1e Teori Penawaran Uang

Summary

TLDRIn this video, Prof. Andre Sumitra discusses the theory of money supply, exploring concepts like money creation by central banks and financial institutions, the role of money multipliers, and the impact of government policies on economic stability. He explains different measures of money supply (M0, M1, M2, M3, M4) and the factors influencing money supply, including inflation, interest rates, and public confidence. The video also covers central bank tools for managing money supply, such as open market operations, interest rate targeting, and reserve requirements, emphasizing their importance in stabilizing prices and supporting economic growth.

Takeaways

- 😀 Money supply refers to the total amount of money available in an economy, including both cash and deposits held by banks.

- 😀 The central bank plays a key role in controlling money supply to ensure economic stability, including controlling inflation and promoting economic growth.

- 😀 The money supply can be understood in both narrow and broad terms: narrow money includes cash and deposits in the financial system, while broad money includes things like savings and time deposits.

- 😀 Factors that influence money supply include inflation, interest rates, economic confidence, and access to financial services.

- 😀 Money multiplier concept explains how an initial deposit can result in a greater increase in the money supply as banks lend out money while keeping a fraction as reserves.

- 😀 Bank central banks use various tools to manage money supply, including open market operations, interest rate targeting, and reserve requirements.

- 😀 The relationship between money supply and interest rates is crucial: increasing money supply can lower interest rates, which in turn stimulates borrowing and investment.

- 😀 Different money supply measures (M0, M1, M2, M3, M4) indicate varying levels of liquidity, with M0 being the most liquid and M4 being the broadest measure.

- 😀 Inflation and economic uncertainty can lead individuals to hold less cash and invest in assets that offer better returns or are more secure.

- 😀 Government policies on money supply have significant effects on the economy, including controlling inflation, fostering growth, and maintaining currency stability.

Q & A

What is the definition of money supply according to Prof. Andre Sumitra?

-Money supply refers to the total amount of money available in an economy, including both cash and deposits stored in banks, provided by the central government or central bank for public transactions.

What are the main components of money supply?

-The main components of money supply include cash (currency), demand deposits (money in checking accounts), and time deposits (money in savings and fixed deposits). Broadly, it can include money in the form of quasi-money, such as savings accounts and foreign currency deposits.

What is the difference between M0, M1, M2, M3, and M4 in terms of money supply?

-M0 refers to the base money, including physical currency in circulation and commercial bank reserves at the central bank. M1 is the sum of M0 plus demand deposits. M2 expands M1 by including savings accounts and short-term deposits. M3 includes M2 along with larger time deposits and other financial instruments. M4 is the broadest measure, including all components of M3 plus other assets like stocks and bonds.

What is the role of a central bank in regulating money supply?

-The central bank controls money supply to stabilize the economy, using various tools such as open market operations, interest rate targeting, and reserve requirements. It aims to maintain price stability, control inflation, and support economic growth.

What is the concept of the 'money multiplier'?

-The money multiplier refers to the process by which an initial deposit in a bank can lead to a greater increase in the total money supply. For example, with a reserve ratio of 10%, a deposit of $1 million can lead to $10 million in money supply as the bank loans out a portion and the process repeats.

How do inflation rates affect money supply?

-High inflation typically reduces the purchasing power of money, causing people to spend or invest their money rather than keep it in savings, thereby decreasing the money supply held as cash. In response, the central bank may alter monetary policy to control inflation.

What is the effect of interest rates on money supply?

-Higher interest rates generally encourage saving as individuals seek higher returns on deposits, potentially reducing the money supply in circulation. Conversely, lower interest rates may encourage spending and borrowing, increasing the money supply.

How does a bank's reserve requirement affect money creation?

-A bank's reserve requirement determines the fraction of deposits it must keep on hand and not lend out. A lower reserve requirement increases the money multiplier effect, leading to a higher money supply, while a higher reserve requirement restricts the money available for lending and reduces money supply expansion.

What role do financial institutions (both bank and non-bank) play in money supply?

-Financial institutions contribute to money creation by offering loans, which increase deposits and, consequently, the money supply. Non-bank financial institutions also provide services that facilitate transactions and investments, indirectly influencing the money supply.

