Startup Story Telling & Fund Raising

Summary

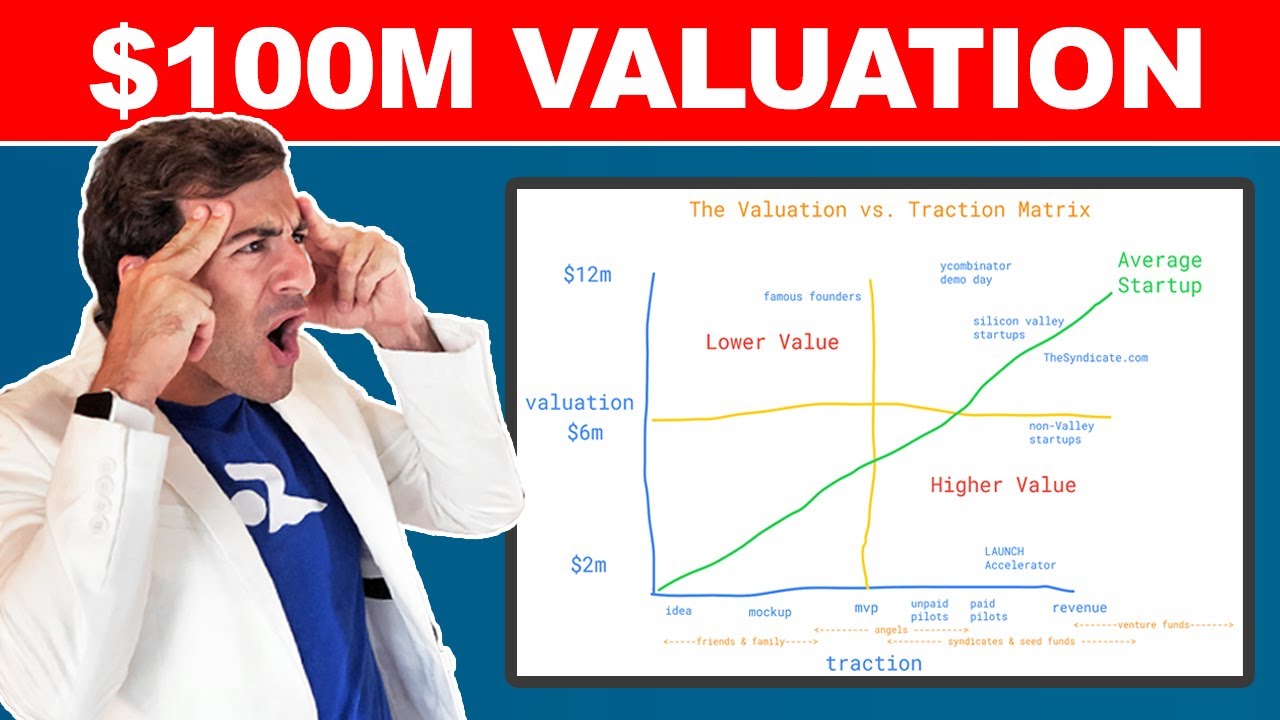

TLDRThis video provides essential insights on how to craft an effective story for early-stage startup fundraising. It highlights the importance of addressing investor concerns by presenting a clear use of proceeds and a roadmap for the next 12-24 months. The narrative should assure investors that the company will reach a higher valuation in the next funding round. A compelling story can drastically improve an investor's impression of the team and increase the likelihood of securing funding. The video also offers support for UK and non-UK startups looking to apply for funding or mentorship.

Takeaways

- 😀 A well-crafted story is critical for securing investor funding, especially at early stages of a startup.

- 😀 The founder’s story should address the major concerns and priorities of investors, such as growth potential and financial returns.

- 😀 Early stage investors typically seek assurance that a startup’s valuation will increase by the next round of funding.

- 😀 It’s essential to present a short-term roadmap (12 to 24 months) clearly to investors, highlighting key milestones and outcomes.

- 😀 Investors are often wary of committing if they fear their money will be 'trapped' or unable to contribute to future rounds.

- 😀 Mitigating investor concerns involves addressing how the funds will be used effectively and showing a clear path to future growth.

- 😀 If you can demonstrate the potential for a 3x increase in valuation by the next funding round, it boosts investor confidence.

- 😀 The team’s credibility is vital in the early stages, but it's difficult to achieve the ideal team structure at this stage.

- 😀 By improving the clarity and quality of the story, you can significantly increase the likelihood of getting funded.

- 😀 The use of proceeds and demonstrating future potential in the business are crucial to persuading investors to support a startup.

Q & A

What is the key concern for investors in early-stage startups, as discussed in the video?

-The key concern for investors is whether their money will be trapped or orphaned, meaning whether the company will be able to progress to a successful next round of funding without losing their investment.

What does the 'use of proceeds' section focus on in the investment process?

-The 'use of proceeds' section focuses on the company's short-term roadmap, usually covering 12 to 24 months, and demonstrates how the funds will help the company grow, ultimately improving its valuation for the next funding round.

How does a startup's short-term roadmap influence an investor's decision?

-A well-defined short-term roadmap, showing how the company will grow in the next 12 to 24 months, helps persuade investors that the startup will increase in valuation, leading to a successful next round of funding.

What impact does a strong story have on the investor's perception of a startup?

-A compelling story improves the investor's perception by addressing potential risks and instilling confidence in the startup's ability to succeed, leading to a higher likelihood of investment.

How does the team’s role affect the investment decision process in an early-stage startup?

-In an early-stage startup, the team’s role is crucial but difficult to measure, as the team may still be incomplete. However, a strong team that inspires hope and reduces fear can significantly improve the startup's chance of receiving investment.

What does it mean when a startup’s story turns green in the investment process?

-When a startup’s story turns green, it means that the story has been optimized to address all key concerns, and there are no red flags, making it very attractive to investors.

What are the main variables that determine whether a startup gets funded or not?

-The main variables include the strength of the team, the quality of the story, and the company's ability to demonstrate growth potential and a clear path to a successful next funding round.

How does the structure of an investment offer mitigate investor risk?

-The structure of an investment offer is designed to address investor concerns by showing that the company has a clear plan for growth, reducing the risk of the investment being 'trapped' or 'orphaned.'

What is the role of 'Section 4' in the investment process?

-Section 4 aims to mitigate the investor's fear of their money being trapped or orphaned by reassuring them that the company's valuation will increase, leading to a successful next funding round.

What are the key resources available for UK and non-UK startups seeking funding, as mentioned in the video?

-UK-based startups can apply for funding through Accelerated Digital Ventures by filling out an application on venturemarket.org. Non-UK startups can reach out to Archimedes Studio, where the speaker runs a personal angel portfolio, for further assistance.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

How To Perfectly Pitch Your Seed Stage Startup With Y Combinator's Michael Seibel

Pre-Seed, Seed, Series A, B, C, D, and E Funding: How They Work Overview

Carolynn Levy - Modern Startup Funding

The Fundraising Process : Preparation phase - Startup valuation

How to be a better fundraiser | Kara Logan Berlin | TEDxSantaClaraUniversity

How To Value A Startup Pre-Revenue (Valuation vs. Traction Matrix)

5.0 / 5 (0 votes)