Convolution & Cross-correlation in High Frequency Trading

Summary

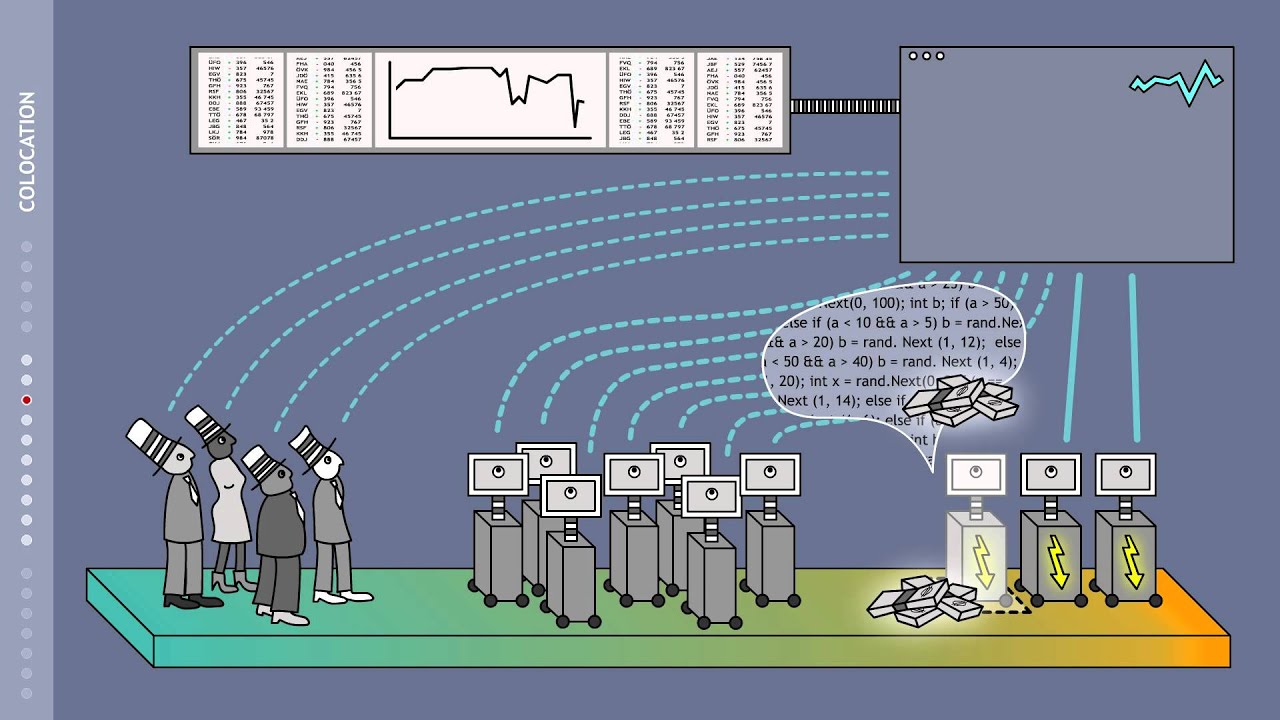

TLDRThis presentation explores high-frequency trading (HFT) through a signals and systems lens, highlighting its significance in predicting stock market trends. It discusses key concepts such as convolution and moving averages, illustrating how they can be applied to analyze real-time market data. Using live examples, the presenter demonstrates how to generate buy and sell signals based on stock price patterns, revealing the potential for significant profits while acknowledging the inherent unpredictability of trading. The overall message emphasizes the vital role of signal processing techniques in enhancing trading accuracy and decision-making in financial markets.

Takeaways

- 😀 High-frequency trading (HFT) involves executing trades within a narrow time frame, typically between 9:15 AM and 3:30 PM.

- 😀 Stock market trends can be predicted using technical analysis tools like Candlestick patterns, moving averages, and convolution.

- 😀 Convolution is used in signal processing to smooth out fluctuations in stock prices, helping to identify market trends more clearly.

- 😀 Moving averages help traders identify bullish (upward) or bearish (downward) market trends by smoothing out stock price data over a set time frame.

- 😀 Cross-correlation helps identify time lags between two related assets, allowing traders to anticipate changes in one asset based on movements in another.

- 😀 Convolution helps reduce noise and volatility in stock price data, making it easier to interpret market trends.

- 😀 Buy signals are generated when the moving average crosses above the candlestick pattern, indicating an upward trend in the market.

- 😀 Sell signals are generated when the moving average crosses below the candlestick pattern, suggesting a downward trend in the market.

- 😀 While not 100% accurate, signal-based systems can greatly assist traders in making more confident and informed decisions in the market.

- 😀 Real-time stock market prediction using moving averages can offer profitable opportunities, such as identifying trends that lead to significant gains or losses.

Q & A

What is high-frequency trading (HFT)?

-High-frequency trading is a form of trading that occurs within a very short timeframe, specifically from 9:15 AM to 3:30 PM. It involves making rapid trades based on market trends to maximize profit.

How does the stock market display trends?

-The stock market trends are often represented using candlestick patterns, which show price movements over time. These patterns illustrate fluctuations, indicating upward and downward trends.

What role does convolution play in predicting stock prices?

-Convolution is used to analyze the relationship between input signals (such as stock prices) and transformation functions (like moving averages). It helps predict future stock prices by smoothing out historical data.

What is cross-correlation and how is it applied in trading?

-Cross-correlation measures the relationship between two signals that may have a time lag. In trading, it helps identify how changes in one asset might predict changes in another, improving decision-making.

What is a moving average and why is it important?

-A moving average is a statistical calculation that analyzes a subset of data points over a specified period. It is important because it helps traders identify trends by smoothing out price fluctuations and reducing noise.

What signals are generated using the moving average strategy?

-The moving average strategy generates buy signals when the moving average crosses above the candlestick pattern and sell signals when it crosses below. This helps traders make informed trading decisions.

Can you explain the significance of the 20-day moving average in trading?

-The 20-day moving average is a commonly used time frame that helps traders evaluate short-term price trends. It smooths out daily fluctuations, allowing traders to identify potential entry and exit points more accurately.

What challenges exist in high-frequency trading?

-Challenges in high-frequency trading include the inherent unpredictability of market movements, reliance on technology, and the potential for false signals that can lead to losses despite the strategy's systematic approach.

How does the presenter demonstrate the trading strategy using a live stock market?

-The presenter uses a script that implements the moving average of a live stock, indicating buy and sell signals. For instance, when a buy signal is triggered, the stock price rises, showcasing the effectiveness of the strategy.

What can be concluded about the role of signaling systems in financial markets?

-Signaling systems play a crucial role in financial market analysis by improving the accuracy of predictions regarding market trends, enabling traders to make faster and more informed decisions.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)