Understand How Price Moves From POI To DOL (A-B Explained)

Summary

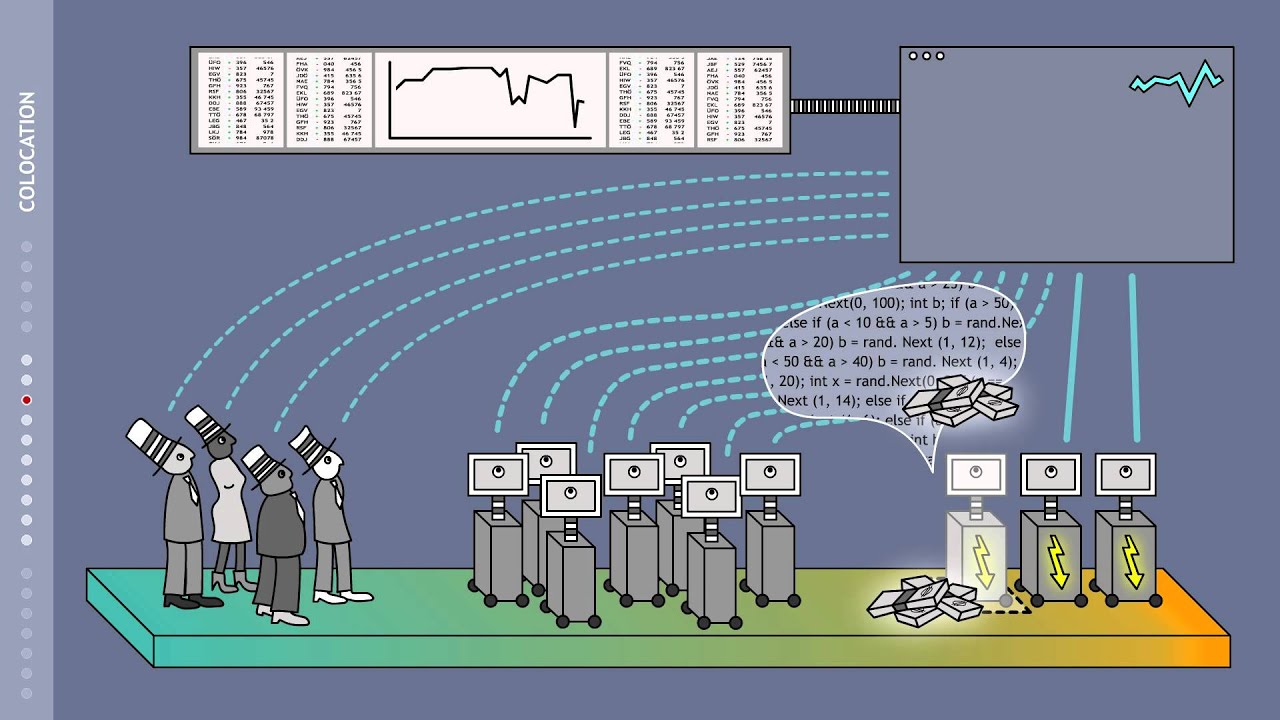

TLDRThis video provides a detailed exploration of high-frequency trading (HFT) algorithms, market manipulation, and the techniques used to predict price movements. The speaker shares insights into identifying market expansions, reversals, and manipulations, particularly during London and New York AM sessions. They highlight the importance of time cycle Smart Money Techniques (SMT) and their custom detection tool to spot significant market shifts. With a focus on algorithmic trading, the lecture emphasizes how understanding these patterns can help traders anticipate price actions effectively, offering foundational knowledge for successful market navigation.

Takeaways

- 😀 The market experiences frequent manipulation, especially in the London and New York AM sessions, which can be tracked through order flow analysis.

- 😀 Manipulation is followed by accumulation and distribution phases, and understanding these phases is key to predicting market movements.

- 😀 The speaker uses an SMT (Smart Money Tracker) tool, which identifies manipulation based on time cycle SMTs—crucial for spotting significant market shifts.

- 😀 Only time cycle SMTs matter for analysis, particularly those relative to specific time frames like 90-minute or 3-minute cycles.

- 😀 High-frequency trading algorithms often trigger large moves by buying or selling at liquidity pools, especially those forming fair value gaps.

- 😀 Manipulation often takes place under key liquidity zones, where institutional order flow can be anticipated for higher prices.

- 😀 Price repricing from manipulation zones can create buying opportunities, especially when support is confirmed at fair value failure gaps.

- 😀 Analyzing higher timeframe institutional order flow helps determine where to expect market shifts and where swings may form.

- 😀 The market structure is algorithmically driven, meaning repetitive patterns and cycles can be leveraged for more accurate market predictions.

- 😀 A thorough understanding of time-based liquidity pools, SMTs, and institutional order flow allows traders to anticipate market movements with greater precision.

- 😀 The foundational understanding of market manipulation and structure shared in the lecture forms the basis for more advanced insights in future lessons.

Q & A

What is the primary concept discussed in the transcript?

-The transcript focuses on understanding market behavior from an algorithmic perspective, emphasizing high-frequency trading (HFT), manipulation, time cycles, and liquidity pools in trading.

What does the speaker mean by 'manipulation' in the market?

-Manipulation refers to intentional market movements that occur as institutions accumulate or distribute positions, typically with the purpose of shaking out retail traders or inducing a price shift before the market moves in the expected direction.

How does the speaker identify when manipulation is ending?

-Manipulation is considered to end when a Smart Money Technique (SMT) signal is triggered, which is specifically detected through time cycle SMTs, particularly those relative to sessions or smaller time intervals (such as 3-minute or 10-minute cycles).

What is the role of SMTs in this market analysis?

-SMTs, or Smart Money Techniques, are used to identify manipulation and reversal points in the market. The speaker's SMT detector tool helps automate the detection of these patterns, allowing traders to anticipate price movements more effectively.

What makes the time cycle SMTs more significant than other SMTs?

-Time cycle SMTs are crucial because they are based on shorter, specific time frames (e.g., 3-minute, 10-minute, or 30-minute cycles), which align more accurately with market manipulation and reversal points compared to broader SMT signals.

What is the significance of inversion gaps (CBs) in the market?

-Inversion gaps, or CBs (Counter-Breaker), are identified when price moves in the opposite direction before retracing. These gaps often serve as zones where traders can enter trades, as they indicate potential price shifts driven by high-frequency trading algorithms.

What does the speaker mean by 'time-based liquidity pools'?

-Time-based liquidity pools are areas of the market where orders have accumulated over time. These zones are often targeted by institutional traders to induce price movements, especially during manipulation phases. They are key to identifying potential reversal points.

How does combining time cycles with higher timeframe arrays help in market analysis?

-By combining time cycles (like 30-minute or 90-minute cycles) with higher timeframe arrays (such as imbalances, breaker blocks, or mitigation blocks), traders can better anticipate where swing points in the market are likely to form, thus improving trade accuracy and precision.

Why does the speaker suggest using an algorithmic perspective in market analysis?

-The speaker suggests using an algorithmic perspective because it allows traders to analyze the market with precision, focusing on high-frequency trading patterns, time cycles, and liquidity pools. This approach helps identify predictable price movements, increasing the probability of successful trades.

What is the main takeaway for beginners learning from this transcript?

-The main takeaway for beginners is that understanding market behavior through time cycles, SMTs, and market manipulation is key to successful trading. The speaker emphasizes that while the concepts may seem complex at first, with practice, traders will start to recognize these patterns more intuitively.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenant5.0 / 5 (0 votes)