CARA INPUT TRANSAKSI PENJUALAN KREDIT, PENJUALAN TUNAI DAN RETURN PENJUALAN DI MYOB ACCOUNTING

Summary

TLDRThis video tutorial provides a step-by-step guide on how to input credit sales, cash sales, and credit notes into MYOB accounting software. The presenter demonstrates how to create transactions, manage customer details, and ensure proper accounting entries for each transaction type. It also covers the process of recording returns via credit notes and the differences between cash and credit sales. Viewers are guided through the process, with clear explanations on how to verify and save transactions, making it an essential resource for MYOB users looking to master sales and returns entries.

Takeaways

- 😀 The video explains how to input various transactions in MYOB accounting software, including credit sales, cash sales, and credit notes.

- 😀 To enter a credit sale, go to the 'Sales' module and choose 'Enter Sales' to input details such as customer name, invoice number, and item details.

- 😀 When entering credit sales, ensure the layout is set to 'Item' if you’re running a trading company, as opposed to 'Service'.

- 😀 For credit sales, make sure to add the correct quantity and price for each item sold, and apply the necessary taxes (PPN).

- 😀 After entering the transaction details, confirm the totals and click 'Record' to save the credit sale, which automatically creates corresponding journal entries.

- 😀 A credit note is used when a customer returns goods. To enter a credit note, select the same customer and create a new 'Credit Note' transaction in the 'Sales' module.

- 😀 For credit notes, adjust quantities to negative values to reflect the returned items, and ensure the transaction reduces both sales and accounts receivable.

- 😀 Cash sales involve the same process as credit sales, but with the added step of confirming immediate payment in the 'Paid Today' field.

- 😀 For cash sales, after entering the necessary details, record the transaction, which generates journal entries reflecting the immediate payment received.

- 😀 To check the transactions you've entered, go to the 'Transaction Journal' in MYOB and filter by date and type (e.g., sales, credit notes, cash sales).

- 😀 The video emphasizes understanding the differences between credit sales and cash sales, particularly in how they affect journal entries and accounts receivable.

Q & A

What is the main focus of the video tutorial?

-The main focus of the video tutorial is to guide viewers on how to input sales transactions (both credit and cash), as well as credit notes, into MYOB accounting software.

What types of sales transactions are covered in the tutorial?

-The tutorial covers credit sales, cash sales, and credit notes transactions in MYOB accounting software.

How do you enter a credit sale transaction in MYOB?

-To enter a credit sale transaction, you need to go to the 'Sales' module, select 'Enter Sales', choose the customer, and input the relevant details such as the item, quantity, price, and tax information. After reviewing, the transaction is recorded.

What is the significance of entering 'quantity' and 'price' in the sales transaction?

-Entering the 'quantity' and 'price' in the sales transaction allows the software to calculate the total amount for the transaction, including tax (VAT), and ensures that the correct financial data is recorded in the journal.

How does a credit note work in MYOB, and why is it used?

-A credit note is used when a customer returns goods or there is an issue with a sale (e.g., damaged items). In MYOB, you enter a credit note by selecting the customer, inputting the return details as negative quantities, and adjusting the journal accordingly.

What is the difference between a credit sale and a cash sale in MYOB?

-A credit sale is a transaction where the customer pays later, and payment is recorded separately. A cash sale, on the other hand, involves immediate payment at the time of the transaction.

What journal entries are involved in a credit sale?

-In a credit sale, the journal entries typically involve debiting the accounts receivable and crediting the sales revenue account. Additional entries are made for tax and inventory adjustments.

What is the role of the 'tax' field in the sales transactions?

-The 'tax' field in sales transactions ensures that the applicable tax (e.g., VAT or sales tax) is added to the transaction total. It is important for accurate reporting and compliance with tax laws.

How do you verify the accuracy of a transaction in MYOB after entering the sales data?

-After entering the sales data, you can verify the accuracy by checking the journal entries. This can be done by using the 'Control + B' shortcut to view the generated journal for the transaction.

What should you do if a customer returns goods in a sale transaction?

-If a customer returns goods, you would enter a credit note in MYOB, adjusting the quantities and prices to reflect the return, and the relevant journal entries will be updated accordingly.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

