Overview of the FREE Price Action Smart Money Concepts toolkit | BigBeluga

Summary

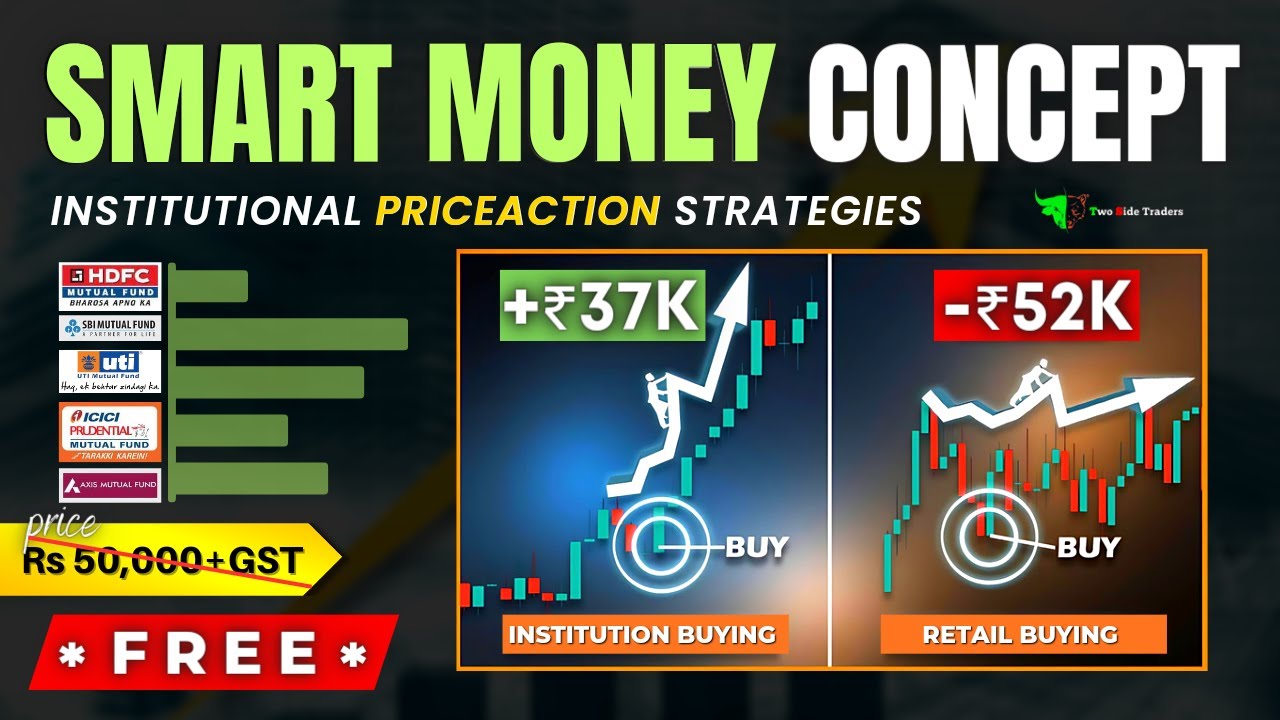

TLDRIn this video, Big Beluga introduces the Smart Money Concept Toolkit, designed to help traders understand and emulate the strategies of institutional players. The toolkit highlights key market indicators, such as market structure, order blocks, fair value gaps, swing failure patterns, and liquidity zones, which provide insights into potential trend reversals and price movements. By focusing on liquidity sweeps and the psychology behind market moves, traders can anticipate big shifts and trade like the pros. Big Beluga offers this toolkit to simplify trading, providing a powerful edge for those looking to make smarter, more informed trades.

Takeaways

- 😀 Market structure is the foundation of the smart money concept, helping to identify key reversal points and market trends.

- 😀 Sweeps on the chart indicate areas where liquidity has been taken out, often signaling potential trend reversals.

- 😀 Volumetric order blocks represent zones where significant buying or selling took place, with bullish ones in green and bearish ones in red.

- 😀 When price breaks through an order block without reversing, it becomes a breaker block, signaling a shift in market momentum.

