Konsep Smart Money Untuk Pemula || Dasar Strategi Para Big Trader

Summary

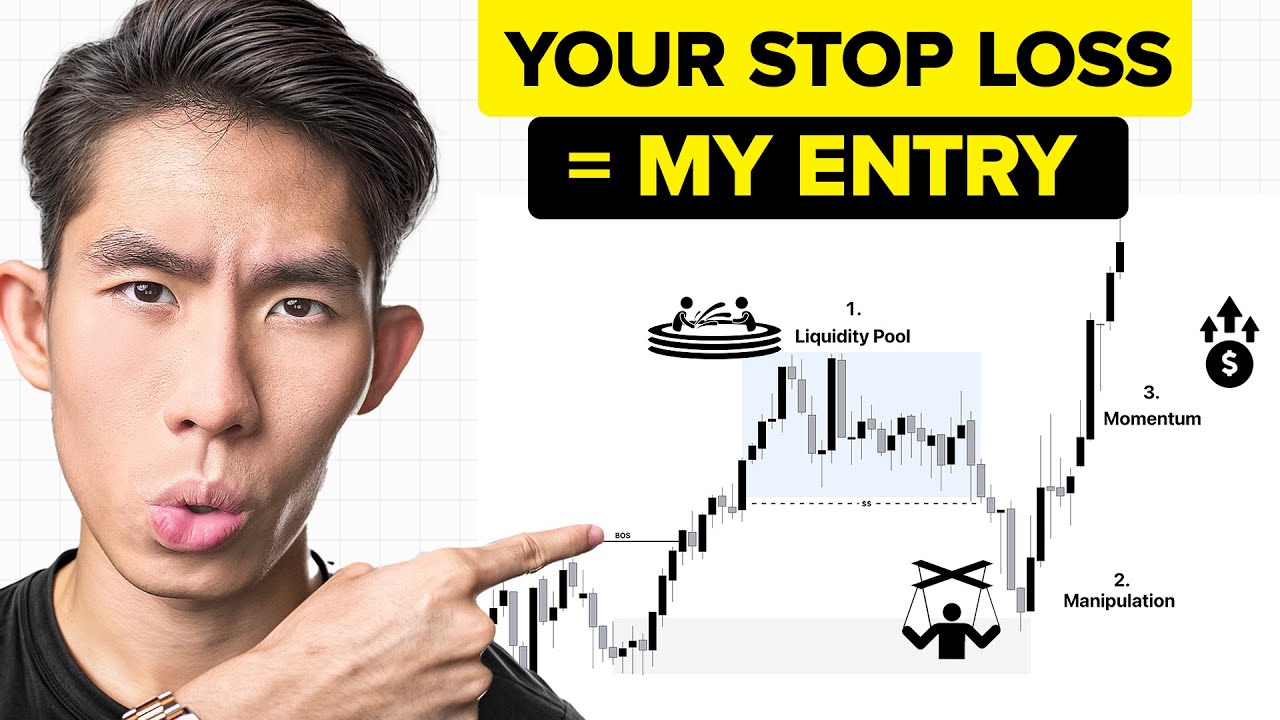

TLDRIn this video, the host discusses the concept of Smart Money in forex trading, emphasizing the manipulation of retail traders by institutional traders. The host explains how understanding price movement, supply, and demand can lead to better trading decisions. Instead of relying on traditional indicators, which may lag behind market movements, traders are encouraged to analyze price action directly. By identifying areas of previous manipulation and liquidity, traders can position themselves strategically in the market. The video aims to empower retail traders to navigate the complexities of trading by gaining insights into institutional behaviors.

Takeaways

- 😀 Understanding market manipulation is essential for retail traders to avoid losses.

- 📈 Smart Money refers to capital controlled by institutional traders who significantly influence market movements.

- 🔍 Relying solely on indicators can hinder trading effectiveness; they often lag behind market conditions.

- ⚖️ Price movements reflect the battle between buyers and sellers, showcasing imbalances that traders should observe.

- 💰 Supply and demand zones indicate potential future price movements, serving as leading indicators for traders.

- 📉 Institutional traders manipulate prices to create liquidity, often targeting retail traders' stop-loss orders.

- 🛑 Retail traders must be aware of their own positions to avoid being trapped in market manipulation.

- 🔄 Identifying historical manipulation zones can guide traders in predicting future price movements.

- 🎯 Practicing price action analysis without indicators can enhance a trader's ability to read the market.

- 🚀 New traders are encouraged to experiment with strategies using indicators before transitioning to Smart Money concepts.

Q & A

What is the main focus of the video?

-The video discusses how retail traders can understand and benefit from the market manipulations performed by institutional traders, focusing on the concept of Smart Money.

Who are considered 'Smart Money' traders?

-Smart Money traders refer to institutional traders, such as banks and large investors, who manage significant amounts of capital and have the ability to influence market movements.

What is the difference between trading with indicators and without them?

-Trading with indicators relies on mathematical formulas and can lag behind market movements, while trading without them allows traders to directly observe price actions and market dynamics.

Why do most retail traders lose money in the market?

-Approximately 95% of retail traders lose money because they often rely on outdated trading methods that institutional traders exploit for manipulation.

What is the importance of understanding supply and demand in trading?

-Understanding supply and demand is crucial because it helps traders identify price levels where institutional traders might be placing their orders, which can lead to profitable trading opportunities.

How do institutional traders manipulate the market?

-Institutional traders manipulate the market by creating false signals to trigger retail traders' orders, often leading them to stop-loss positions that the institutions then exploit for liquidity.

What is meant by liquidity in trading?

-Liquidity refers to how easily an asset can be bought or sold without affecting its price. High liquidity allows for quick transactions, while low liquidity can lead to unfavorable price movements.

What strategies can retail traders use to better understand market movements?

-Retail traders should practice trading without indicators to improve their ability to read price actions, perform backtesting, and analyze historical market behaviors to recognize patterns.

How can a trader identify areas of manipulation in the market?

-Traders can identify manipulation by looking for patterns in price movements, particularly around key support and resistance levels where retail traders may have placed stop-loss orders.

What should a beginner trader do if they find the concepts challenging?

-Beginner traders should take their time to understand the concepts, practice with strategies that use indicators, and gradually transition to reading price actions without relying solely on technical indicators.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

ICT Institutional Order Flow Explained – Trade Like the Banks and Outsmart the Market

| MCA trading | made simple - Episode 3: Stop & DM Positions Interaction

STOCK MARKET BASICS

The Market Is Rigged: Here’s How You Can Still Win

How Smart Money Manipulate YOUR Trades….(leaked video)

The Truth About Inducement In ICT Concepts

5.0 / 5 (0 votes)