What factors influence an individual’s decision to offer money in the economy?

-Factors influencing the decision include income levels, inflation rates, interest rates, access to financial services, risk perception, and personal financial goals. For example, people may offer more money if they expect future income increases, lower inflation, or higher returns from investments.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

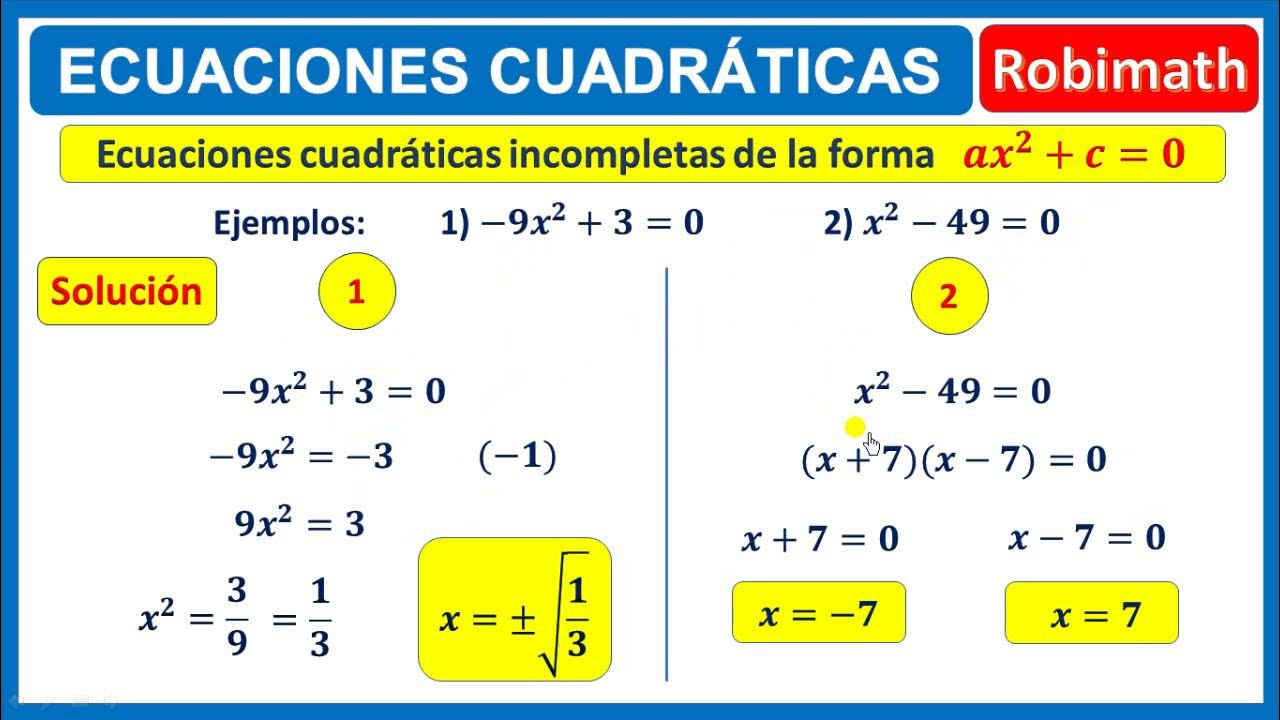

Ecuaciones cuadráticas de la forma ax2 + c=0

Memahami Conversion, Cara Menghitungnya dan 3 Cara Meningkatkan Conversion Rate Digital Marketing

Prof. Ali Saukah: Kemitraan Pembelajaran untuk English DL (PM)-Eps.1 @Suyantoid

FUNÇÃO DO 1 GRAU | FUNÇÃO AFIM | \Prof. Gis/- AULA 1

Kontribusi BINUS dalam Memperkaya Riset untuk RI | JURNAL BINUSIAN

PROF RACHMAT KRIYANTONO (PROF RK); ISU, KRISIS DAN PUBLIC RELATIONS, STUDI KASUS ARLA

Cara Membuat Literature Review Tiga Tips Mudah | Tirta Mursitama

5.0 / 5 (0 votes)