Determinants of Money Supply - High Powered Money & Money Multiplier

Summary

TLDRThis video explains the determinants of money supply, focusing on concepts like high power money, money supply, and the money multiplier. It discusses how central banks, particularly the Reserve Bank of India (RBI), control the issuance of money and the creation of money supply. Key terms such as high power money, monetary base, and money multiplier are explored, along with formulas and diagrams illustrating their relationships. The video highlights how changes in high power money influence the broader money supply in an economy.

Takeaways

- 😀 Money supply refers to the total amount of money circulating within a country, including currency and deposits in banks.

- 😀 High-powered money (or the monetary base) consists of currency issued by the RBI and the government, forming the foundation for money supply.

- 😀 The government and the RBI have the exclusive authority to print and issue money, which is classified as high-powered money.

- 😀 Commercial banks create money through the lending process, where loans lead to the creation of new deposits, thus expanding the money supply.

- 😀 The money multiplier effect shows how increases in high-powered money lead to larger increases in overall money supply through the banking system.

- 😀 Banks are required to hold a portion of deposits as reserves, known as the required reserve ratio (RRR), which limits their ability to lend and create money.

- 😀 The money multiplier is calculated as the reciprocal of the required reserve ratio (1/RRR), indicating how much money can be created from a given amount of high-powered money.

- 😀 For example, if the required reserve ratio is 20%, the money multiplier would be 5, meaning ₹1 of high-powered money could create ₹5 in total money supply.

- 😀 High-powered money increases as the RBI or government issues more currency or bonds, which in turn allows banks to lend more and expand the money supply.

- 😀 The value of the money supply is influenced by the amount of currency in circulation (C) and the reserves held by commercial banks (R).

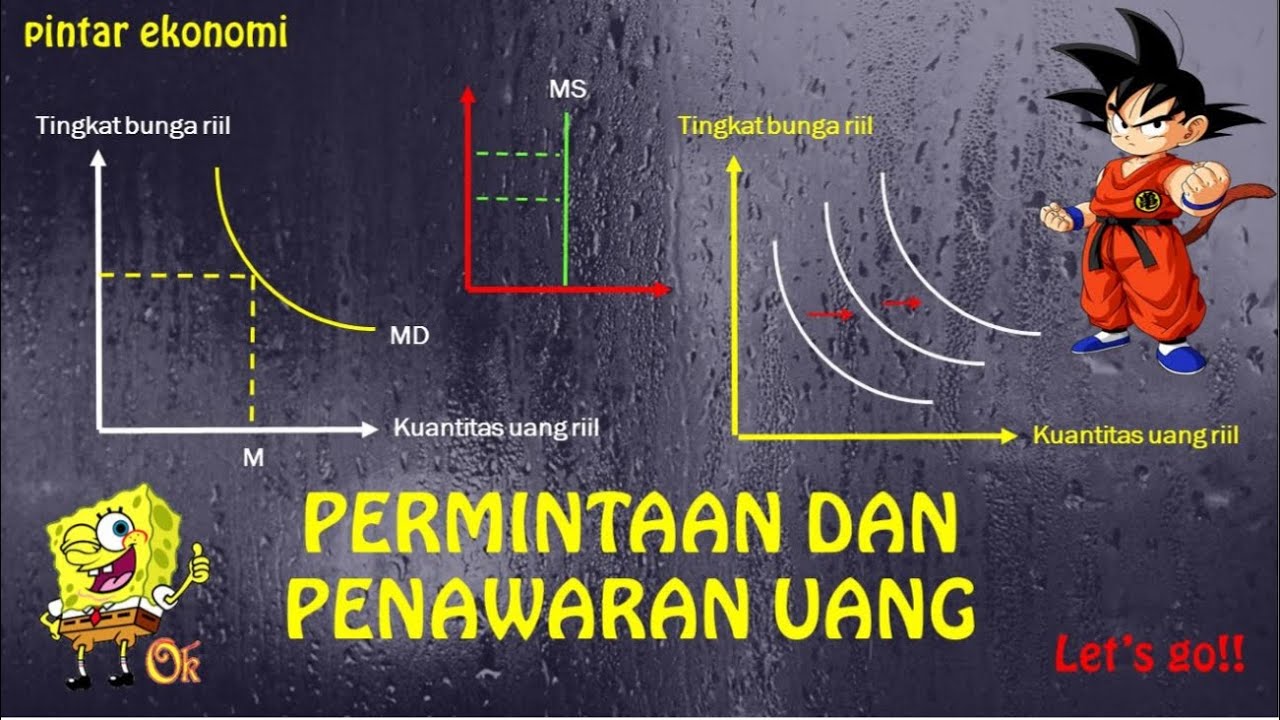

- 😀 The relationship between high-powered money and the money supply can be visualized in a diagram, showing that an increase in high-powered money leads to a proportional increase in money supply.

Q & A

What is money supply, as described in the script?

-Money supply refers to the total amount of money available in an economy, including currency in circulation (coins and banknotes) and deposits held in commercial bank accounts. It represents the total money circulating in the country.

What is meant by 'high-power money'?

-'High-power money' is the money issued by the central bank (RBI in India) and the government. This includes currency notes and coins, and it forms the monetary base that can be expanded through credit creation by commercial banks.

How does high-power money relate to money supply?

-High-power money is a part of the money supply, as it forms the base for the creation of money in the economy. When high-power money increases, it leads to an increase in the overall money supply through mechanisms like credit creation by banks.

What is the 'monetary base' and why is it important?

-The monetary base refers to the sum of high-power money, which includes currency issued by the central bank and the reserves held by commercial banks. It is important because it is the foundation for money creation in the economy, which affects inflation, interest rates, and economic growth.

How does the Reserve Bank of India (RBI) control the supply of high-power money?

-The RBI controls the supply of high-power money by regulating the issuance of currency and managing reserves. The RBI has the authority to print and issue currency and can influence money supply through its monetary policies, such as adjusting reserve requirements and conducting open market operations.

What is the 'money multiplier'?

-The money multiplier refers to the ratio of the total money supply to the monetary base. It shows how much money can be created in the economy based on an initial deposit or increase in high-power money. The multiplier effect happens when commercial banks lend out money, increasing the overall supply.

How does the money multiplier work in relation to high-power money?

-The money multiplier amplifies the effect of high-power money on the total money supply. When the RBI increases high-power money (e.g., by printing more currency), commercial banks can lend out a portion of this money, which in turn increases the money supply through a chain reaction.

What role do commercial banks play in the creation of money?

-Commercial banks play a key role in the creation of money by lending out a portion of the deposits they receive. Through this lending process, they effectively multiply the money supply in the economy. They also must keep a certain percentage of their deposits as reserves, known as the 'required reserve'.

What is the relationship between currency in circulation and deposits in banks?

-Currency in circulation refers to the physical money (notes and coins) held by the public, while deposits refer to the money that people hold in banks. Both are parts of the total money supply, with currency representing a portion of it and bank deposits increasing through processes like lending and credit creation.

What is the 'required reserve' and why is it important?

-The 'required reserve' is the minimum amount of funds that commercial banks are required to hold with the central bank, expressed as a percentage of their deposits. It is important because it ensures banks have enough liquidity to meet withdrawal demands and helps the central bank control the money supply.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード5.0 / 5 (0 votes)