Market hit ALL TIME HIGH. How to invest AFTER Rate Cuts? | Akshat Shrivastava

Summary

TLDRIn this video, Akshat Srivasta, a full-time investor and hedge fund manager, unpacks the intricacies of interest rate cuts in layman's terms. He explains the impact of rate cuts on borrowing costs, inflation, and asset prices, and how they influence economic growth. Discussing the long-term trends of the US market, he advises on portfolio design and the importance of investing in quality assets. He also touches on the potential for a recession and the strategic importance of hard assets in a post-2008 world of quantitative easing.

Takeaways

- 📉 **Economy and Interest Rates**: The script discusses the impact of Federal Reserve's decisions to cut or raise interest rates, and how these actions influence the economy's liquidity and inflation.

- 💹 **Market Reactions**: It clarifies that while stock markets may not immediately react positively to interest rate cuts, long-term investors should not panic as markets tend to rise over extended periods.

- 🏦 **Understanding Recessions**: The script suggests that recessions are a part of economic cycles, and investors should look for opportunities to buy assets at lower prices during these times.

- 🌐 **Global Market Comparison**: It compares the US and Indian markets, suggesting that the US market might offer better opportunities at certain times due to factors like index valuations and political events.

- 💼 **Investment Strategy**: The speaker shares his personal investment strategy, emphasizing the importance of investing in high-quality assets and managing a diverse portfolio.

- 📈 **Long-Term Growth**: The script highlights the importance of focusing on long-term growth rather than short-term market fluctuations.

- 💰 **Inflation Impact**: It explains how inflation can erode the real value of investments and why it's crucial to consider inflation when evaluating returns.

- 📉 **Quantitative Easing**: The script discusses the concept of quantitative easing and how it has shaped the modern economic landscape, influencing asset aggregation strategies.

- 🏠 **Real Estate Belief**: The speaker expresses a personal belief in investing in real estate as a hard asset to hedge against inflation and economic uncertainty.

- 🚀 **Accelerating Growth**: The script touches on how central banks use interest rate cuts to stimulate economic growth by increasing the money supply and encouraging borrowing and spending.

Q & A

What is the general impact when the Fed cuts interest rates?

-When the Fed cuts interest rates, the cost of borrowing decreases, which can lead to lower EMI payments and reduced fixed deposit rates. This action increases liquidity in the economy, potentially stimulating economic activity but also possibly leading to inflation.

Why do interest rates need to be cut or increased?

-Interest rates are adjusted to control inflation and stimulate economic growth. When inflation is high, rates are increased to slow down the economy, and when growth is sluggish, rates are cut to boost spending and investment.

How does a low-interest-rate environment affect asset prices?

-Low interest rates typically lead to an increase in asset prices such as stocks and gold, as investors seek higher returns in the face of lower returns from traditional savings.

What is the relationship between interest rates and inflation?

-Interest rates and inflation are inversely related. High interest rates can help curb inflation by reducing the money supply, while low interest rates can stimulate spending and potentially increase inflation.

Why might the Fed cut interest rates rapidly?

-The Fed might cut interest rates rapidly to prevent a recession or to stimulate an economy that is showing signs of weakness. Rapid cuts can increase the money supply quickly, aiming to boost economic activity.

How can investors respond to changing interest rates?

-Investors can respond to changing interest rates by adjusting their portfolios, potentially investing more in assets that are expected to perform well in a low-interest-rate environment, such as stocks and real estate.

What is the significance of the S&P 500 chart in the context of interest rate changes?

-The S&P 500 chart illustrates the long-term upward trend of the stock market, despite short-term fluctuations due to interest rate changes and economic cycles. It underscores the importance of a long-term investment perspective.

What does the term 'quantitative easing' mean, and how does it affect asset aggregation?

-Quantitative easing refers to a monetary policy where central banks purchase financial assets to increase the money supply and encourage lending and investment. It has led to an increase in asset prices and has fundamentally shaped the way wealth is accumulated, favoring those who can acquire hard assets.

Why might the US market perform better than the Indian market in the short term?

