KONSEP BIAYA DAN AKUNTANSI BIAYA

Summary

TLDRThis video provides an introduction to cost accounting, explaining its importance in understanding and managing business expenses. It covers the basic concepts of cost, accounting, and the relationship between costs and financial decisions. The speaker defines cost accounting as a method for calculating and reporting costs to aid decision-making. It emphasizes the role of cost accounting in different types of businesses, from manufacturing to service industries. Additionally, the video compares financial and managerial accounting, highlighting their different functions and users. The speaker also addresses the overlap between financial accounting and cost accounting.

Takeaways

- 😀 Accounting for costs, or cost accounting, is a process of determining and managing the costs associated with a project or business.

- 😀 Cost accounting involves measuring economic sacrifices in monetary terms to achieve specific objectives, which might not always involve cash outlays but can include asset depreciation or increased liabilities.

- 😀 The key distinction between costs (biaya) and losses (kerugian) is that costs are incurred for a specific economic purpose, while losses represent waste or mismanagement.

- 😀 Accounting is the process of recording, classifying, summarizing, and reporting financial transactions of an entity to generate useful information for decision-making.

- 😀 Cost accounting helps produce detailed cost information such as the cost of production and other financial metrics, which are vital for decision-making and external reporting.

- 😀 There are various types of costs based on different classification criteria, including direct vs indirect costs, variable vs fixed costs, and capital vs revenue expenditures.

- 😀 A company’s main functions, such as production, marketing, and administration, generate different kinds of costs that can be categorized according to their respective functions.

- 😀 Different cost accounting methods exist, such as job order costing (harga pokok pesanan) and process costing (harga pokok proses), depending on the nature of production and business processes.

- 😀 Cost accounting can be divided into two main types based on user needs: financial accounting, which is designed for external users (e.g., shareholders, creditors), and management accounting, which is intended for internal users (e.g., company management).

- 😀 The overlap between financial accounting and management accounting in cost accounting is significant as it provides both internal cost information for decision-making and external information for financial reporting.

Q & A

What is the main focus of cost accounting as explained in the video?

-Cost accounting is focused on analyzing, recording, and reporting the costs of production or services to support decision-making within a company. The goal is to provide useful information for internal stakeholders to manage and control costs effectively.

