TM 4 determinant money supply ch 16 part 1 rumus money multipler (m)

Summary

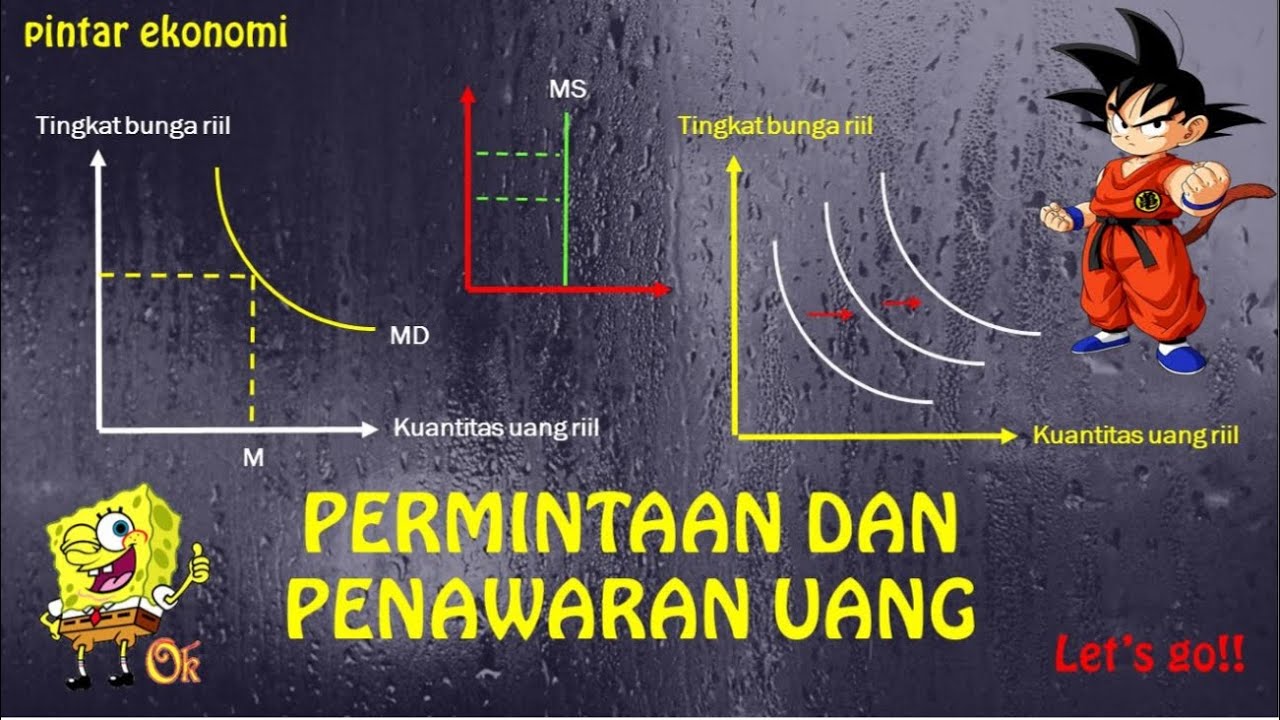

TLDRThe transcript discusses key concepts related to money supply, monetary policy, and banking systems. It introduces the money multiplier effect, explaining how the behavior of depositors and banks influences the creation of money. The role of central banks in regulating reserves and the importance of reserve ratios is emphasized. Additionally, the script delves into practical calculations related to money supply and the impact of different reserve ratios on the banking system. The session also touches on the importance of understanding monetary policies for managing economic stability.

Takeaways

- 😀 The discussion focuses on money supply, specifically how central banks and commercial banks interact with depositors and the economy.

- 😀 A 10% reserve requirement is mentioned, which impacts the ability of banks to create money through lending.

- 😀 Money multiplier is a key concept, where banks can multiply the initial deposit by a factor, increasing the overall money supply.

