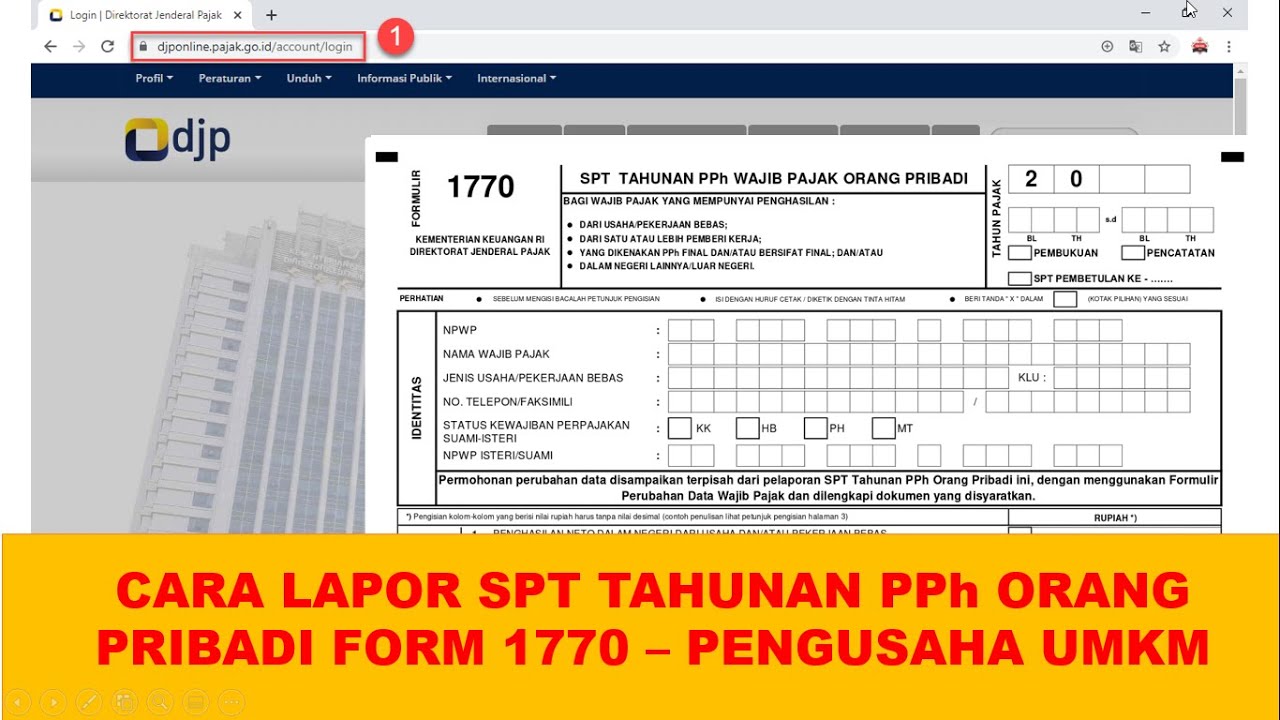

Cara Lapor SPT Tahunan PPh Orang Pribadi Pengusaha UMKM | Tutorial Lengkap

Summary

TLDRThis video provides a step-by-step guide on how individual taxpayers, especially small business owners (UMKM), can file their annual tax return (SPT) using the Kortex platform. It covers logging in, completing the required sections such as income and asset declarations, adding attachments, and submitting the form. The video also explains how to address tax deductions, overpayment, and payment methods. It encourages users to visit the official tax website for further assistance and highlights the importance of accurate submission for a smooth tax filing process.

Takeaways

- 😀 The Kortex platform is used for submitting the annual individual tax return (SPT tahunan PPH) for small and medium entrepreneurs (UMKM) in Indonesia.

- 😀 Taxpayers can log in to the Kortex platform using their NPWP, password, and CAPTCHA.

- 😀 To start the SPT submission, users need to navigate to the 'Tax Return' menu and select 'Create Tax Return.'

- 😀 When creating an SPT, taxpayers must select the relevant year and SPT status (e.g., tax return filing).

