Dividend Discount Gordon Model || CFA Level-1 || Equity

Summary

TLDRThis video explains the Dividend Discount Model (DDM) with constant growth, also known as the Gordon Growth Model, which is used to value stocks based on dividends and their growth rate. The model’s core formula calculates stock value by factoring in expected dividends and a constant growth rate. Key topics include the role of sustainable growth rate (SGR), retention ratios, and reinvested earnings in affecting stock value. The video also demonstrates the model’s application through practical examples, showing how growth influences stock prices. Viewers will gain insights into calculating stock value with and without growth assumptions.

Takeaways

- 😀 The Dividend Discount Model (DDM) is a method to value stocks based on expected dividends and growth rates. The core formula is P0 = D1 / (r - g), where P0 is the stock price, D1 is the next dividend, r is the required rate of return, and g is the dividend growth rate.

- 😀 The Gordon Growth Model, a type of DDM, assumes constant, perpetual growth of dividends. This is widely used for valuing companies with predictable growth patterns.

- 😀 When calculating stock price using the DDM, the growth rate (g) must always be less than the required rate of return (r). If g equals or exceeds r, the model will not work mathematically.

- 😀 The Sustainable Growth Rate (SGR) is a critical factor in determining the growth rate of dividends. It is calculated as ROE × Retention Ratio, where ROE is the return on equity and the retention ratio is the proportion of earnings reinvested into the business.

- 😀 Historical growth rates, industry averages, or the company's own SGR can serve as potential sources for estimating the growth rate (g). These provide insights into how much the company can sustainably grow its dividends.

- 😀 The price of a stock can increase significantly when growth is considered in the model. For example, including a growth rate in the formula raises the stock price compared to a no-growth scenario.

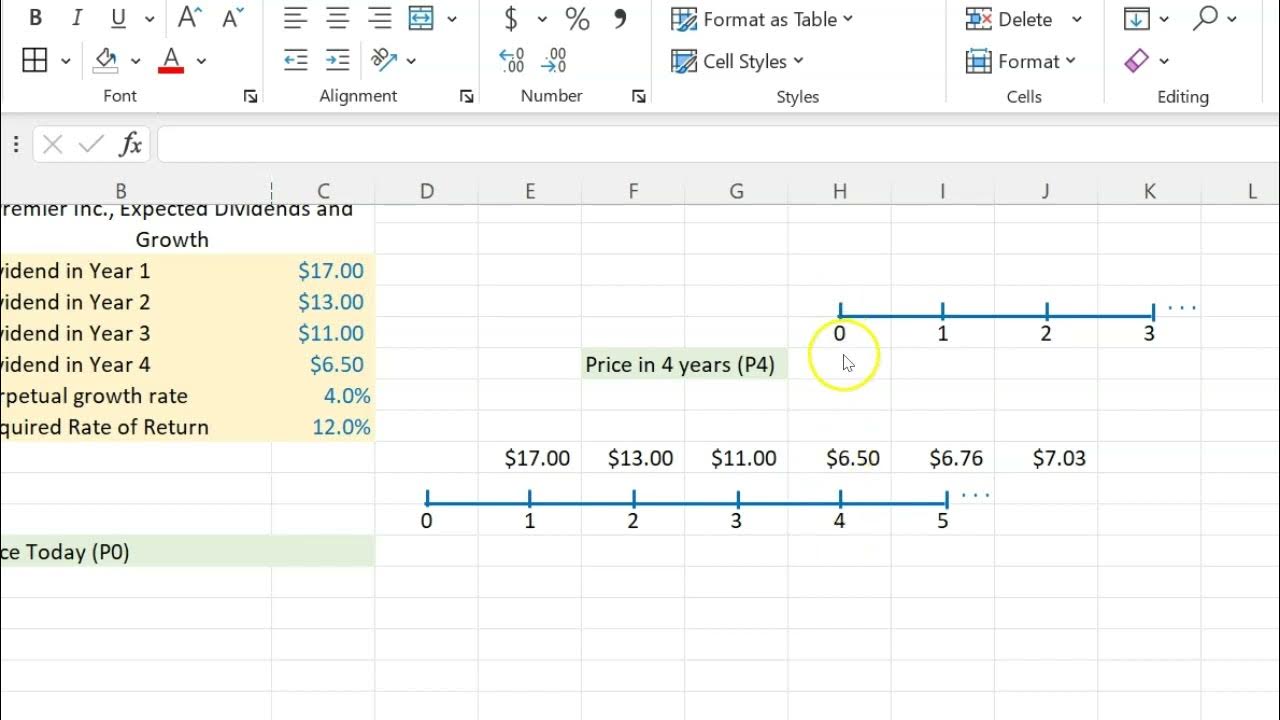

- 😀 The Dividend Discount Model can also apply in situations where dividends are expected to start at a later time, or where the growth rate changes after a certain period, such as multi-stage growth models.

