Posting to a Ledger

Summary

TLDRThis video explains how to post journal entries to a general ledger in the accounting cycle. It covers the structure of the ledger, including individual account numbers, dates, and debit/credit columns. Viewers learn how to track transactions, update balances, and reference the general journal. The process includes posting entries for cash, accounts payable, supplies, rent, insurance, and fees earned, while demonstrating how to adjust balances accordingly. The video concludes with a preview of upcoming lessons on adjusting entries and encourages viewers to engage with any questions in the comments.

Takeaways

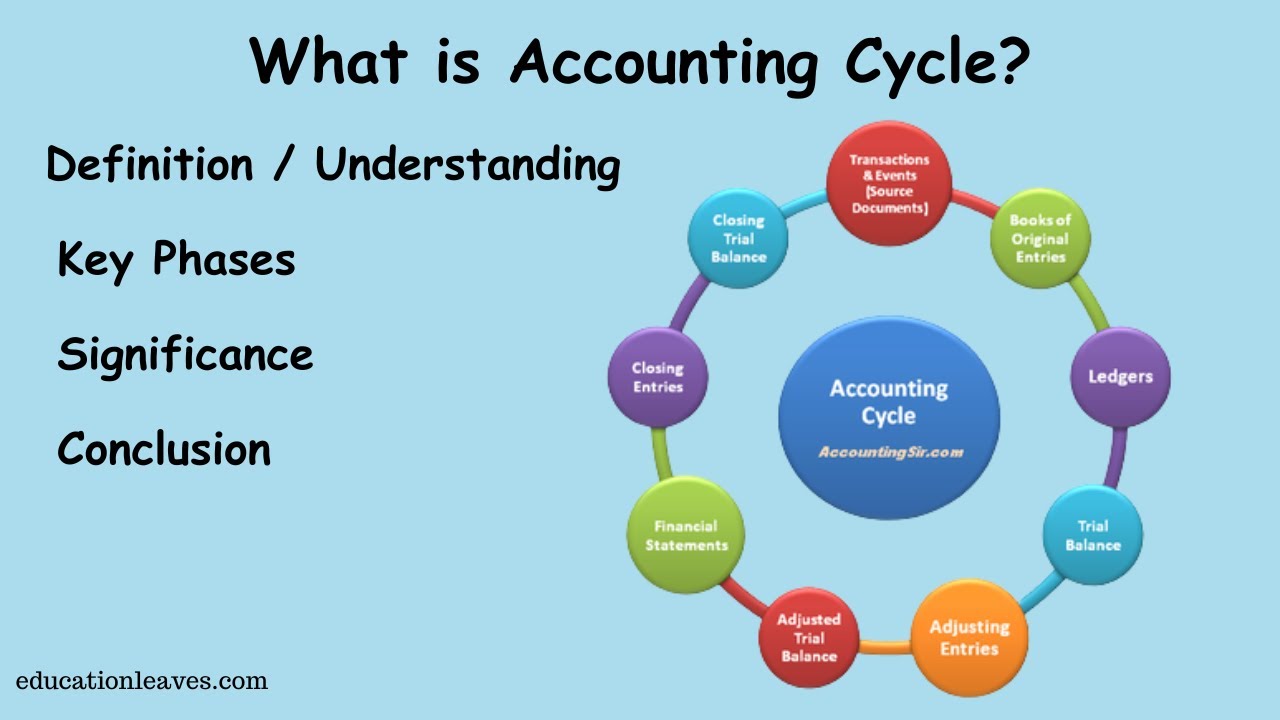

- 😀 The next step in the accounting cycle is posting journal entries to the general ledger.