- 😀 The platform asks taxpayers to answer questions about their business type, including whether they are a small business with a certain income threshold (under 4.8 billion IDR).

- 😀 Taxpayers must fill out income details, which are reflected in the 'Attachment 3B' section of the form.

- 😀 The 'Main Form' (Induk) must be completed first, starting with personal information and any deductions applicable.

- 😀 If the taxpayer does not have withholding tax receipts or foreign tax credits, they must mark the relevant sections accordingly.

- 😀 The 'Attachment S' section is essential for listing assets owned at the end of the tax year.

- 😀 Once the SPT is filled out, taxpayers must sign it electronically and confirm the submission by clicking 'Pay and Submit.'

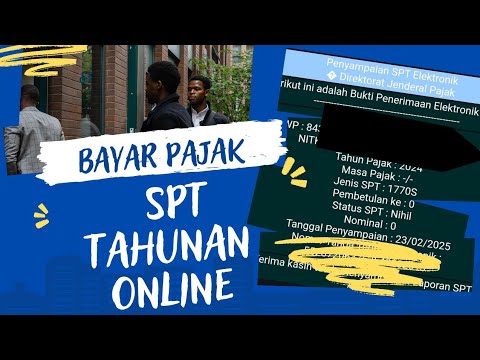

- 😀 After submission, taxpayers can download their electronic receipt and the submitted SPT document for their records.

Q & A

What is the purpose of the video?

-The purpose of the video is to guide individuals on how to report their Annual Tax Return (SPT) for personal income tax (PPH) as a small business owner or UMKM taxpayer using the Kortex application.

What language is the Kortex application used in for the tutorial?

-The Kortex application used in the tutorial is in English.

Who can access the Kortex application?

-The Kortex application can only be accessed by authorized individuals for data security purposes.

How do you log in to the Kortex application to access the SPT menu?

-To log in, you need to input your 16-digit NPWP, password, and CAPTCHA. Then, click the login button to access the SPT menu.

What should you do to create an SPT in the Kortex application?

-To create an SPT, select the 'Tax Return' menu, then choose the 'Create Tax Return' button. After that, select the correct SPT type based on the tax year and status.

What are the steps involved in completing the SPT form in Kortex?

-The steps involve filling out the main section first by answering questions about income and status, then completing other sections such as income details, tax deductions, and assets. Finally, submit and sign the form electronically.

What if a taxpayer has income from a final tax object?

-If a taxpayer has income from a final tax object, they should select 'yes' in the appropriate section of the SPT form.

How do you input income details in the SPT?

-To input income details, you need to go to Attachment 3B, Part A, click 'Edit', and fill in the required details. After finishing, click 'Save' to save the income list.

How do you handle tax credit from foreign taxes in the SPT?

-If there is no foreign tax credit or proof of deductions, select 'no' in the relevant sections (10A and 10D) to indicate that no foreign tax credit applies.

How do you complete the asset declaration in the SPT?

-To complete the asset declaration, go to Attachment S, Part A, click 'Add' to input assets, and fill in the asset details such as type and classification.

What happens after submitting the SPT in the Kortex application?

-Once submitted, the SPT will appear in the 'Tax Return Submitted' menu. The taxpayer can download the Electronic Receipt and the printed copy of the submitted SPT.

What should a taxpayer do if their SPT shows underpayment?

-If there is underpayment, the taxpayer will have the option to pay using their deposit balance or generate a billing code for payment.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Cara lapor SPT Tahunan PPh Orang Pribadi pengusaha umkm menggunakan eform 1770

Cara Lapor SPT Tahunan PPh Orang Pribadi Pengusaha dengan Tarif Umum | Tutorial Lengkap

Cara Lapor Spt Online Tahun 2025

CARA LAPOR SPT TAHUNAN CORETAX TERBARU || LAPOR PAJAK UMKM OMZET DIBAWAH 500 JUTA

Tutorial Efiling 2022: Cara Lapor Pajak SPT Tahunan Secara Online Penghasilan Dibawah Rp 60 Juta

Mudah Banget! Membuat Laporan Keuangan UMKM untuk Lapor SPT Tahunan

5.0 / 5 (0 votes)