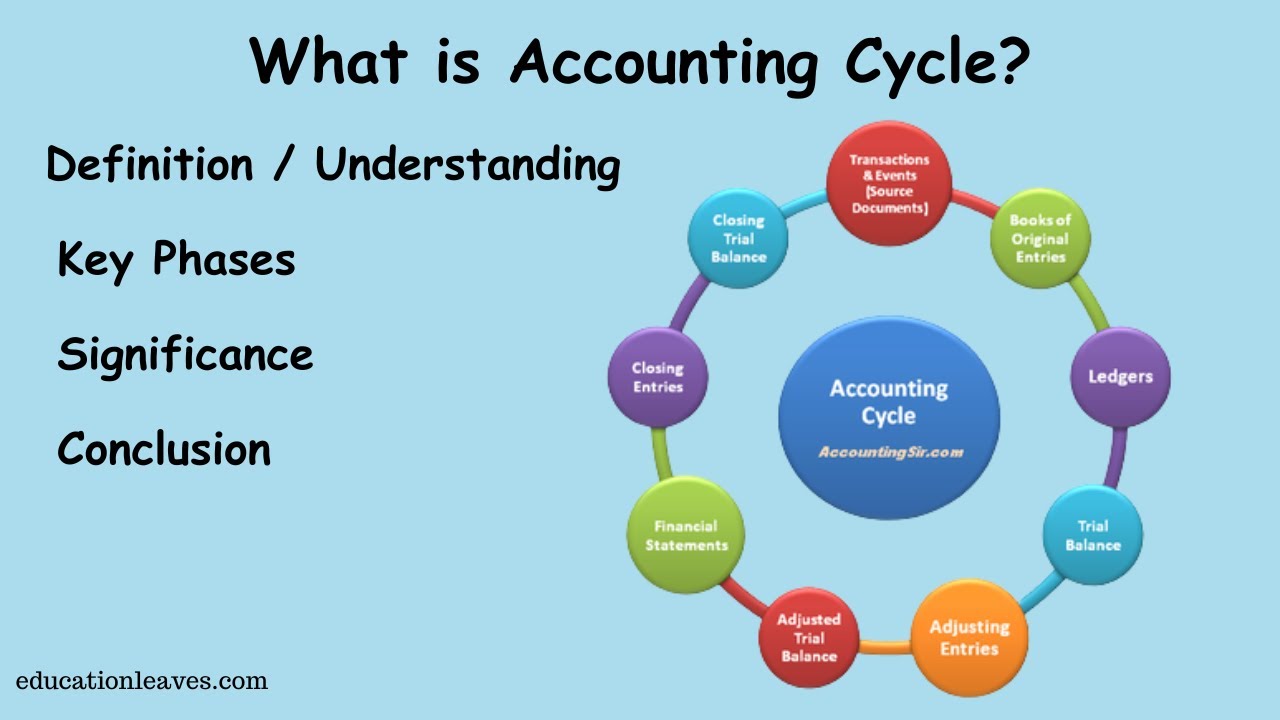

TLDRThis video tutorial covers adjusting journal entries, creating an adjusted trial balance, and preparing financial statements for NetLock Security. The instructor walks through seven adjustments required for the June 30, 2024, unadjusted trial balance, including supplies, prepaid insurance, depreciation, interest expenses, unearned revenue, and accrued salaries. Each step is carefully explained with corresponding journal entries, focusing on the key concepts of accrual accounting. The video is part of a series that provides comprehensive guidance for students and professionals learning financial accounting.

