CARA BUAT BUKTI POTONG PPH 21 KARYAWAN DAN LAPOR SPT MASA PPH 21 DI CORETAX MULAI 2025

Summary

TLDRThis video tutorial provides a step-by-step guide on how to use the Cortex platform to report the PPh Pasal 21 tax for employees in Indonesia starting in 2025. It covers logging into the platform, creating tax cut proof (Bukti Potong), generating the tax return (SPT), and submitting it online. The tutorial also explains handling both permanent and non-permanent employees, the necessary steps for payment, and the final submission process. Viewers are encouraged to follow along and practice the steps themselves for a seamless tax filing experience.

Takeaways

- 😀 The tutorial provides a step-by-step guide on how to create and report PPh 21 tax slips and the SPT Masa PPh 21 (tax report) using the Cortex platform, starting with January 2025.

- 😀 Users must log into the Cortex platform using their authorized personal or corporate account, ensuring they have the necessary permissions to create tax documents.

- 😀 For employees classified as 'non-permanent,' even if their status is temporary, tax slips should still be created if they receive regular income throughout the year, from January to December 2025.

- 😀 The process includes generating tax slips for permanent and non-permanent employees, which are then used to create and file the monthly tax reports (SPT).

- 😀 After generating tax slips, the system will automatically generate the corresponding tax report draft, and users will need to pay the tax billing before submitting the report.

- 😀 The video explains the importance of filling out accurate personal data (such as NPWP, name, and address) for each employee or contractor, ensuring the tax slip's validity.

- 😀 Users must complete the necessary sections like tax rates, income amounts, and any applicable deductions or exemptions before saving and submitting the draft tax slip.

- 😀 Once the draft tax slip is saved, it can be marked as 'issued,' which updates its status from 'unissued' to 'issued.' This change is crucial for the report's finalization.

- 😀 The next step is to create the monthly tax report (SPT) by selecting the appropriate tax year and period, ensuring the tax report is correctly prepared and compliant with regulations.

- 😀 Once the SPT is finalized, users will need to confirm and submit it, including generating the payment code (billing), which can be paid through the usual online payment methods like bank transfers.

- 😀 The tutorial concludes by explaining that once payment is made, the SPT status will change from 'waiting for payment' to 'reported,' and users can download the final confirmation document and tax report.

Q & A

What is the main objective of the video?

-The main objective of the video is to demonstrate the process of creating a tax withholding slip (bukti potong), generating an SPT Masa PPh Pasal 21 report, and submitting it via the KORTEX system starting in 2025.

What platform is being used to file the tax reports starting from 2025?

-Starting from 2025, all tax reports, including SPT Masa PPh Pasal 21, must be filed using the KORTEX system.

Is it necessary to use a PIC account for this process?

-Yes, it is necessary to log in using a PIC (Person in Charge) account, or a personal tax account authorized to handle the creation of tax withholding slips and report filings.

What types of employees are included when creating a tax withholding slip?

-Tax withholding slips should be created for both permanent employees (pegawai tetap) and non-permanent employees (pegawai tidak tetap) who receive regular income throughout the year.

What steps must be followed to create a tax withholding slip for employees?

-First, log in to KORTEX with a PIC account, select the appropriate company, and create the tax withholding slip by entering details such as the employee's income and tax calculations. After that, save and submit the draft.

What happens after creating the draft tax withholding slip?

-After the draft tax withholding slip is created, it will appear as 'not issued'. To make it official, you must click 'Issue' to finalize and move it to the 'Issued' category.

How is the SPT Masa PPh Pasal 21 generated after the withholding slip is created?

-Once the withholding slip is issued, the next step is to generate the SPT Masa PPh Pasal 21 by selecting the 'Create Concept SPT' option, and filling out necessary details, including the tax period and payment information.

What should you do after creating the SPT Masa concept?

-After creating the SPT Masa concept, review the sections, ensure all information is correct, and then save the concept. Once saved, the 'Pay and Submit' button will appear for final submission.

