What's Going on With Ginkgo Bioworks Stock? $DNA

Summary

TLDRSynthetic biology company Ginkgo Bioworks saw its stock price decline following disappointing 2022 earnings results. Despite past promises of their innovative platform, revenues from their core cell engineering segment were flat while downstream value revenues remained negligible. As Ginkgo pivots to biopharma and acquires other companies, longtime concerns persist about lack of gross margins clarity and dependence on future milestone payments. While synthetic biology offers excitement, Ginkgo’s stalled growth and shifted priorities raise uncertainty, warranting a cautious view of the stock.

Takeaways

- 😕 Ginkgo Bioworks missed its 2023 revenue guidance, with cell engineering revenue remaining flat

- 😞 Downstream value revenues were only $4 million in 2023, far below expectations

- 🤔 $1 billion in milestone payments were cancelled, resetting revenue timeline

- 😯 2024 revenue guidance predicts a 10% decline due to macroeconomic headwinds

- 😠 Lack of transparency around COGS makes profitability analysis difficult

- 🧐 Pivot towards bio-pharma resets revenue timelines even further into the future

- 😫 Stock issuances for acquisitions signals dilution rather than business growth

- 🤨 Business model shift after 16 years raises doubts about viability

- 😤No reasonable explanation provided for flat cell engineering revenue growth

- 😒 Analyst remains pessimistic on stock due to growth struggles and lack of transparency

Q & A

Why is Ginkgo Bioworks stock sinking despite strong growth projections?

-Ginkgo missed its 2023 revenue guidance by 9% despite projecting strong growth. This raises doubts about its ability to achieve its ambitious goals. Flat cell engineering revenue and low downstream value are also concerns.

What types of revenue does Ginkgo Bioworks have and which matter most?

-It has related party revenue, biocurity revenue, cell engineering revenue (key metric), and downstream value revenue. Cell engineering and downstream value revenues matter most as indicators of platform success.

What is Ginkgo's 2024 revenue outlook?

-It projects 22% YoY growth in cell engineering revenue to $175M in 2024. But total revenue is expected to decline 10% to $225-245M due to lower biocurity revenue.

Why is Ginkgo making more acquisitions?

-It claims the acquisitions will supplement its core foundry platform. But this signals it needs external help to boost growth after 16 years in business.

How long can Ginkgo fund operations with its current cash reserves?

-It has $955M cash after burning $360M in 2023. It expects cash burn to improve in 2024-2025, giving an estimated runway of 2-3 years.

Why doesn't Ginkgo provide cost of goods sold data?

-Without COGS data, gross margins are unclear. Costs may be bundled into its high R&D spending instead, reducing transparency.

What are the analyst's parting thoughts on Ginkgo?

-Growth stalled in 2023 amid a biopharma pivot and cancellation of $1B in milestone payments. Old concerns persist while new ones emerged regarding growth and transparency.

What does downstream value revenue indicate?

-Downstream revenue comes from successful commercial products made using Ginkgo's platform. It helps validate the platform and is key for long-term business model success.

Why is related party revenue a concern?

-Related party revenue comes from insiders and doesn't reflect real platform demand. It raises questions about whether revenue is artificially inflated.

What might indicate progress for Ginkgo in the coming years?

-Investors want to see cell engineering and downstream revenues grow substantially. These will indicate true commercial traction for its synthetic biology platform.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

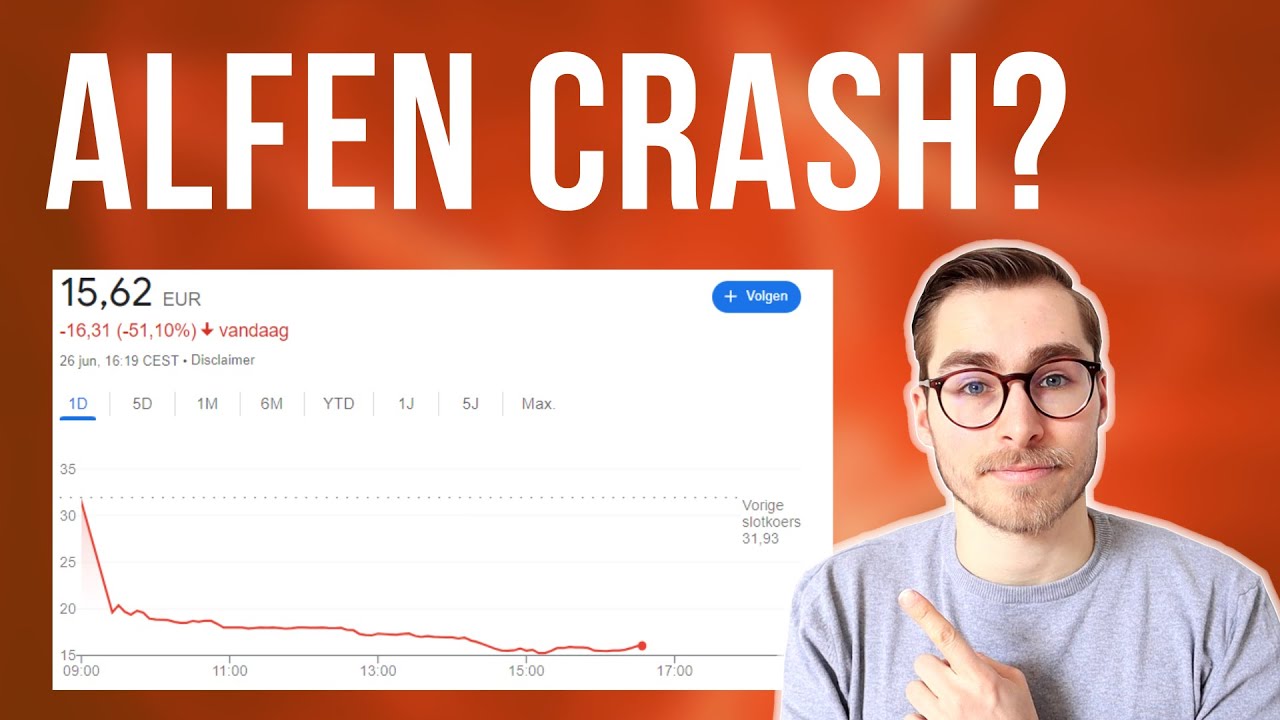

Wat is er aan de hand met ALFEN?

TERUNGKAP! Alasan Sebenarnya FACEBOOK jadi META

TESLA Stock - TSLA Crashes Over 9%.. Whats Next?

Making Biology Easier to Engineer, Together (Patrick Boyle, Ginkgo Bioworks) | iGEM 2024 (Keynote)

I Update My Buy Recommendation for Adobe Stock | ADBE Stock Analysis

Why Warren Buffett Bought ULTA Beauty Stock!

5.0 / 5 (0 votes)