Tambah Transaksi - Akuntansiku Smart Accounting

Summary

TLDRThis tutorial demonstrates how to use an accounting app to easily manage financial transactions, such as income, expenses, and debts. The video explains how to add capital, record purchases, manage receivables, and handle payables using simple steps in the app. Users can track transactions like additional capital or debt repayments without needing advanced accounting knowledge. The app simplifies the process with intuitive features, allowing users to input amounts and categorize them as needed. The guide also shows how to review and modify recorded transactions, making financial management accessible for everyone.

Takeaways

- 😀 Users can easily add financial transactions by clicking the '+' icon in the app.

- 😀 The app supports various types of transactions, including investments (modal), expenses, receivables (piutang), and payables (hutang).

- 😀 For investments, users input the amount, select the source (cash or bank), and choose the investment type (e.g., stock or additional capital).

- 😀 When entering expenses, users specify the amount and the purpose (e.g., office supplies), and the app links the transaction to the chosen account.

- 😀 The app makes it simple to add receivables by inputting the amount owed and categorizing it (e.g., unpaid invoices or receivables from customers).

- 😀 Payables are entered similarly, with the amount owed being recorded and categorized under the appropriate transaction type.

- 😀 After entering transactions, the app automatically displays financial details, including debits and credits, for easy tracking.

- 😀 Users can easily correct any mistakes by editing or deleting previously entered transactions and re-entering them as needed.

- 😀 The app automatically handles the complexities of accounting, making it accessible for users without deep accounting knowledge.

- 😀 The application simplifies accounting by removing the need to understand complicated debit/credit systems, allowing users to focus on entering data.

- 😀 The tutorial shows that the app instantly reflects the financial changes users make, making it easy to track investments, expenses, receivables, and payables.

Q & A

What types of transactions can be entered into the accounting app?

-The app allows users to input various types of financial transactions including capital injections (modal), expenditures (pengeluaran), receivables (piutang), and liabilities (hutang).

How do you add a new transaction in the app?

-To add a transaction, users need to click the 'plus' icon or the 'add' button, then select the type of transaction they want to enter, such as modal, pengeluaran, piutang, or hutang.

What is the purpose of the 'Tanam Modal' (Capital Injection) feature?

-The 'Tanam Modal' feature allows users to input capital into their accounting system, specifying an amount (e.g., 500,000 IDR) and linking it to either a cash or bank account.

Can users categorize the type of capital injection they input?

-Yes, users can categorize the capital injection as 'additional capital' or 'stock capital' (modal saham), depending on the nature of the investment.

How does the app handle expenditures like purchases?

-For expenditures, users can input the amount and specify what the expense is for (e.g., office supplies or ATK), linking it to either a cash or bank account. The app automatically updates the financial records.

What happens when users input a receivable transaction (piutang)?

-When a receivable transaction is entered, users specify the amount owed to them (e.g., a loan), categorize it (e.g., accounts receivable), and link it to a cash or bank account. The app updates the financial records accordingly.

How do users enter liability transactions (hutang) in the app?

-To enter a liability, users specify the amount of the debt (e.g., 80,000 IDR), categorize it (e.g., accounts payable), and link it to a cash or bank account.

Does the app automatically update financial records after entering transactions?

-Yes, the app automatically updates the financial records once a transaction is entered, showing the impact of each entry (e.g., changes to capital, expenses, receivables, and liabilities).

Can users make corrections or adjustments to previously entered data?

-Yes, if a user makes a mistake or needs to modify a transaction, they can edit or delete the entry using the 'edit' or 'delete' options in the app.

How does the app help users without accounting expertise?

-The app simplifies accounting for non-experts by automatically handling complex tasks like debit and credit entries, and it offers a user-friendly interface to track capital, expenses, receivables, and liabilities.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

Piutang Karyawan untuk Akun Piutang (AR) pada Accurate Dekstop

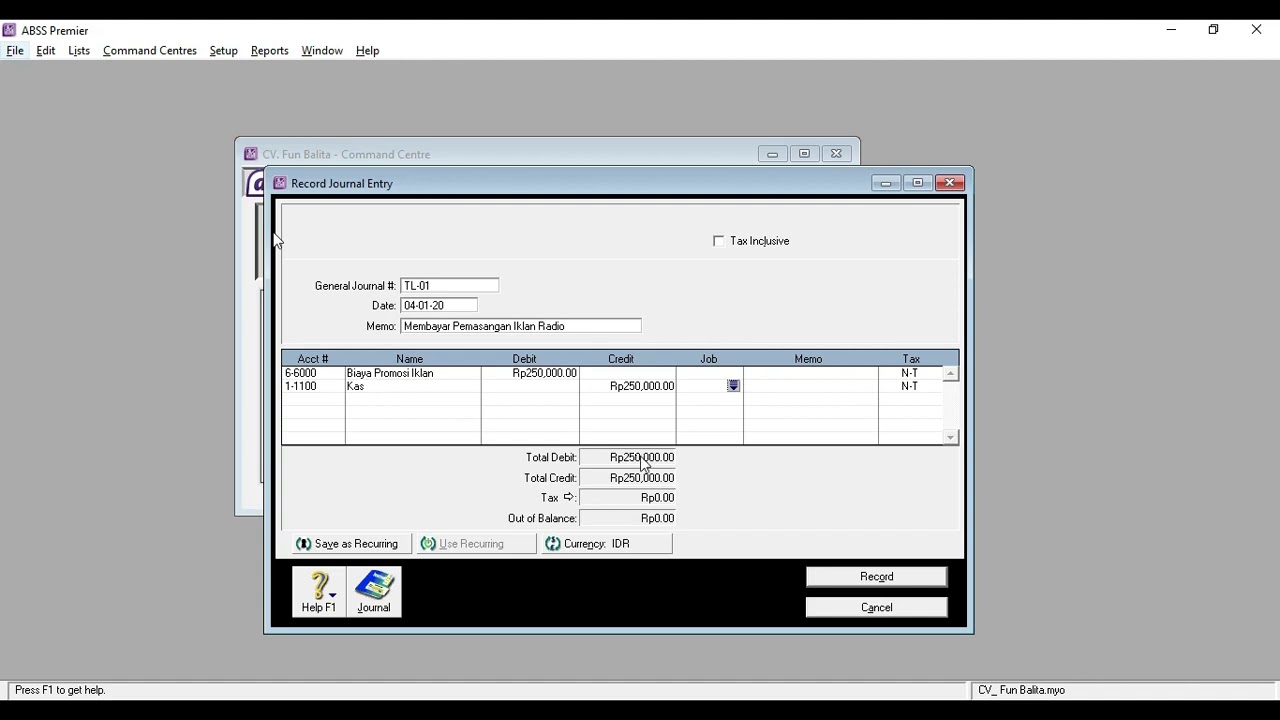

028 Aplikasi Komputer Akuntansi II (ABSS) Pertemuan 3 (Part3)

PENGANTAR AKUNTANSI 1 - JURNAL

Odoo Accounting: Unmatched productivity. Online.

The INCOME STATEMENT for BEGINNERS

FINANCIAL ANALYSIS #1 Preparation of Income Statement and Balance Sheet @THINKTANKLIKEBEES

5.0 / 5 (0 votes)