- 😀 Fair value gaps highlight imbalances between buying and selling volume, allowing traders to anticipate price return areas.

- 😀 The Swing Failure Pattern (SFP) occurs when price breaks a recent high or low but quickly reverses, signaling a failed move and a potential reversal.

- 😀 Liquidity concepts focus on identifying areas with significant buy-side and sell-side liquidity, where smart money often operates.

- 😀 Equal highs and lows are key liquidity zones, where smart money hunts for orders, either pushing through them or reversing right after.

- 😀 The Smart Money Concept Toolkit is designed to help traders spot key liquidity areas and market moves, making it easier to trade like institutional players.

- 😀 With tools like order blocks, fair value gaps, and swing failure patterns, the toolkit enables traders to anticipate major market shifts in real-time.

- 😀 You can access the Smart Money Concept Toolkit for free on TradingView, with more advanced tools and tips available at BigBeluga.com.

Q & A

What is the Smart Money Concept Toolkit by Big Beluga?

-The Smart Money Concept Toolkit by Big Beluga is a comprehensive trading tool designed to help traders understand and trade like institutional investors by identifying market structure, liquidity zones, order blocks, and fair value gaps.

What does 'market structure' refer to in the Smart Money Concept Toolkit?

-Market structure refers to the overall direction and flow of the market, highlighting major reversal points and trend development using solid lines and X markers to visualize turning points.

What are 'sweeps' on the chart, and why are they important?

-Sweeps mark areas where liquidity has been taken out of the market. These often indicate potential trend reversals as they show where large orders have been executed and liquidity has been cleared.

What are 'volumetric order blocks' and how are they identified?

-Volumetric order blocks are zones on the chart that represent areas of significant buying or selling activity. They are color-coded: red for bearish order blocks and green for bullish order blocks.

What happens when price breaks through an order block zone?

-When the price breaks through an order block instead of reversing, the order block becomes a 'breaker block.' For instance, if price breaks through a bullish order block, it turns into a bearish breaker block, signaling a momentum shift.

What is a 'fair value gap' and how does it affect trading decisions?

-A fair value gap is an imbalance caused by unequal buying and selling volumes. Traders watch for these gaps because prices often return to these areas to 'fill' the gap before continuing in the prevailing direction.

What is a Swing Failure Pattern (SFP)?

-A Swing Failure Pattern occurs when the price briefly breaks a recent high or low but quickly reverses direction. It signals that the market attempted but failed to continue in that direction, often indicating a potential reversal.

How does the toolkit use liquidity concepts like equal highs and equal lows?

-Equal highs and equal lows represent areas where multiple stop orders or pending orders accumulate. These zones act as liquidity pools that smart money targets either to trigger large moves or to reverse after capturing liquidity.

What are liquidity wicks and sweep zones in the context of this toolkit?

-Liquidity wicks and sweep zones are visual representations of areas where liquidity has been taken or manipulated. They highlight where large institutional orders may have entered or exited, providing traders clues about future market moves.

How does the Smart Money Concept Toolkit simplify trading compared to traditional indicators?

-The toolkit consolidates multiple complex trading concepts—like market structure, liquidity, order blocks, and fair value gaps—into one unified system, removing clutter and allowing traders to focus on high-probability institutional moves.

Where can traders access or try the Smart Money Concept Toolkit?

-Traders can try the Smart Money Concept Toolkit for free on TradingView and visit BigBeluga.com for additional resources, tools, and educational content to enhance their trading strategies.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

| MCA trading | made simple - Episode 9: H4 Reversals & Range Mode

How Operator TRAPS New Traders | *FREE Advance Price Action Trading | Smart Money Concepts In Hindi

How Smart Money Moves the Market (And How You Can Follow It)

Master Supply and Demand Trading Smart Money Concept | Step by Step Forex Guide

Konsep Smart Money Untuk Pemula || Dasar Strategi Para Big Trader

C'est quoi le Smart Money Concepts en Trading ? | EP.1

5.0 / 5 (0 votes)