Dividend Discount Model (DDM)

Summary

TLDRThis video script explains the concept of the Dividend Discount Model (DDM), which calculates the price of an asset by determining the present value of its future cash flows. Various types of DDM are discussed, including the one-period, two-period, and multi-period models, as well as scenarios with constant, growing, or supernormal dividends. The script also covers company life cycles, from the introduction phase to maturity, and emphasizes the importance of choosing the correct perpetuity formula based on the asset's growth stage. Additionally, it highlights how to calculate share prices using DDM in different growth contexts.

Takeaways

- 😀 The price of any asset is determined by the present value of all its future cash flows, whether it's a company, a building, a stock, or a bond.

- 😀 For stocks, the price is calculated as the present value of all future dividends, forming the basis of the Dividend Discount Model (DDM).

- 😀 The one-period Dividend Discount Model involves calculating the present value of the dividend and the share price in a single year, then discounting them to today.

- 😀 In a two-period Dividend Discount Model, the price is determined by the present value of dividends in two years and the share price at the end of the second year, discounted appropriately.

- 😀 The multiple-period Dividend Discount Model is similar but extends the calculation to include more periods, depending on how many years the stock is held.

- 😀 The concept of a company's life cycle is crucial in valuing its future dividends, with stages such as introduction, growth, maturity, and potential decline.

- 😀 Mature companies, which have low or zero growth rates, are valued using either ordinary perpetuity (if growth is zero) or growing perpetuity (if growth is low and stable).

- 😀 The ordinary perpetuity formula is used for companies with constant cash flows, and the growing perpetuity formula is used when dividends grow at a constant rate.