Takeaways

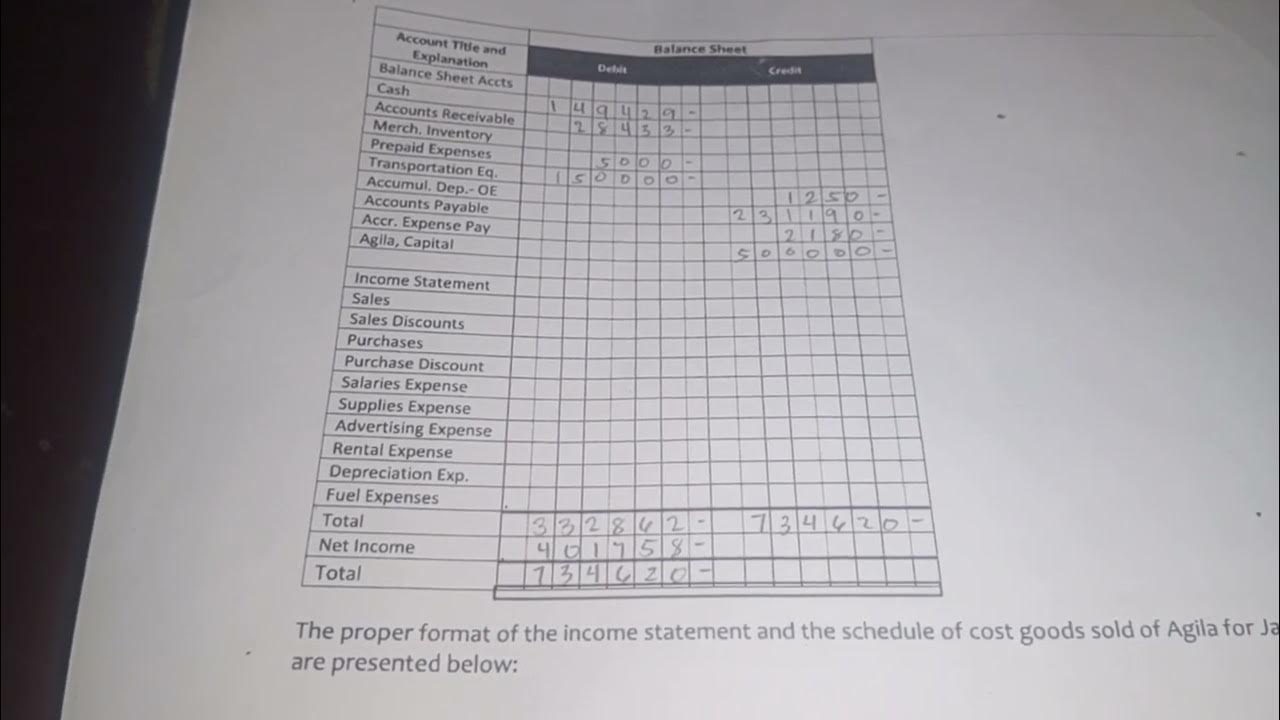

- 💻 The problem involves preparing adjusting journal entries, an adjusted trial balance, and financial statements.

- 📊 The example provided shows the unadjusted trial balance of a company called Netlock Security, a firm offering hacking prevention services.

- 📝 Supplies adjustment: The physical count revealed $300 of supplies on hand, while accounting records showed $5,000, leading to a $4,700 adjustment.

- 💼 Prepaid insurance adjustment: A $28,000 insurance policy was purchased on March 1st, 2024. Four months of the policy have been used up, requiring an adjustment of $9,333.

- 💻 Depreciation adjustment: Computers purchased years ago for $214,000 are depreciated over 10 years, requiring a $21,400 annual depreciation expense.

- 💵 Interest accrual: A note payable issued on February 1st, 2024, with 10% annual interest, accrued $1,250 in interest over five months.

- 💼 Unearned revenue: A three-month security contract paid $15,000 upfront on May 1st. Two months of services have been delivered, resulting in $10,000 of earned revenue.

- 👩💼 Salary accrual: The company owes $1,500 in unpaid salaries for three employees who worked for two days, each earning $250 per day.

- 📅 Accrued revenue: The company provided services worth $4,000 in June for a new client but had not billed them yet, leading to an accounts receivable entry.

- 🎥 Future steps: The next video will cover filling in the adjusted trial balance and completing the financial statements.

Q & A

What kind of problem is being addressed in the video?

-The video addresses adjusting journal entries, the preparation of an adjusted trial balance, and financial statements.

What service does Netlock Security offer?

-Netlock Security offers hacking prevention services to large companies.

Why is the supplies account being adjusted in Part A?

-The supplies account is being adjusted because there is a discrepancy between the recorded amount of supplies ($5,000) and the actual amount on hand ($300). The adjustment records the used-up supplies.

How is the prepaid insurance being adjusted in Part B?

-Prepaid insurance is being adjusted to account for the four months of insurance used since March 1st. $9,333 of the $28,000 insurance policy has expired, so the journal entry records this usage as an expense.

What is the depreciation adjustment for the computers in Part C?

-The computers, purchased years ago for $214,000 with an estimated life of 10 years, require a depreciation adjustment of $21,400 for the current year.

How is interest expense calculated for the note payable in Part D?

-The interest expense is calculated at 10% annually on a $30,000 note payable, resulting in $3,000 per year. Since the note was issued on February 1st, 5 months of interest have accrued, totaling $1,250.

What adjustment is made for unearned revenue in Part E?

-The company had received $15,000 for a three-month contract. By June 30th, two months of the service had been provided, so $10,000 of the unearned revenue is recognized as earned revenue.

What is the accrued salaries expense adjustment in Part F?

-The company owes three employees for two days of work, with each employee earning $250 per day. The total accrued salaries expense is $1,500, which is recorded as a liability (salaries payable).

What adjustment is made for unbilled revenue in Part G?

-The company provided a month of service under a $4,000 per month contract but had not yet billed the client. The adjustment recognizes the revenue as earned and records it as accounts receivable.

What are the five types of adjustments mentioned in the video?

-The five types of introductory adjustments are for prepaid expenses, depreciation, accrued expenses, accrued revenues, and revenues.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тариф5.0 / 5 (0 votes)