The TRIAL BALANCE Explained (Full Example!)

Summary

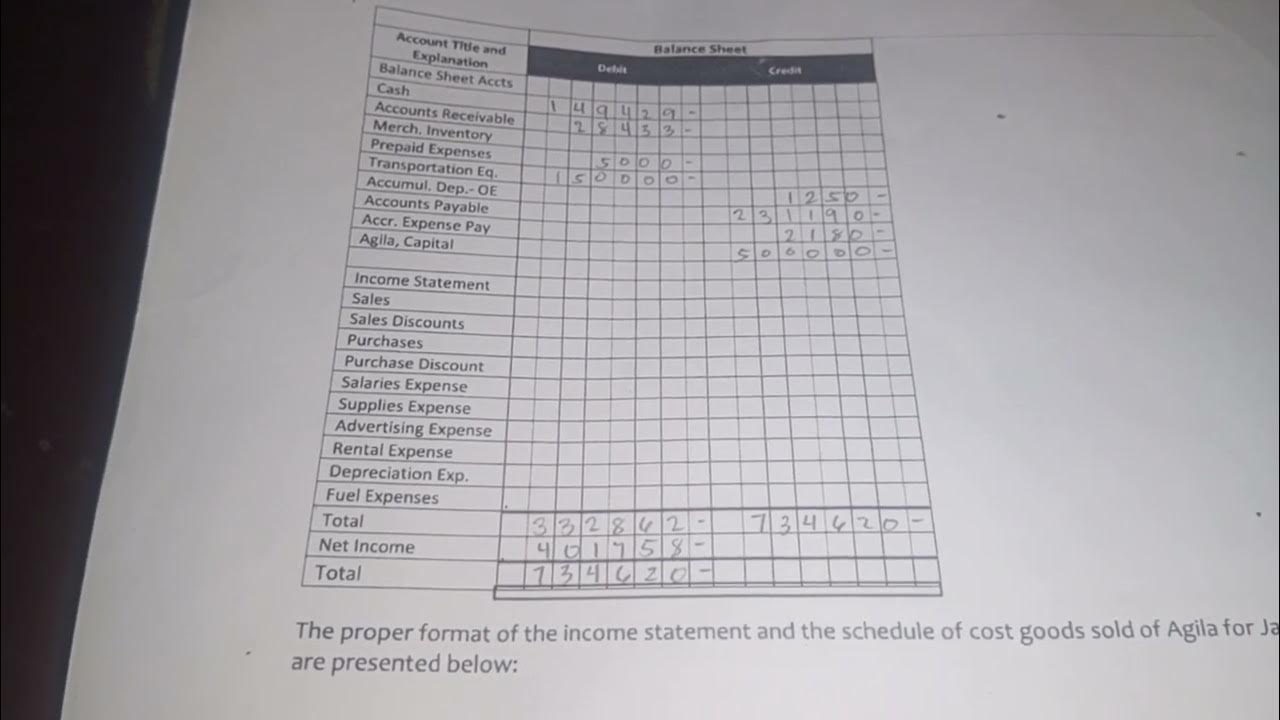

TLDRIn this video, James explains how to create a trial balance (TB), an essential accounting tool used to check the accuracy of journal entries. The trial balance lists the closing balances of all general ledger accounts, ensuring that total debits equal total credits. Though technology has automated balance checks, trial balances still play a key role in identifying errors and assisting in the preparation of financial statements. The video also provides a practical example of constructing a trial balance for a window cleaning business, highlighting key accounting transactions and the structure of a working trial balance.

Takeaways

- 😀 The trial balance (TB) is an accounting report showing the closing balances of all general ledger accounts at a specific point in time.

- 😀 Historically, trial balances were used to check that debit and credit totals matched, but with accounting software, this is now done automatically.

- 😀 The trial balance is an internal document used by accountants to check for errors and help in preparing financial statements.

- 😀 Auditors also use trial balances to determine which accounts need to be reviewed during audits.

- 😀 A trial balance is typically laid out with accounts grouped by type: assets, liabilities, equity, dividends, revenues, and expenses.

- 😀 Accounts with zero balances are generally excluded from the trial balance to reduce its size.

- 😀 Debit accounts (like assets and expenses) are shown in the left column, while credit accounts (like liabilities and revenue) are shown in the right column.

- 😀 The totals of the debit and credit columns in a trial balance should always match, but matching totals do not guarantee there are no errors.

- 😀 Errors may occur even if the trial balance matches, such as posting entries to the wrong accounts or incorrect amounts.

- 😀 A working trial balance helps track debits and credits by listing accounts with additional columns for journal entries and totals to verify balances.

- 😀 After entering journal entries, the total debits and credits should balance, confirming that the trial balance is 'bounced.'

Q & A

What is a trial balance in accounting?

-A trial balance is an accounting report that lists the closing balances of all general ledger accounts at a specific point in time. It is used to ensure the accuracy of the debit and credit columns and is a key step in preparing financial statements.

How did the trial balance function in the days of paper-based accounting?

-In paper-based accounting, the trial balance was used to manually check if the totals of the debit and credit columns matched, ensuring that the books were balanced. This function has become less relevant with modern accounting software that automatically performs this check.

Why is a trial balance still used in modern accounting despite accounting software?

-A trial balance is still used as an internal tool by accountants to check for errors, assist in preparing financial statements, and support auditors in selecting which accounts to review. It’s also helpful for ensuring consistency and accuracy in financial records.

What information does a trial balance typically contain?

-A trial balance includes a complete list of all general ledger accounts, with columns for debit and credit totals. It also shows the period end date, account types (assets, liabilities, equity, revenue, expenses), and account balances, grouped accordingly.

What is a working trial balance, and how does it differ from a regular trial balance?

-A working trial balance is a variation of the regular trial balance that simplifies tracking by combining debits and credits into a single column. Debits are recorded as positive numbers, and credits as negative numbers, which makes it easier to calculate the total balances.

What are the key account types found in a trial balance?

-The main account types found in a trial balance are assets, liabilities, equity, revenue, and expenses. Assets, dividends, and expenses typically have debit balances, while liabilities, owner's equity, and revenue usually have credit balances.

What does it mean if the debit and credit totals in a trial balance do not match?

-If the debit and credit totals do not match, it indicates that there are errors in the accounting entries, such as posting the same transaction twice, entering incorrect amounts, or misposting to the wrong accounts.

What does the phrase 'double-entry bookkeeping' refer to in the context of trial balances?

-Double-entry bookkeeping refers to the system where every financial transaction is recorded in two accounts—once as a debit and once as a credit—ensuring that the total debits always equal the total credits, which is reflected in the trial balance.

How does a trial balance help identify errors in accounting?

-A trial balance helps identify errors by highlighting discrepancies between the debit and credit columns. While it doesn’t guarantee the accuracy of the entries, it signals the need for further investigation into potential mistakes, such as incorrect postings or calculations.

Why are accounts with zero balances typically excluded from the trial balance?

-Accounts with zero balances are typically excluded from the trial balance to reduce its size and make it easier to read. Including them would clutter the report without providing additional useful information.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)