The Fundraising Process : Preparation phase - Startup valuation

Summary

TLDRValuation is a critical aspect of fundraising for startups, especially in the early stages when determining share prices for investors. The value of a startup depends on factors like its growth stage, product-market fit, and available metrics. Three popular valuation methods include the Cost Approach, often used for early-stage startups, the Venture Capital (VC) method, which focuses on potential exit value and future growth, and the Discounted Cash Flow (DCF) method, which calculates intrinsic value based on projected future cash flows. Each method has its own advantages and challenges depending on the maturity of the company.

Takeaways

- 😀 Valuation is crucial for startup fundraising, determining the price of shares when seeking investors.

- 😀 ADC startups often find it difficult to value their companies due to their early-stage nature.

- 😀 The stage of a company affects the choice of valuation method: earlier stages rely more on estimates, while mature companies have more data to work with.

- 😀 More mature businesses have detailed data on product-market fit, sales, and other metrics, which support different valuation methods.

- 😀 There are different methods for valuation, including the Cost Approach, VC Method, and Discounted Cash Flow (DCF) Method.

- 😀 The Cost Approach is typically used by seed and early-stage startups, focusing on the costs incurred since the company’s inception.

- 😀 The Venture Capital (VC) method, or VC method, is forward-looking, estimating a company's potential exit value based on high growth assumptions.

- 😀 The VC method often leads to long negotiation periods due to its focus on projections and growth.

- 😀 The DCF method estimates a startup's intrinsic value by projecting future cash flows and discounting them to present value.

- 😀 The DCF method is more applicable to mature startups but is highly sensitive to assumptions made in the projections.

- 😀 For more information on valuation methods, there is a detailed blog post linked in the description.

Q & A

What is the importance of valuation in the fundraising process for startups?

-Valuation is crucial in the fundraising process because it helps determine the price of shares in the company that investors will purchase. It plays a key role in negotiations with potential investors.

Why is it difficult for ADC startups to value their companies?

-It is difficult for ADC startups to value their companies because they often lack sufficient data and metrics, especially at early stages, making it harder to assess their true worth.

How does the stage of a startup affect the valuation method used?

-The stage of the startup impacts the valuation method used because more mature startups have more data and metrics (e.g., product-market fit, sales) to support a more complex and accurate valuation, whereas early-stage startups typically rely on simpler approaches.

What are the main types of valuation methods used for startups?

-The main valuation methods for startups include the Cost Approach, the Venture Capital (VC) Method, and the Discounted Cash Flow (DCF) Method.

What is the Cost Approach to valuation, and when is it typically used?

-The Cost Approach values a company based on the total costs incurred since its inception. It is often used by seed-stage and early-stage startups when there is little data or market validation to support other methods.

What is the Venture Capital (VC) Method, and how does it work?

-The VC Method is a forward-looking approach where investors estimate the potential exit value of the company and discount that value to the present. It assumes high growth potential and is usually associated with long negotiation periods.

How does the Discounted Cash Flow (DCF) Method work in startup valuation?

-The DCF Method estimates the intrinsic value of a startup by projecting future cash flows over a specific period and discounting them to their present value. It is more suitable for mature startups with predictable cash flows.

What is a potential downside of the DCF method for startup valuation?

-The DCF method is highly sensitive to assumptions about future performance, which can make the valuation less reliable if those assumptions prove inaccurate, especially for early-stage startups.

Why might negotiation periods be long when using the VC Method?

-Negotiation periods may be long with the VC Method because it involves predicting the company's future success and exit value, which can lead to disagreements between investors and founders over the assumptions made in the valuation process.

What kind of startups are most likely to use the DCF method?

-The DCF method is typically used by more mature startups that have stable operations, predictable cash flows, and a clearer market position, making it suitable for companies further along in their lifecycle.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

Terry Smith explains: the free cash flow yield

Investor ayyi ila chepakudadu😅

Startup Story Telling & Fund Raising

Lecture 9 - How to Raise Money (Marc Andreessen, Ron Conway, Parker Conrad)

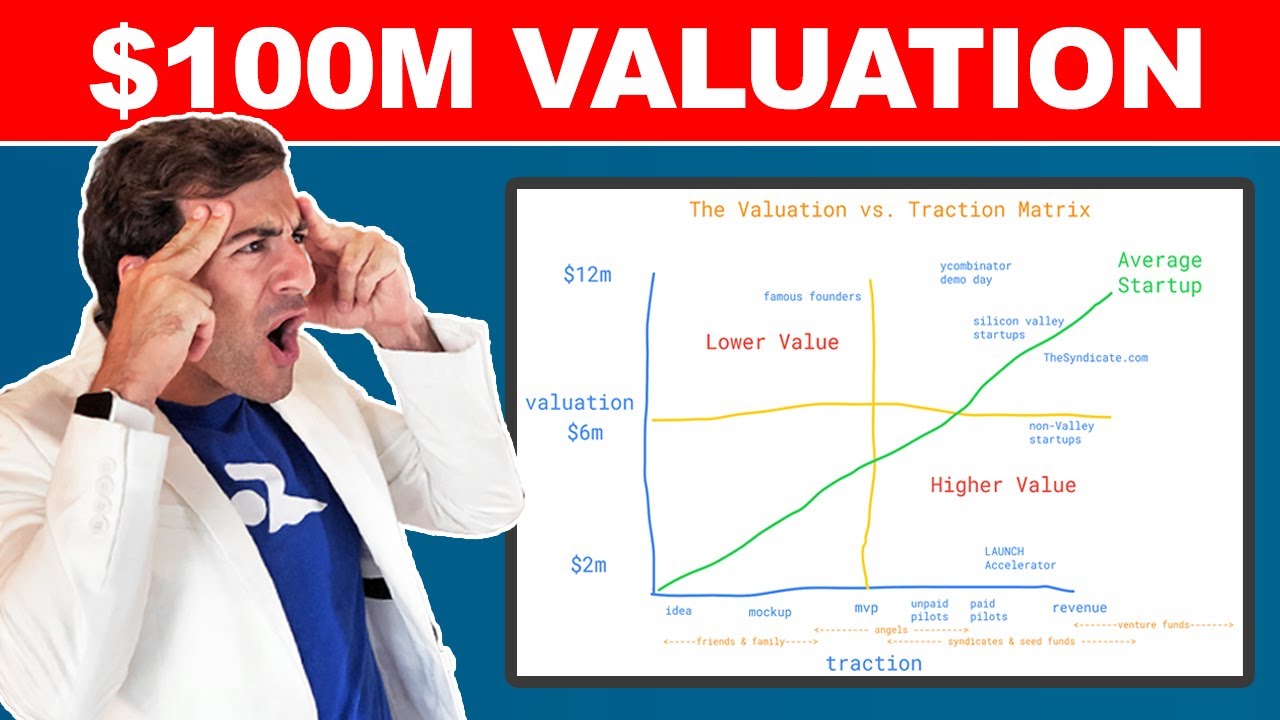

How To Value A Startup Pre-Revenue (Valuation vs. Traction Matrix)

"Unlocking Business Success: Keith Newman & Brian Smith Share Key Strategies

5.0 / 5 (0 votes)