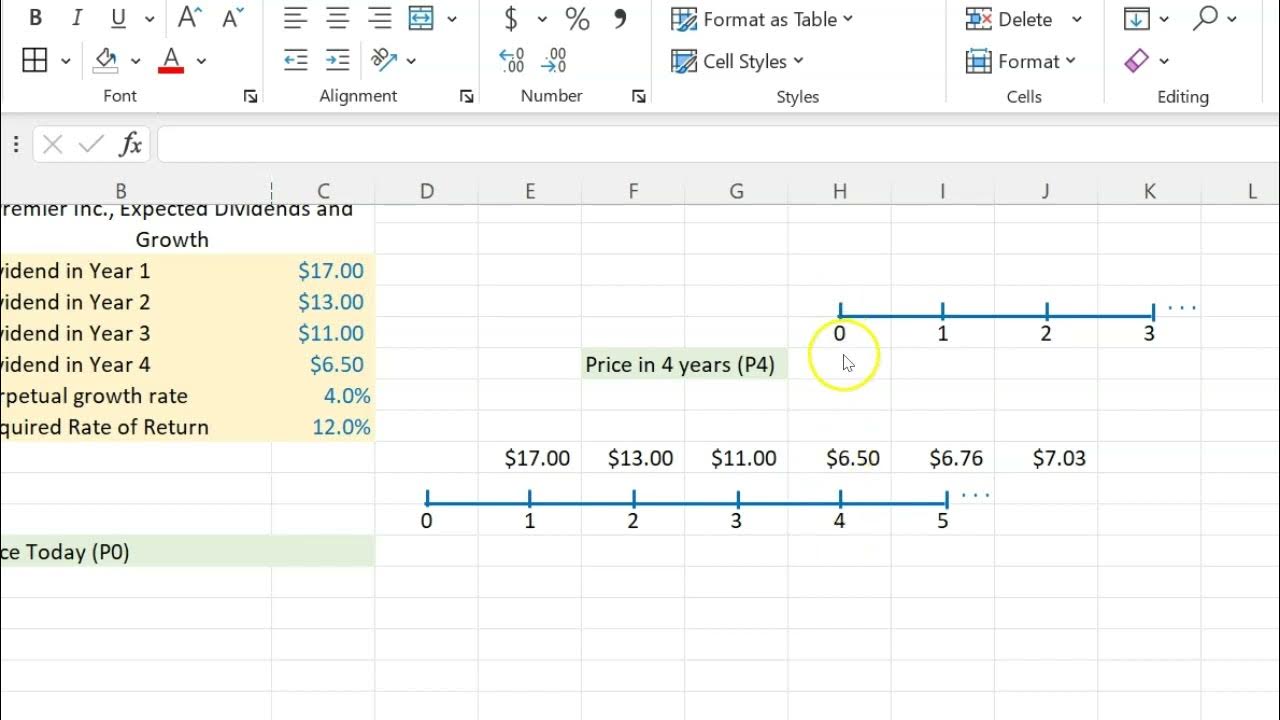

- 😀 In the case of a supernormal growth phase, where dividends increase significantly at first and then stabilize, both the present value of single cash flows and perpetuity formulas are used together.

- 😀 The calculation of share price involves discounting dividends for the first few years using the present value of single cash flow, followed by applying perpetuity formulas for stable or growing dividends in later years.

Q & A

What is the price of an asset based on the script?

-The price of any asset is equal to the present value of all future cash flows associated with that asset. This can include cash flows such as dividends, interest payments, or sale prices, depending on the type of asset.

What is the Dividend Discount Model (DDM) mentioned in the script?

-The Dividend Discount Model (DDM) is a method used to calculate the price of a share. It is based on the principle that the price of the share today is the present value of all future dividends the shareholder will receive.

How do you calculate the price of a share using the one-period Dividend Discount Model?

-In the one-period DDM, the price today is the sum of the present value of the dividend to be received in the next year and the present value of the share's price at the end of that year. The formula is: Price today = (Dividend in Year 1 + Price in Year 1) / (1 + Interest Rate).

What is the difference between the one-period and two-period Dividend Discount Models?

-The one-period DDM considers only one year's dividend and the share's price after that year. In contrast, the two-period DDM accounts for dividends over two years and the selling price at the end of the second year. The price today is the sum of the present value of both dividends and the price in Year 2.

What does the formula for multiple-period DDM look like?

-The formula for the multiple-period DDM extends the present value calculation for each period, including dividends and the final selling price. The price today is calculated by summing the present value of each dividend and the selling price in the final year, discounted by the appropriate interest rate.

How does the company life cycle affect dividend discount models?

-The company's life cycle influences the growth rate used in the DDM. In the introduction and growth stages, the company may experience high growth, while in the maturity phase, growth slows down. For a mature company, the dividend growth rate may be stable or even zero, affecting the choice of a perpetuity model for valuing future dividends.

What is an ordinary perpetuity and when is it used in dividend discount models?

-An ordinary perpetuity is a cash flow that continues forever at a constant value. In the DDM, it is used when the company reaches the maturity phase, with dividends either stable or growing at a constant rate. The price today is the dividend in the first year of the perpetuity, divided by the interest rate.

What is the formula for calculating the price of a share using an ordinary perpetuity?

-The formula for calculating the price using an ordinary perpetuity is: Price today = Dividend in Year 1 / Interest Rate. This formula is applied when the company has stable dividends and no growth in the future.

How is the growing perpetuity model different from the ordinary perpetuity model?

-A growing perpetuity model is used when dividends are expected to grow at a constant rate every year. The formula for calculating the price is: Price today = Dividend in Year 1 / (Interest Rate - Growth Rate). This contrasts with an ordinary perpetuity, where no growth in dividends is assumed.

What is the supernormal growing dividend model and how does it work?

-The supernormal growing dividend model is used when a company experiences a high dividend growth rate initially, followed by a stable growth rate at maturity. In this model, you calculate the present value of the dividends during the high-growth phase and then apply a growing perpetuity formula for the dividends in the maturity phase.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

A Basic Discounted Cash Flow Model

Valuation based on FCFF & FCFE || Equity || CFA Level-1

Stock Valuation With Non-Constant Dividends (Using Excel)

#4 Net Present Value (NPV) - Investment Decision - Financial Management ~ B.COM / BBA / CMA

Dividend Discount Gordon Model || CFA Level-1 || Equity

Dividend Discount Model || Equity || CFA Level-1

5.0 / 5 (0 votes)