Dividend Discount Model || Equity || CFA Level-1

Summary

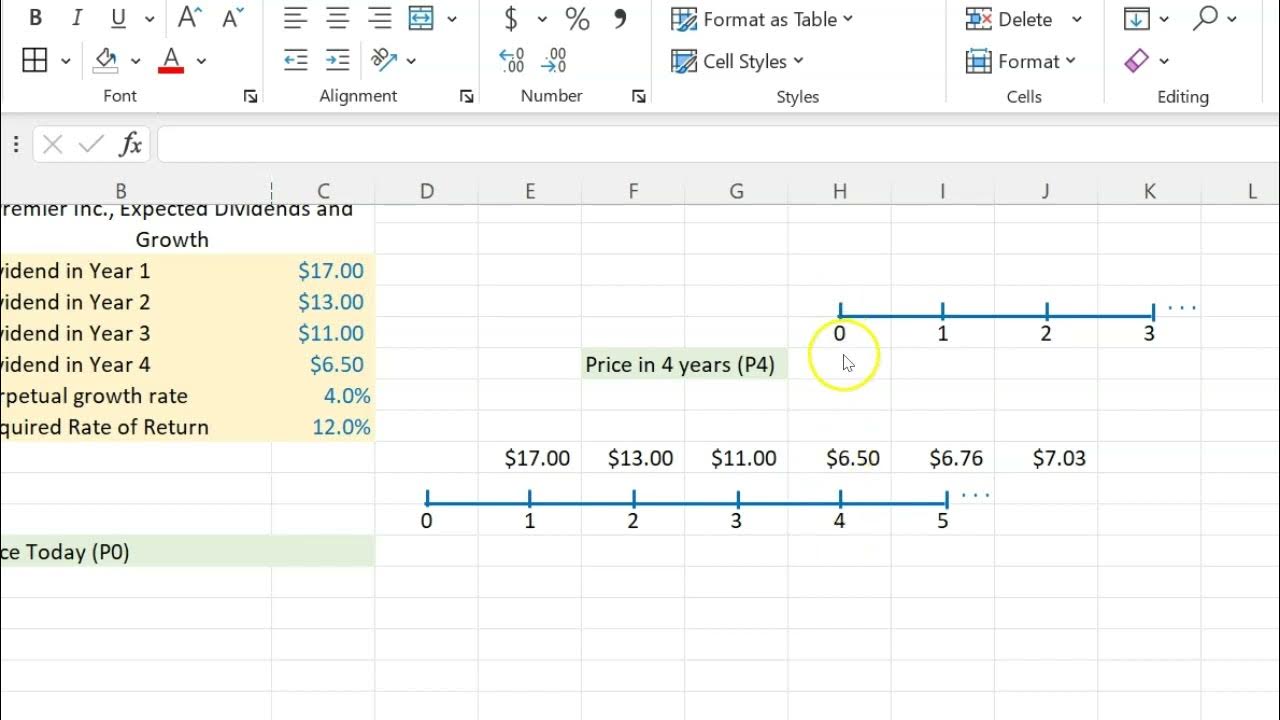

TLDRIn this detailed video, the Dividend Discount Model (DDM) is discussed as a key method for valuing equity stocks. The model incorporates variables like price, dividends, and the cost of equity, with a particular focus on calculating the present value of future dividends. The video also covers various holding periods (1 year, 3 years, 5 years), explaining how to apply the model in different scenarios. The content is enriched with practical examples, emphasizing how changes in risk and market expectations affect stock valuation, and how this model compares to other valuation methods.

Takeaways

- 😀 The Dividend Discount Model (DDM) is a key valuation model used to estimate the value of equity stocks based on dividends and growth expectations.

- 😀 The most basic version of DDM involves calculating stock value using dividends expected in the next year, factoring in the cost of equity (Ke) and growth rate.

- 😀 The cost of equity (Ke) can be derived from the Capital Asset Pricing Model (CAPM), where Ke = Rf + Beta * (Rm - Rf). This reflects the required return for equity investments based on market risk.

- 😀 The cost of equity (Ke) varies depending on the risk level of the stock compared to the market, represented by Beta. A higher Beta indicates greater risk and thus a higher cost of equity.