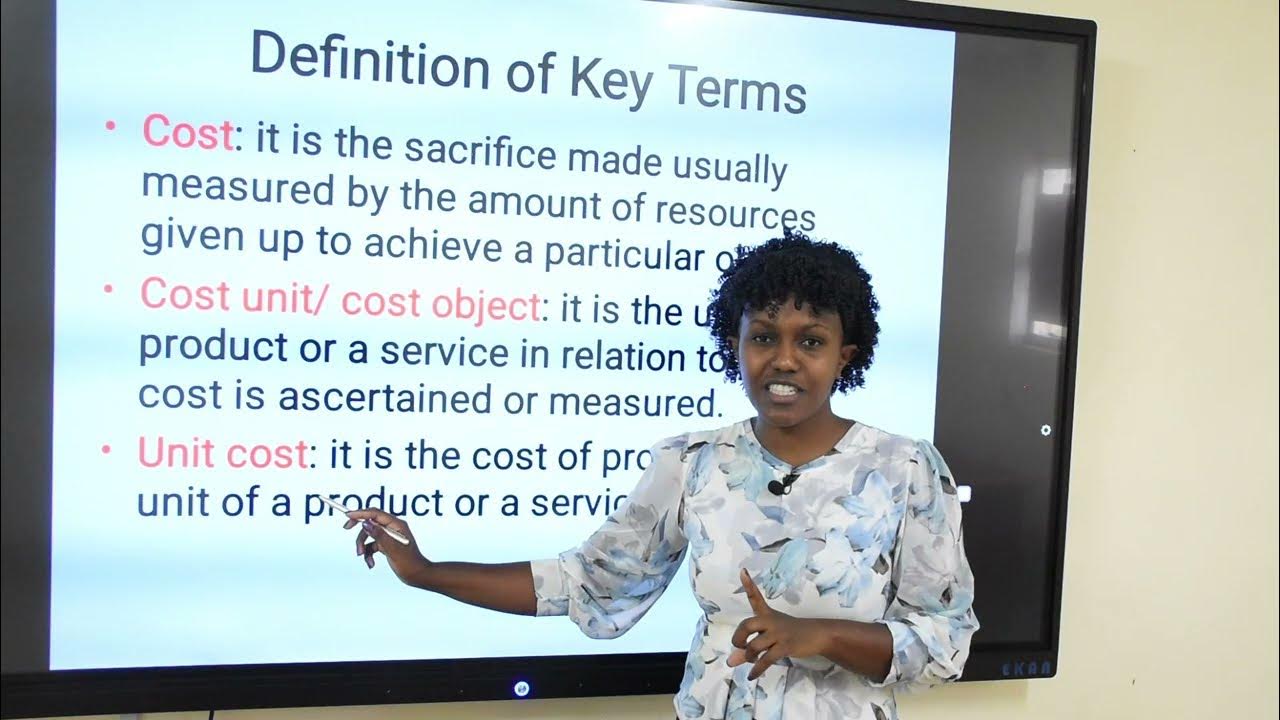

What are the key components that define 'cost' in cost accounting?

-Cost in cost accounting refers to the sacrifice of economic resources measured in monetary units that have occurred for specific purposes. This includes not just cash expenditure but also other asset sacrifices like depreciation or increases in liabilities.

How is cost accounting different from expense accounting?

-Cost accounting is focused on tracking costs for specific purposes within a company, while expense accounting records all expenses, including losses and other outflows, often unrelated to production activities.

What are the key functions of accounting as described in the video?

-Accounting involves four main processes: recording, classifying, summarizing, and reporting financial transactions. These processes help in providing relevant information for decision-making and meeting external requirements like regulatory compliance.

What is the relationship between cost accounting and financial accounting?

-Cost accounting overlaps with both financial and managerial accounting. It is part of financial accounting as it provides product cost information for financial reporting, and it is also a part of managerial accounting because it helps managers make decisions regarding pricing, cost control, and operational improvements.

What are the different types of costs mentioned in the video?

-The video mentions various types of costs based on different classifications: direct costs (like raw materials and direct labor), indirect costs (like overhead), variable costs (which change with production volume), fixed costs (which remain constant regardless of production), and others based on time periods like capital expenditures and revenue expenditures.

What is the distinction between direct and indirect costs in cost accounting?

-Direct costs are those that can be directly attributed to a specific product or service, such as raw materials and direct labor. Indirect costs, or overhead, are those that cannot be directly traced to a specific product, such as rent, utilities, or administrative salaries.

What is the difference between financial accounting and management accounting?

-Financial accounting focuses on providing external users with financial information that adheres to generally accepted accounting principles (GAAP). Management accounting, on the other hand, focuses on providing internal stakeholders with detailed, actionable information for decision-making and internal control.

What role does cost accounting play in decision-making for management?

-Cost accounting provides managers with critical cost information that helps in making decisions related to product pricing, cost management, resource allocation, and overall operational strategy. It supports both short-term and long-term decision-making processes.

Does cost accounting only apply to manufacturing companies?

-While cost accounting is often taught using manufacturing examples due to the complexity of production-related transactions, it is also applicable to other sectors like service companies (e.g., airlines, utility companies) and retail businesses. The principles of cost accounting can be adapted to various industries to manage and allocate costs effectively.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

2. Cost Accounting - Cost – Analysis, Concepts & Classifications

KONSEP BIAYA DAN KLASIFIKASI BIAYA (BAGIAN 1)

Introduction to Cost and Management Accounting

Bridge Course in Accounting - Basics of Accounting

Cara HITUNG LABA BERSIH (Profit Bisnis) untuk Usaha Kecil

Akuntansi Dasar | Pengantar Akuntansi | Tutor Aja

5.0 / 5 (0 votes)