FA16 - Adjusted Trial Balance

Summary

TLDRThis video script outlines the process of transferring adjusting journal entries into an adjusted trial balance. The presenter demonstrates how to accurately input figures, ensuring debits and credits match, and explains the importance of this step for preparing financial statements. A humorous incident involving a spilled drink adds a personal touch to the tutorial.

Takeaways

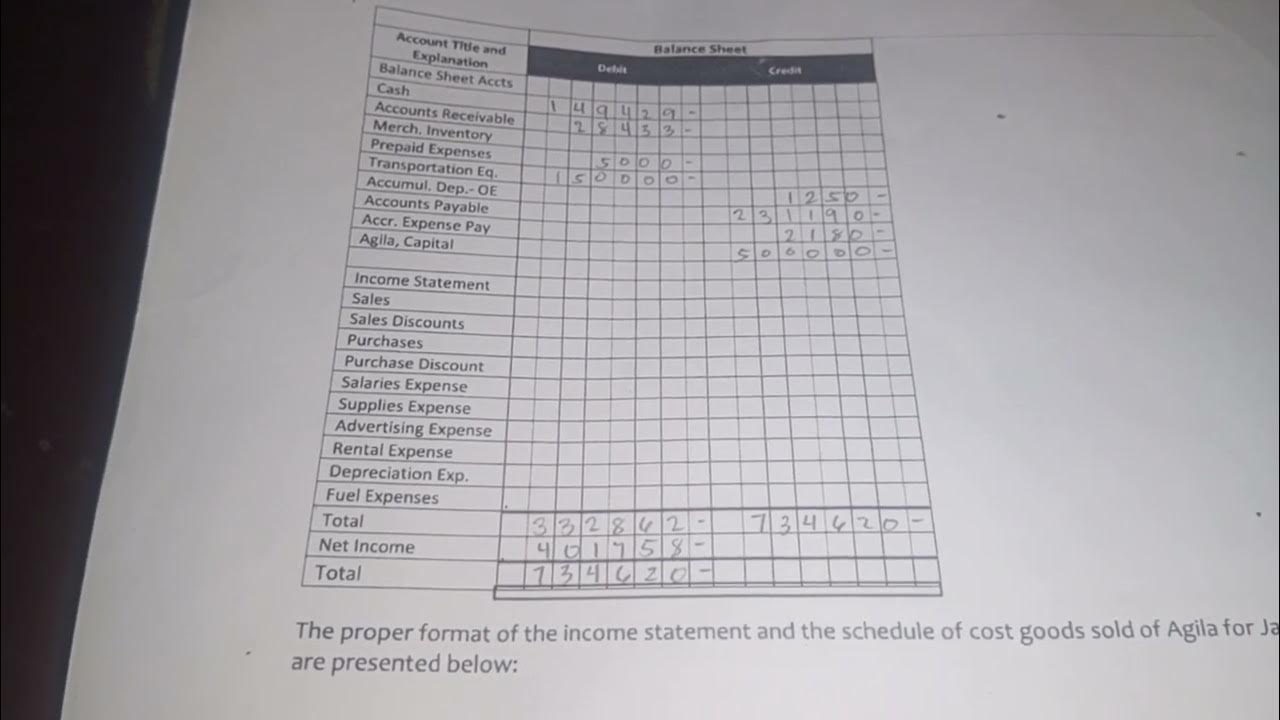

- 📝 The process involves transferring adjusting journal entries into an adjusted trial balance.

- 💻 The speaker uses a computer to copy journal entries from part one.

- 🔍 A quick behind-the-scenes moment is shared where a drink accident occurred during filming.

- 📉 Debit and credit entries are carefully transferred to the adjusted trial balance columns.

- 🧮 The importance of accuracy is emphasized, with a reminder to stop if the totals do not match.

- 🔄 Adjustments are made by adding or subtracting the adjusting amounts from the unadjusted balances.

- 📉 The adjusted trial balance is used to ensure that debits and credits still balance.

- 📋 The speaker demonstrates how to calculate the new balances after adjustments.

- 📊 The final step is to total up all the columns to confirm that the adjusted trial balance is correct.

- 📈 The adjusted trial balance is crucial for preparing accurate financial statements.

Q & A

What is the purpose of adjusting journal entries?

-Adjusting journal entries are used to update the accounts in the general ledger to reflect the current status of assets, liabilities, revenues, and expenses. This ensures that the financial statements accurately represent the financial position of a company at a specific point in time.

What is an adjusted trial balance?

-An adjusted trial balance is a list of all accounts with their balances after adjusting entries have been posted. It is used to ensure that the total debits equal the total credits, which is a fundamental accounting equation.

Why is it important to ensure that debits and credits are equal in the adjusted trial balance?

-Ensuring that debits and credits are equal is crucial because it confirms that all transactions have been recorded correctly and that there are no errors in the accounting process. This equality is a basic principle of double-entry bookkeeping.

What does the term 'transposing numbers' mean in the context of the script?