- 😀 Dividend (D1) in DDM refers to the expected dividend for the next year, which can be calculated by applying the growth rate to the current dividend.

- 😀 The present value of stock can be calculated using both the dividend and price components, considering the expected dividends and stock price at the end of the holding period.

- 😀 For a holding period model, such as 1-year or multi-year, the stock price is adjusted for dividends expected during that period and discounted back to the present.

- 😀 When calculating the price of a stock using DDM, the future dividends and stock price are discounted to their present values using the cost of equity (Ke).

- 😀 The model assumes a constant growth rate for dividends, though real-life situations rarely follow a 'no-growth' assumption for long periods.

- 😀 The DDM is used to find the present value of future cash flows from dividends and expected stock prices, combining these components to estimate a stock's value based on an investor's expectations.

Q & A

What is the Dividend Discount Model (DDM) and why is it important?

-The Dividend Discount Model (DDM) is a method used to determine the value of an equity stock by estimating the present value of its expected future dividends. It is important because it helps investors estimate the fair value of a stock, enabling them to make informed investment decisions.

What are the key variables in the Dividend Discount Model?

-The key variables in the Dividend Discount Model include the current price of the stock (P0), expected dividends (D1, D2, D3, etc.), and the cost of equity (Ke). These are essential for calculating the present value of expected future cash flows.

What does 'cost of equity' (Ke) represent in the DDM?

-The 'cost of equity' (Ke) represents the return required by an investor to hold the stock, reflecting the risk level compared to the market. It is calculated using the Capital Asset Pricing Model (CAPM) formula: Ke = Rf + β × (Rm - Rf), where Rf is the risk-free rate, β is the beta of the stock, and (Rm - Rf) is the market risk premium.

How does the risk level of a stock affect its cost of equity?

-The risk level of a stock, measured by its beta (β), affects its cost of equity. A higher beta indicates higher risk and thus a higher cost of equity, whereas a lower beta suggests lower risk and a lower cost of equity.

What is the significance of the growth rate in the Dividend Discount Model?

-The growth rate in the DDM represents the expected rate at which dividends will increase over time. It is crucial for estimating the future dividends' value, influencing the overall valuation of the stock. The model assumes either a constant growth rate for perpetual growth or varying growth rates over different periods.

How do you calculate the present value of future dividends in the DDM?

-To calculate the present value of future dividends in the DDM, you discount each expected dividend by the cost of equity. For a holding period of multiple years, the present value is calculated using the formula: P0 = D1/(1 + Ke) + D2/(1 + Ke)^2 + ... + Dn/(1 + Ke)^n, where D1, D2, ..., Dn represent expected dividends, and n is the number of years.

What is the formula for the DDM when there is no growth in dividends?

-When there is no growth in dividends, the DDM simplifies to P0 = D1 / Ke, where D1 is the expected dividend for the next period and Ke is the cost of equity. This is used for valuing a stock with constant dividends.

How is the valuation different when considering a holding period of multiple years?

-When considering a holding period of multiple years, the DDM includes the discounted present value of dividends for each year plus the expected price at the end of the holding period. The calculation is: P0 = D1/(1 + Ke) + D2/(1 + Ke)^2 + ... + Dn/(1 + Ke)^n + Pn/(1 + Ke)^n, where Pn is the expected price at the end of the holding period.

What is the main limitation of the Dividend Discount Model?

-The main limitation of the DDM is that it relies heavily on accurate assumptions regarding future dividends and the growth rate. It is not well-suited for valuing stocks of companies that do not pay dividends or have unpredictable dividend patterns.

What should an investor do to verify their calculations in the DDM?

-To verify calculations in the DDM, an investor should use tools like financial calculators or Excel spreadsheets to ensure accuracy. Additionally, checking the assumptions used for future dividends, growth rates, and cost of equity is essential for reliable valuation.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Analisis Dividen Tunai hingga Tips Menghindari Dividen Trap

Valuation based on FCFF & FCFE || Equity || CFA Level-1

Stock Valuation With Non-Constant Dividends (Using Excel)

Dividend based Models || Equity || CFA Level-1

Dividend Discount Gordon Model || CFA Level-1 || Equity

Dividend Discount Model (DDM)

5.0 / 5 (0 votes)