-The US market might outperform the Indian market in the short term due to factors such as a discounted index, an impending election, and potential policy changes that could stimulate the economy.

What are the potential long-term consequences of continuous interest rate manipulation?

-Continuous interest rate manipulation could lead to economic bubbles, where asset prices inflate beyond sustainable levels, eventually leading to a burst and a potential economic downturn.

How should investors manage their portfolios in an environment of fluctuating interest rates and potential inflation?

-Investors should manage their portfolios by diversifying across different asset classes, focusing on quality assets, and maintaining a long-term perspective. They should also be prepared to adjust their strategies in response to changing economic conditions and policy actions.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

Bajaj Finance & CAMS- Undervalued now? [and 3 other stocks] | Akshat Shrivastava

6 Stocks to Bulk Buy or SIP | Akshat Shrivastava

David Rogers Webb on how to stop “The Great Taking”

The Truth About "Trading Gurus" From a Hedge Fund Manager

3 Stocks with HUGE Short Term Tailwinds - Time to buy? Rahul Jain Analysis #stockstowatch

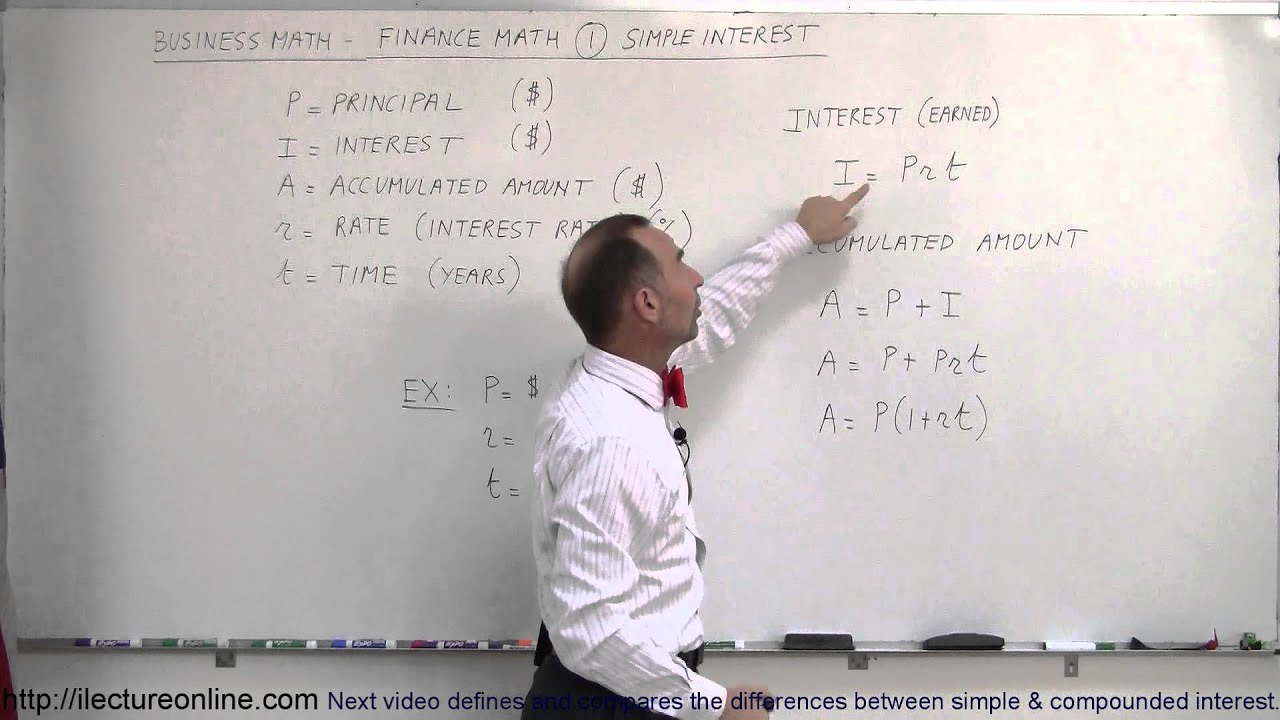

Business Math - Finance Math (1 of 30) Simple Interest

5.0 / 5 (0 votes)