CARA MEMBUAT DATA PERSEDIAAN DI MYOB ACCOUNTING

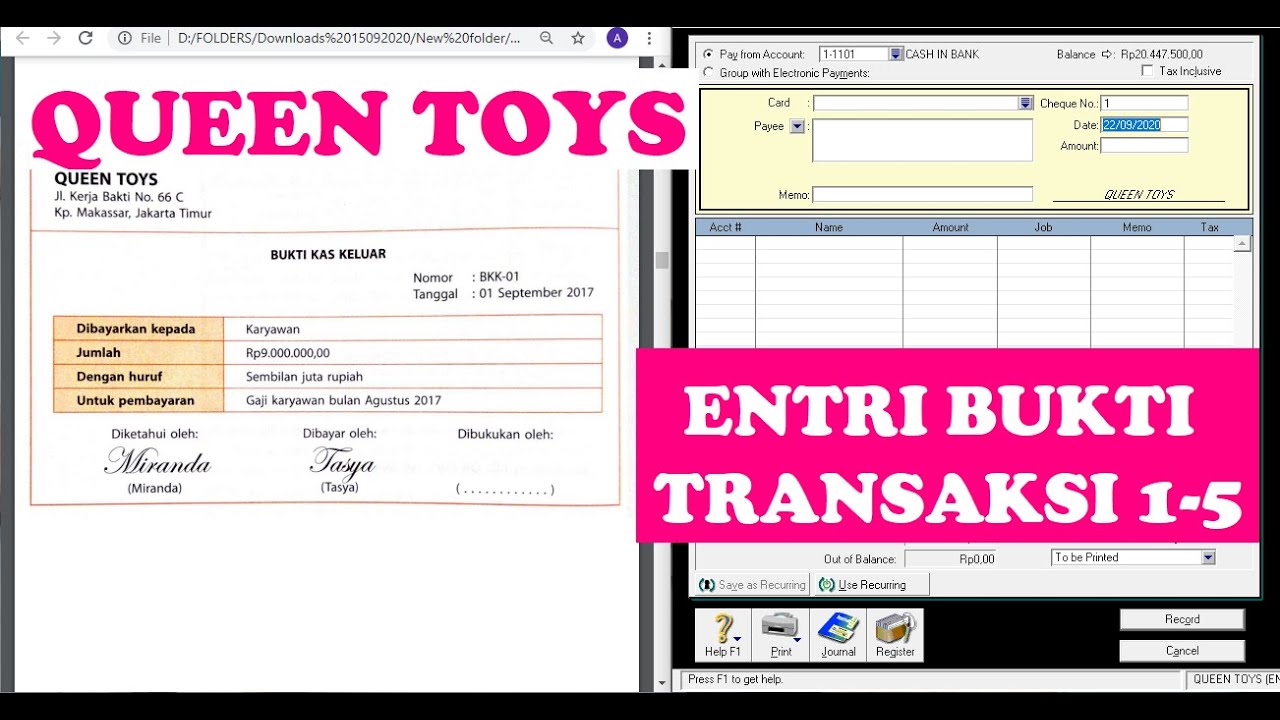

(9-QT) MENGENTRI BUKTI TRANSAKSI 1-5 | MYOB Accounting Plus V18 ED (Queen Toys)

Cara Install Aplikasi MYOB Accounting Plus Versi 18

SISTEM AKUNTANSI PIUTANG || @dafsofficial

Cash Budget | Explained With Full Example | Cost Accounting

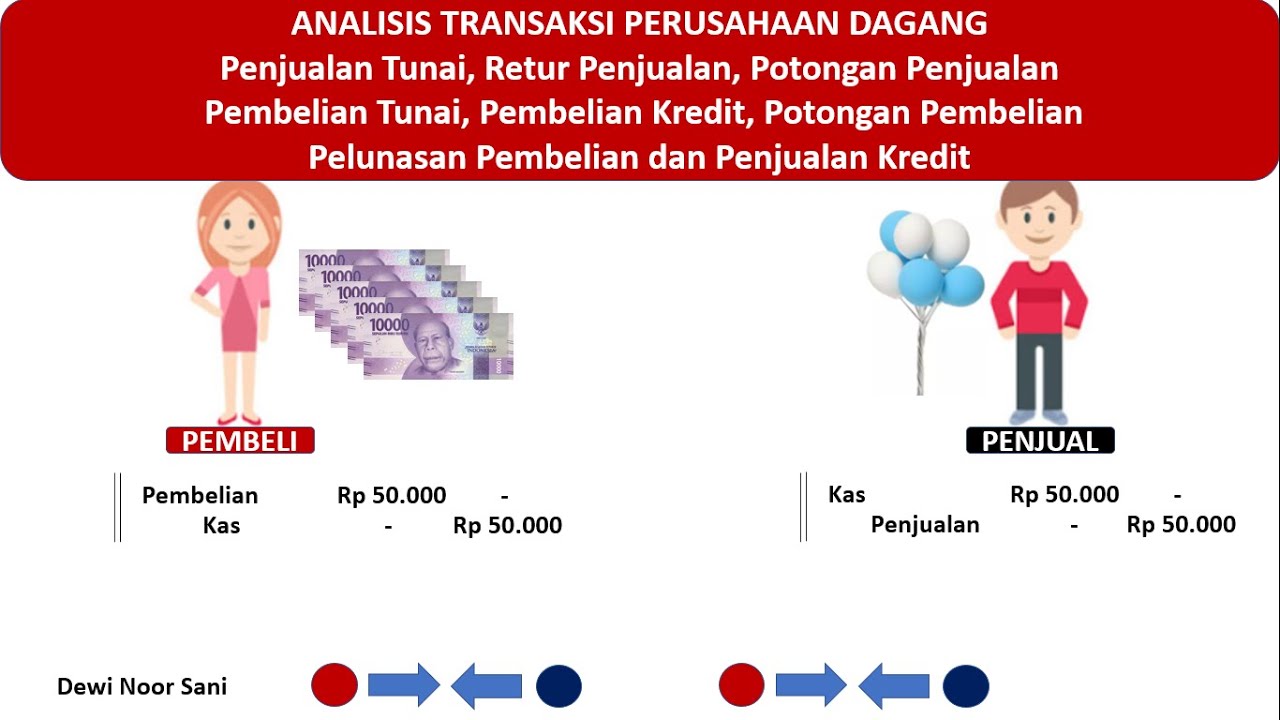

ANALISIS TRANSAKSI PERUSAHAAN DAGANG

5.0 / 5 (0 votes)