- 😀 If a company retains earnings instead of distributing them as dividends, it may invest those funds into projects that generate future earnings. This reinvestment contributes to future dividend growth and stock price appreciation.

- 😀 When applying DDM in real-world scenarios, it's important to consider how future dividend payments and growth expectations affect the stock's current valuation, especially in cases of fluctuating or delayed dividends.

- 😀 In multi-stage dividend growth models, different growth rates are applied for different periods. This allows for more flexibility in valuing companies that experience variable growth over time.

Q & A

What is the Dividend Discount Model (DDM) and how does the Constant Growth Approach fit into it?

-The Dividend Discount Model (DDM) is a method used to value a company based on the present value of its expected future dividends. The Constant Growth Approach, also known as the Gordon Growth Model, assumes that dividends will grow at a constant rate indefinitely, simplifying the valuation of a company that distributes dividends regularly.

What is the formula used in the Gordon Growth Model for stock valuation?

-The formula for stock valuation in the Gordon Growth Model is: P₀ = D₁ / (r - g), where P₀ is the current stock price, D₁ is the expected dividend in the next period, r is the required rate of return, and g is the constant growth rate of dividends.

How does the inclusion of a growth rate affect stock valuation?

-Including a growth rate (g) in the formula increases the value of the stock, as the future dividends are expected to grow over time. For example, with a dividend of ₹15 and a growth rate of 6%, the stock value increases from ₹150 (without growth) to ₹250 (with growth).

What are the common methods for estimating the growth rate (g) in the Dividend Discount Model?

-The growth rate (g) can be estimated using historical growth rates, industry averages, or the Sustainable Growth Rate (SGR), which is calculated as the Return on Equity (ROE) multiplied by the retention ratio (1 - dividend payout ratio).

What is the Sustainable Growth Rate (SGR) and how is it calculated?

-The Sustainable Growth Rate (SGR) is the rate at which a company can grow its earnings while maintaining a constant return on equity and a fixed dividend payout ratio. It is calculated as: SGR = ROE × (1 - Dividend Payout Ratio).

Why is it important that the growth rate (g) be less than the required rate of return (r) in the Gordon Growth Model?

-If the growth rate (g) exceeds the required rate of return (r), the denominator in the formula (r - g) will become negative, making the stock valuation formula invalid. Therefore, the growth rate must always be less than the required rate of return.

How can the Gordon Growth Model be adjusted if the growth rate changes over time?

-In cases where the growth rate changes over time, a multi-stage dividend growth model can be used. This involves applying different growth rates for different time periods, then calculating the present value of dividends for each stage and discounting them back to the present.

What is the impact of dividend payout ratios on the Sustainable Growth Rate (SGR)?

-The dividend payout ratio directly affects the SGR. A lower payout ratio means more earnings are retained and reinvested in the business, leading to higher growth. Conversely, a higher payout ratio means less retention and lower growth potential.

What happens if a company does not have available dividends for the immediate future in the Dividend Discount Model?

-If a company does not have dividends for the immediate future, analysts can calculate the future dividends expected to be paid out and discount them back to the present value using the appropriate rate of return. The model can be adapted by finding the expected dividends in future years and using them for stock valuation.

What is the role of the required rate of return (r) in the Dividend Discount Model?

-The required rate of return (r) represents the minimum return that investors expect from an investment. It is used as the discount rate in the Dividend Discount Model to calculate the present value of future dividends. The rate should reflect the risk associated with the company and the market.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Stock Valuation With Non-Constant Dividends (Using Excel)

Dividend Discount model (multistage) || Equity || CFA Level-1

Dividend Discount Model (DDM)

Analisis Dividen Tunai hingga Tips Menghindari Dividen Trap

Dividend based Models || Equity || CFA Level-1

Dividend Discount Model || Equity || CFA Level-1

5.0 / 5 (0 votes)