What is the role of the 'Pay and Submit' button in the KORTEX system?

-The 'Pay and Submit' button allows users to pay the tax bill generated by the system, after which the SPT Masa will be officially reported and the tax receipt will be issued.

How can the tax payment be made after generating the billing code?

-Once the billing code is generated, the payment can be made through various payment methods such as bank transfers or using online platforms like e-banking.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

Cara Membuat Bukti Potong PPh 21 Karyawan Tahun 2025 Coretax

Menghitung Pajak Penghasilan Pasal 21 || Materi Ekonomi Kelas XI

Angsuran PPh Pasal 25: Cara Menghitung dan Melaporkannya

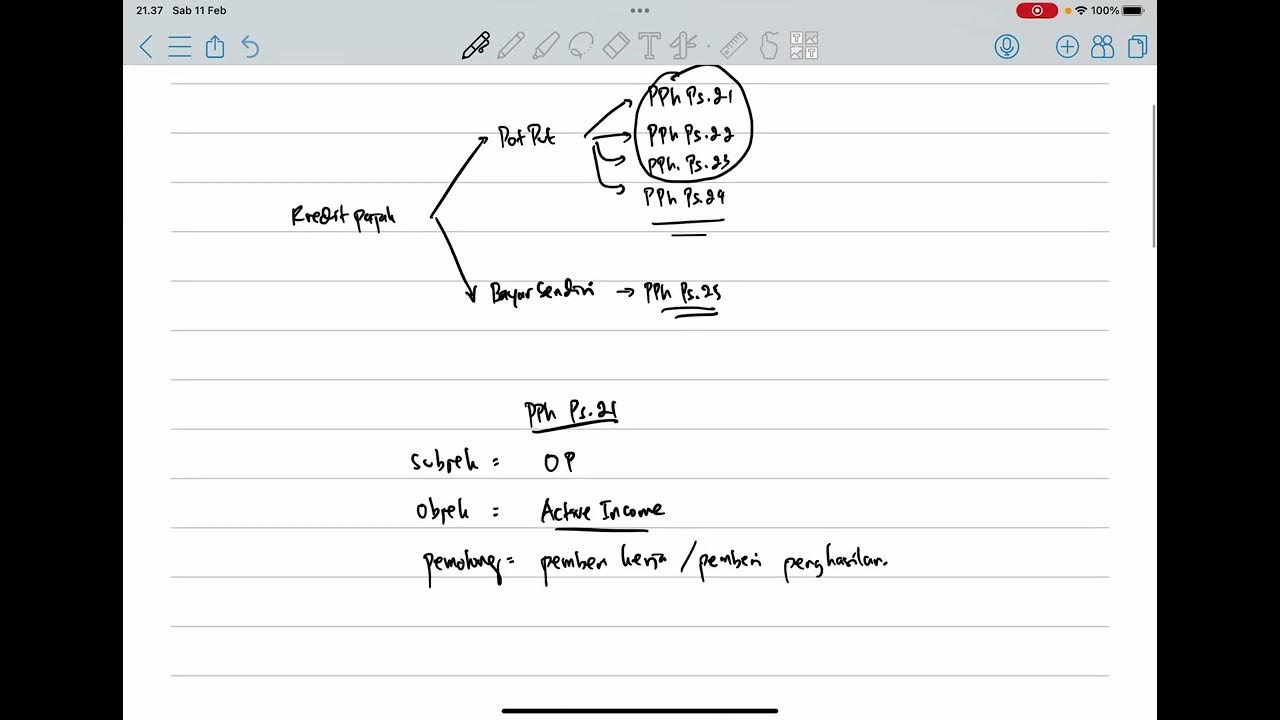

PPh Orang Pribadi (Update 2023) - 5. Kredit Pajak

Cara Menghitung dan Melaporkan PPh 21 Di Dalam Core Tax

Cara Lapor SPT PPh 21 Desember Tahun 2024

5.0 / 5 (0 votes)