Cara lapor SPT Tahunan PPh Orang Pribadi pengusaha umkm menggunakan eform 1770

Summary

TLDRThis tutorial provides a comprehensive guide on filing the annual Personal Income Tax Return (SPT) for individual taxpayers, specifically targeting small and medium-sized enterprises (UMKM) using the e-form 1770. The video covers essential prerequisites such as obtaining an Electronic Filing Identification Number (EFIN) and preparing financial statements in PDF format. It walks viewers through the online submission process via the DJP Online platform, detailing each step from logging in to submitting the final report, including the necessary verifications. This informative session aims to simplify tax reporting for UMKM owners, ensuring compliance with tax obligations.

Takeaways

- 😀 Ensure you have an Electronic Filing Identification Number (EFIN) before filing your annual personal income tax (SPT) as a UMKM.

- 📑 Prepare a summary of your gross income for each month of the previous year in PDF format for submission.

- 🌐 Access the DJP Online platform at djp-online.pajak.go.id to begin the filing process.

- 🔐 Log in to your DJP Online account using your EFIN, password, and security code.

- 📝 Start the filing process by clicking the 'Lapor' (Report) button on the information page.

- 📥 Download and install any required software if you are filing for the first time.

- 📊 When creating your SPT, indicate whether you are running a business or freelancing and select the relevant tax year.

- ✉️ After submitting your request, check your email for a verification code necessary for proceeding.

- 📈 Fill in your financial details accurately, including assets, liabilities, and family member information as needed.

- ✅ Confirm all entries before submitting and ensure that you upload your gross income summary PDF correctly.

Q & A

What is the purpose of the tutorial?

-The tutorial aims to guide MSME taxpayers in Indonesia on how to file their annual individual income tax (SPT PPH) using the e-form 1770.

What initial step must taxpayers take before filing their SPT?

-Taxpayers must ensure they have obtained an Electronic Filing Identification Number (EFIN) to register for an online DJP account.

What document must taxpayers prepare for the filing process?

-Taxpayers need to prepare a PDF file of their monthly gross turnover for the entire year, which will be uploaded during the SPT filing.

How do taxpayers access the DJP Online platform?

-Taxpayers can access DJP Online by entering the URL 'djp-online.pajak.co.id' in their web browser.

What should taxpayers do if they encounter a pop-up when logging in?

-If a pop-up appears, taxpayers should close it by clicking the 'X' in the upper right corner.

What information is required to log in to DJP Online?

-Taxpayers need to enter their 15-digit EFIN, account password, and a security code to log in.

What option should a taxpayer select when asked about their business status?

-The taxpayer should select 'yes' if they are running a business or self-employed.

What is the significance of the verification code received via email?

-The verification code received via email is necessary for submitting the e-form and confirms the taxpayer's identity.

How can taxpayers manage their asset and liability declarations in the e-form?

-Taxpayers can add or remove assets and liabilities by using the '+' and '-' buttons provided in the e-form interface.

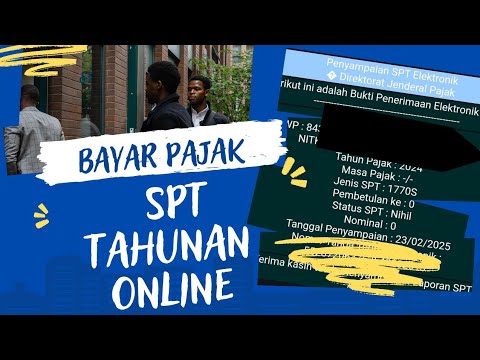

What should taxpayers do after successfully submitting their SPT?

-After submission, taxpayers should check their email for a confirmation receipt of their SPT filing.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

Cara Lapor SPT Tahunan PPh Orang Pribadi Pengusaha UMKM | Tutorial Lengkap

Cara Lapor Spt Online Tahun 2025

Tutorial Pelaporan SPT Tahunan 1770 | Bagi WP Orang Pribadi dengan e-Form

Tutorial Efiling 2022: Cara Lapor Pajak SPT Tahunan Secara Online Penghasilan Dibawah Rp 60 Juta

Mudah Banget! Membuat Laporan Keuangan UMKM untuk Lapor SPT Tahunan

Cara Lapor SPT Tahunan untuk Orang Pribadi Pengusaha dan Pekerja Bebas

5.0 / 5 (0 votes)