-Transposing numbers refers to the mistake of swapping the positions of two digits when entering them, which can lead to incorrect financial records.

Why did the speaker mention the importance of being careful and taking time when transferring numbers?

-The speaker emphasized the importance of being careful and taking time to avoid mistakes such as transposing numbers or incorrectly categorizing debits and credits, which could lead to an imbalance in the adjusted trial balance.

What is the significance of the number $4,700 mentioned in the script?

-The number $4,700 represents the debit balance for Supplies Expense and the credit balance for Supplies, indicating the cost of supplies used during the period.

How does the speaker handle the situation where they have to add an additional credit to an existing credit in the trial balance?

-The speaker plans to add the additional credit of $4,000 to the existing credit of $10,000 in the Security Revenue cell, acknowledging that they will have two credits to account for.

What does the speaker mean by 'the big side gets the balance'?

-The speaker is referring to the practice of taking the larger of two amounts (debit or credit) and using that to determine the final balance for an account in the adjusted trial balance.

Why is it necessary to add the unadjusted and adjusted balances together for certain accounts?

-It is necessary to add the unadjusted and adjusted balances together for certain accounts to reflect the true financial position of the company, taking into account any changes that occurred during the accounting period.

What is the final step the speaker mentions before preparing financial statements?

-The final step mentioned is totaling up both the debit and credit columns in the adjusted trial balance to ensure they match, which indicates that the financial statements will be accurate.

Why did the speaker mention the date June 30th in relation to the supplies count?

-The speaker mentioned June 30th because it is the end of the accounting period, and the supplies count of $300 reflects the physical count of supplies on hand at that date, which should match the accounting records.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

FA15 - Adjusting Journal Entries - MORE EXAMPLES

Prepare Journal Entries Part 1 (Filipino)

November 15, 2024

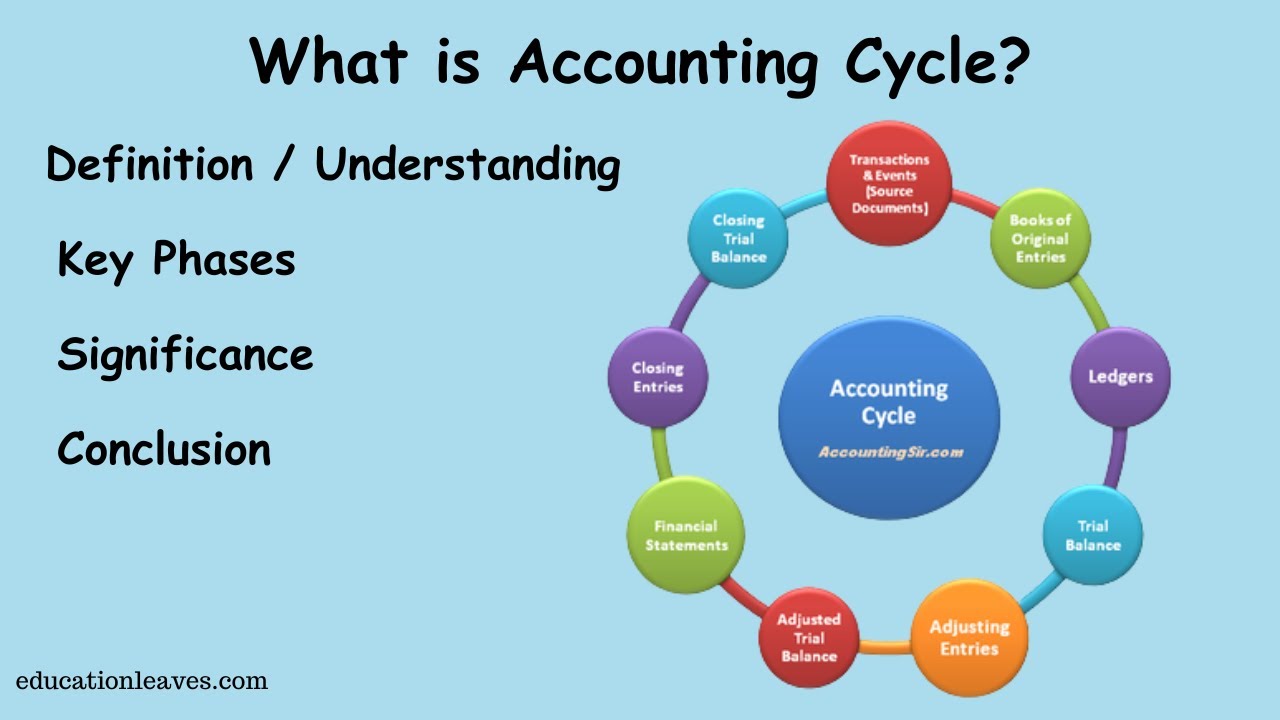

What is Accounting cycle? | Key phase, Significance of Accounting cycle

TRIAL BALANCE CHAPTER -14 T.S.Grewal Solution question number -2 Class-11 accounts session (2022)

Accounting Cycle Step 1: Analyze Transactions

5.0 / 5 (0 votes)