- 😀 The role of central banks in regulating the money supply, including controlling the reserve ratio, is emphasized.

- 😀 Depositors' behavior plays a critical role in the amount of money created within the economy. A larger deposit means a larger multiplier effect.

- 😀 The central bank's requirements impact the liquidity and the lending capacity of commercial banks.

- 😀 The importance of understanding the relationship between depositors, banks, and central banks is highlighted.

- 😀 The reserve ratio directly influences how much money commercial banks can lend out, impacting economic activity.

- 😀 Calculations and formulas are used to estimate the money supply and the money multiplier, with an emphasis on understanding these equations.

- 😀 Different scenarios are explored to demonstrate how changes in deposit rates and bank decisions can affect the overall money supply.

- 😀 The script concludes by advising the audience to practice the calculations related to money supply using the given formulas for better understanding.

Q & A

What is the role of money supply in the economy?

-Money supply refers to the total amount of money circulating in the economy, including cash and deposits. It plays a crucial role in controlling inflation, economic growth, and employment levels. The central bank manages the money supply to ensure economic stability.

What does the term 'money multiplier' mean?

-The money multiplier is a concept that describes how an initial deposit can lead to a larger increase in the total money supply through the lending activity of banks. It is calculated based on the reserve ratio set by the central bank.

How does the reserve ratio affect the money supply?

-The reserve ratio, which is the fraction of deposits that banks must hold in reserve, directly impacts the money multiplier. A lower reserve ratio means banks can lend more, increasing the money supply, while a higher ratio restricts lending, reducing the money supply.

What is the significance of a 10% reserve ratio mentioned in the transcript?

-A 10% reserve ratio means that for every deposit, the bank is required to keep 10% in reserve and can lend out the remaining 90%. This reserve ratio influences how much money the bank can lend, thus impacting the money supply and economic activities.

What does the term 'excess reserves' mean in the context of this transcript?

-Excess reserves refer to the amount of money that banks hold in reserve beyond the required reserve ratio. Banks can choose to hold excess reserves or lend them out, which impacts the money multiplier and overall money supply.

How does the behavior of depositors affect the money multiplier?

-The behavior of depositors, such as how much money they deposit and whether they choose to hold cash instead of depositing it in the bank, directly impacts the money multiplier. If depositors keep a large portion of their money in cash, the money multiplier is reduced.

What role does the central bank play in controlling the money supply?

-The central bank controls the money supply through policy tools such as adjusting the reserve ratio, conducting open market operations, and setting interest rates. These actions influence how much money is available for lending and spending in the economy.

What happens if depositors change their behavior and start withdrawing more money?

-If depositors start withdrawing more money, the reserves of banks decrease, which reduces the amount available for lending. This could lead to a decrease in the money multiplier and overall money supply in the economy.

Why is it important for banks to manage their deposit ratios?

-Managing deposit ratios is essential for banks to ensure they have enough reserves to meet withdrawal demands while also being able to lend money. A balanced approach to deposit ratios allows banks to maintain financial stability and contribute to the economy's growth.

What is the formula for calculating the money supply (M) in this context?

-The money supply (M) is calculated by multiplying the money multiplier (MP) by the amount of initial deposits (C). The formula provided in the transcript is M = (1 / reserve ratio) * C, where C represents the initial deposit and the reserve ratio is a central factor in the calculation.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Materi Makro M13 - Uang, Bank, dan Penawaran Uang (Bagian 3)

Permintaan dan Penawaran Uang | Ekonomi SMA Kelas 11

TM 4 determinant money supply ch 16 part 2 (contoh soal 1)

ch 22 demand for money part 1 of 5 fisher 1

KEBIJAKAN MONETER - Kebijakan Moneter dan Kebijakan Fiskal Part 1

Permintaan Uang, Kebijakan Moneter, Fungsi LM dan Keseimbangan Pasar (Man 21B)

5.0 / 5 (0 votes)