Business Math - Finance Math (8 of 30) Effective Rate of Interest

Summary

TLDRThis video explains the concept of the effective rate of interest. It demonstrates how simple interest, compounded monthly, and compounded daily yield different results for the same 5% annual rate. By using an example of $1,000 invested for one year, the video calculates the effective rate for monthly compounding (5.16%) and daily compounding (5.27%), showing how compounding frequency affects earnings. The effective rate is defined as the interest rate that would produce the same returns as compounding at different intervals, clarifying how compounding methods influence overall investment growth.

Takeaways

- 😀 The effective rate of interest helps determine the equivalent simple interest rate needed to match the earnings from compounded interest.

- 😀 Simple interest is calculated by applying a fixed percentage to the initial investment without compounding.

- 😀 When interest is compounded monthly, the effective rate will be higher than the nominal interest rate.

- 😀 The more frequently interest is compounded (e.g., daily vs. monthly), the higher the effective interest rate.

- 😀 The formula for calculating the effective rate of interest is: (1 + (r/n))^n - 1, where 'r' is the nominal rate and 'n' is the number of compounding periods per year.

- 😀 For monthly compounding at 5%, the effective rate of interest is 5.16%.

- 😀 For daily compounding at 5%, the effective rate of interest is 5.13%.

- 😀 A higher compounding frequency (like daily vs. monthly) leads to a slightly higher effective interest rate.

- 😀 Understanding the effective rate of interest allows investors to compare returns from different compounding periods.

- 😀 In the examples provided, to match the earnings of 5% compounded monthly, the equivalent simple interest rate would need to be 5.16%.

- 😀 The concept of effective rate of interest clarifies how compounding affects the overall returns on an investment.

Q & A

What is the effective rate of interest?

-The effective rate of interest is the equivalent interest rate that would yield the same amount of money when compounded, but using simple interest. It allows us to compare different compounding methods like monthly or daily to simple interest.

How does the effective rate of interest relate to compounding methods?

-The effective rate of interest varies depending on the compounding frequency. For example, compounding daily results in a higher effective rate than compounding monthly, even if the nominal rate is the same.

What happens when you invest $1,000 at 5% simple interest for a year?

-At 5% simple interest, the investment earns $50 after one year, as the interest is calculated only on the initial principal without compounding.

What is the result of compounding interest monthly at 5% for $1,000?

-When compounding interest monthly at a 5% nominal rate, the effective rate of interest becomes 5.16%, which results in earning slightly more money compared to simple interest.

How do you calculate the effective rate of interest for monthly compounding?

-To calculate the effective rate for monthly compounding, the formula is: 1 + (rate / 12) raised to the power of 12 minus 1. For a 5% rate, this results in an effective rate of 5.16%.

What happens when you compound interest daily at 5% for $1,000?

-When compounding daily at 5%, the effective rate becomes 5.27%, which is higher than the 5.16% from monthly compounding, thus earning more over the same period.

Why does compounding daily give a higher effective rate than compounding monthly?

-Compounding daily results in interest being added more frequently, allowing the investment to grow faster over time, which leads to a higher effective rate of interest compared to monthly compounding.

What is the formula to calculate the effective rate of interest?

-The formula for the effective rate of interest is: 1 + (rate / number of conversions per year), raised to the number of conversions per year, minus 1.

How do you calculate the effective rate of interest for daily compounding?

-For daily compounding, the formula is similar but with 365 conversions per year. For a 5% nominal rate, this results in an effective rate of approximately 5.13%.

What do the results of the effective rate of interest mean in practical terms?

-The effective rate of interest shows the true interest rate you would need with simple interest to earn the same amount of money as with different compounding methods like monthly or daily.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

Annual Percentage Rate (APR) and effective APR | Finance & Capital Markets | Khan Academy

Serial Keluarga Sikapi: Cara Menghitung Bunga Pinjaman

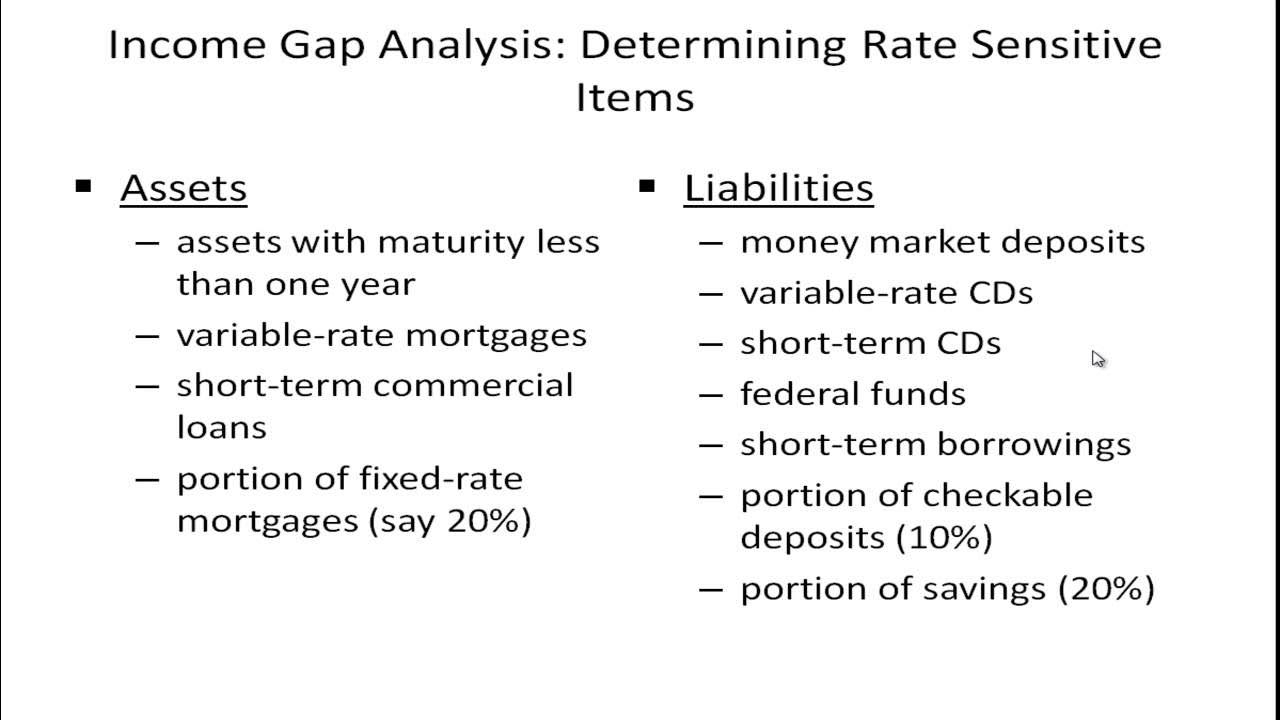

Managing Interest Rate Risk - Income Gap Analysis

Zins & Zinsrechnung (ohne Zinseszins)

RBI’s Repo Rate Calculations: How Does The RBI Policy Actually Affect You?

Pembahasan Contoh Soal Bunga Tunggal

5.0 / 5 (0 votes)