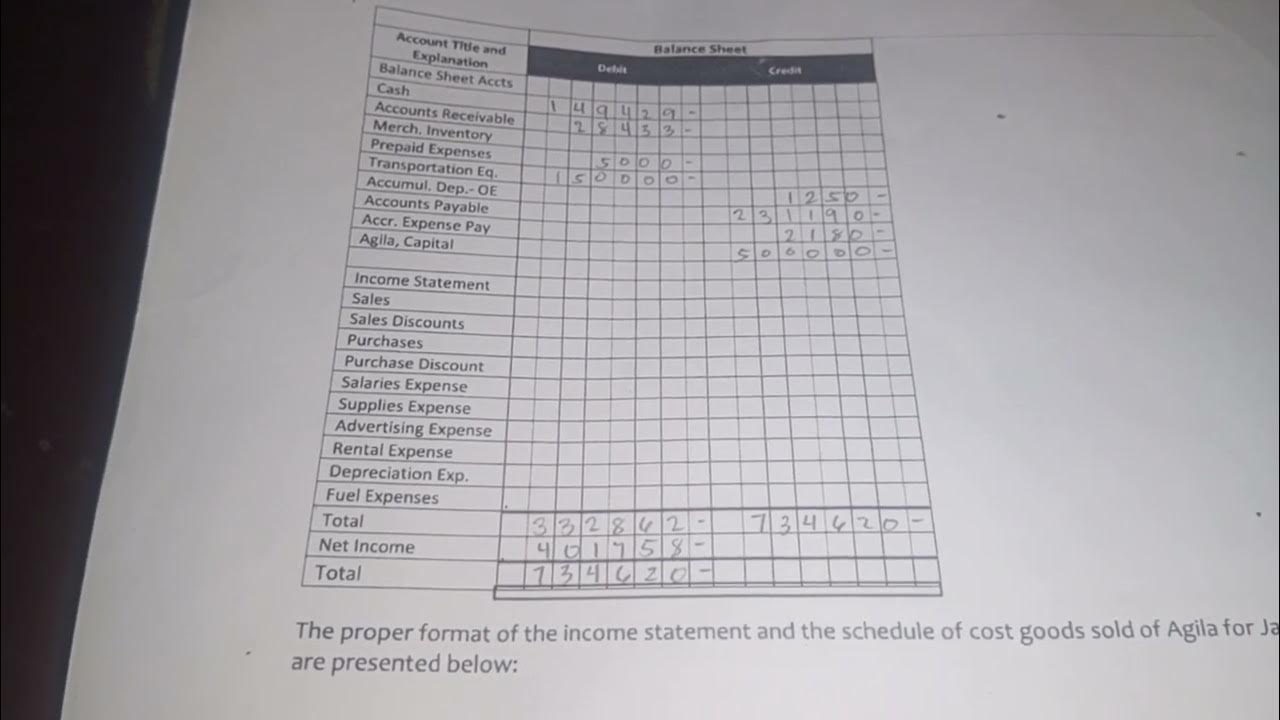

- 😀 Each account in the general ledger corresponds to an individual account in the chart of accounts.

- 😀 The ledger contains columns for date, post reference, debit and credit amounts, and balance updates.

- 😀 The post reference column helps ensure that journal entries are correctly posted to the ledger.

- 😀 Debits increase asset accounts like cash, while credits decrease asset accounts.

- 😀 When posting journal entries, update the balance in each account after each entry.

- 😀 The post reference column is used to indicate which journal page the entry originated from.

- 😀 The ledger also records accounts like supplies, rent expense, and prepaid insurance.

- 😀 Liability accounts like accounts payable increase with credits, and balances are adjusted based on normal account rules.

- 😀 Accounting software makes the posting process easier by automating many steps in the ledger update process.

- 😀 In the next video, adjusting entries will be discussed, showing how they affect both the journal and the ledger.

Q & A

What is the next step in the accounting cycle after journalizing transactions?

-The next step is to post the journal entries to the general ledger. This involves transferring the individual transaction details from the journal to their respective ledger accounts.

What is the purpose of the 'Post Ref' column in the general ledger?

-The 'Post Ref' column is used to indicate which journal page the journal entry was posted from. It serves as a reference to verify that the transaction has been correctly posted to the ledger.

How do you determine which column to use when updating the ledger balance?

-You use the debit and credit columns based on the transaction details from the journal entry. If the transaction is a debit (such as increasing an asset), you update the debit column; if it is a credit (such as increasing a liability or revenue), you update the credit column.

Why is the 'date' column in the ledger often left blank?

-The 'date' column is typically left blank because it is usually only filled out when entering the beginning balance or adjusting entries. It may not be needed for regular posting, except for these specific cases.

What does it mean when a general ledger account has a 'balance' entry?

-The 'balance' entry updates the current balance in that account after a journal entry is posted. This balance reflects the cumulative effect of all transactions posted to that particular account.

How are normal balances determined for different types of accounts?

-Normal balances depend on the type of account. For example, asset accounts have a normal debit balance (they increase with debits), while liability and equity accounts have a normal credit balance (they increase with credits).

What should be done if an account is missing from the chart of accounts when posting a journal entry?

-If an account is missing, it should be added to the chart of accounts. For example, if an accounts receivable account is needed but doesn't exist, it should be created and included in the ledger.

How do debits and credits affect a cash account?

-Debits increase the cash balance, while credits decrease it. For example, if cash is debited by $5,000, the balance increases by $5,000; if credited by $2,000, the balance decreases by $2,000.

What happens when accounts payable is debited for a transaction?

-When accounts payable is debited, it reduces the liability, indicating that a payment has been made or a debt has been settled. Accounts payable decrease with debits because they are liability accounts.

What are adjusting entries, and why are they important in the accounting cycle?

-Adjusting entries are made at the end of an accounting period to ensure that revenues and expenses are recorded in the period they occur, rather than when cash transactions happen. They are crucial for accurate financial reporting and compliance with accounting principles.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)