GENERAL LEDGER: Visual Guide to Posting Journals

Summary

TLDRIn this video, James explains the concept of the general ledger in accounting, likening it to a database that stores records of all accounts and journal entries. He walks viewers through its role in the accounting cycle, detailing how transactions are posted to the ledger, both manually and with the help of subledgers. Using examples from a cheese business called 'Let it Brie,' James demonstrates accrual accounting with manual journal entries and automatic entries triggered by accounting software. The video also touches on the history of bookkeeping and offers tips for effective ledger management.

Takeaways

- 😀 The general ledger is a database that stores a complete record of all accounts and journal entries in an organization.

- 😀 The general ledger plays a crucial role in the accounting cycle, particularly after identifying transactions and preparing journal entries.

- 😀 In the past, businesses would use physical books for accounting, but today, general ledgers are digital databases that record financial transactions.

- 😀 Subledgers support the general ledger by providing extra detail for specific accounts, like accounts payable or receivables.

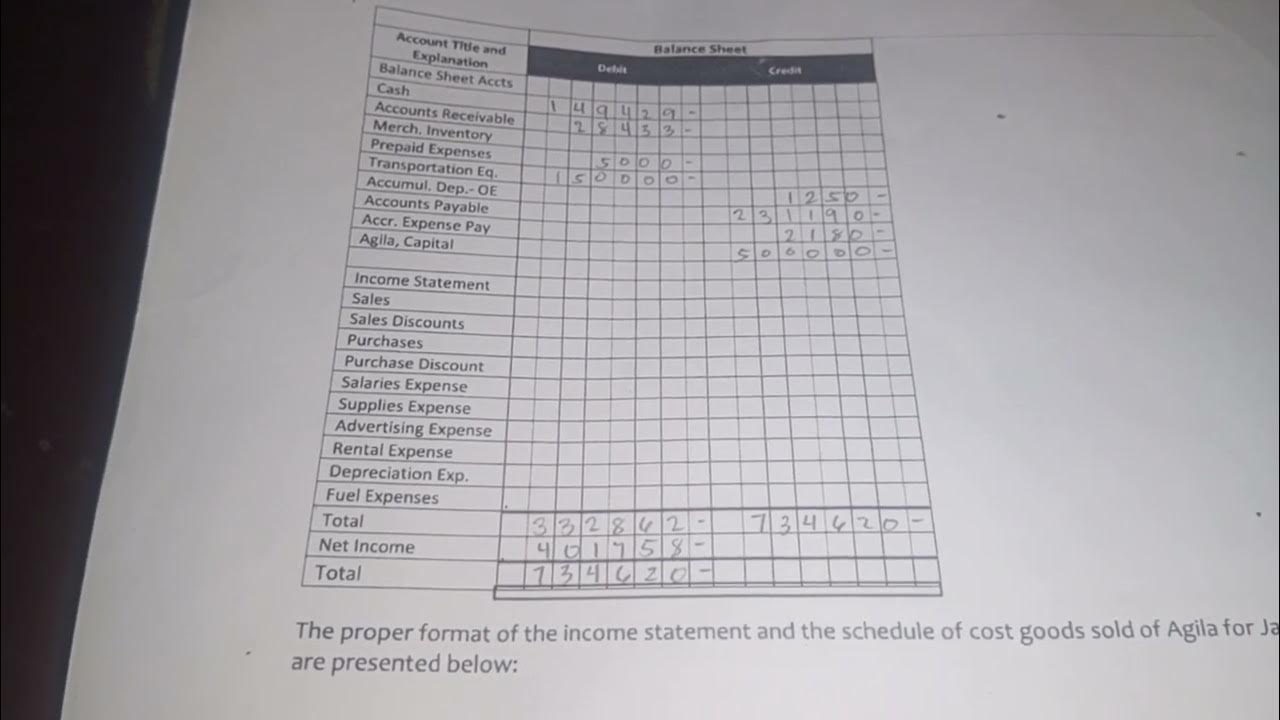

- 😀 In the example of Let it Brie, accrued expenses like electricity are recorded in the general ledger before receiving the invoice, using double-entry accounting.

- 😀 When a business incurs an expense but hasn't yet received the bill, this is called an accrued expense, and it needs to be recorded even without the invoice.

- 😀 Manual journal entries are posted directly into the general ledger when subledgers are not used, as shown in the example with overhead expenses and accrued expenses.

- 😀 A subledger (like the accounts payable subledger) provides detailed information about the individual transactions that make up a control account balance in the general ledger.

- 😀 In accounting, the totals in the general ledger and the subledger must match, ensuring accurate financial reporting.

- 😀 Accounting software can automate journal entries when payments are made, as demonstrated with the payment to Dairy Lane, saving time and reducing manual work.

- 😀 The general ledger is updated in real-time with journal entries, either manually or automatically, and these updates directly reflect on the business's financial records.

Q & A

What is the general ledger in accounting?

-The general ledger is a database that stores a complete record of all your accounts and journal entries. It is the central place where all financial transactions are recorded.

How does the general ledger fit into the accounting cycle?

-The general ledger is posted in step three of the accounting cycle, right after identifying transactions and preparing journal entries.

What are subledgers and how do they relate to the general ledger?

-Subledgers are smaller ledgers that provide extra detail for specific accounts. They support the general ledger by breaking down details, such as the accounts payable subledger, which tracks individual supplier balances.

How did ledger management differ in the past compared to now?

-In the past, ledgers were physical books that businesses used to record transactions by hand. Today, ledgers are digital databases, but terms like bookkeeping and ledger are still used.

What is an accrued expense, and how is it recorded in the general ledger?

-An accrued expense is an expense that has been incurred but not yet paid or invoiced, such as a utility bill. It is recorded by debiting an expense account and crediting a liability account in the general ledger.

How does the posting of a manual journal entry affect the general ledger?

-When a manual journal entry is posted, the relevant accounts in the general ledger are updated. For example, debiting overhead expenses and crediting accrued expenses will adjust the balances in these accounts.

What is the difference between a control account and a subledger?

-A control account, like accounts payable, is a summary account in the general ledger, while a subledger provides detailed information supporting the control account, such as specific supplier balances.

What happens when a payment is made to a supplier in relation to the accounts payable subledger?

-When a payment is made, it is recorded in the accounts payable subledger by reducing the balance of the specific invoice. The general ledger is updated to reflect the payment, reducing the accounts payable control account and the cash account.

What are T accounts and how are they used in the general ledger?

-T accounts are a visual representation of accounts in the general ledger, where debits are on the left side and credits are on the right. They help track the balance changes as transactions are posted.

Why is the use of automatic journal entries beneficial in accounting?

-Automatic journal entries save time and reduce errors by automatically recording transactions in the general ledger when payments are made, such as when a payment to a supplier is processed.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenant5.0 / 5 (0 votes)