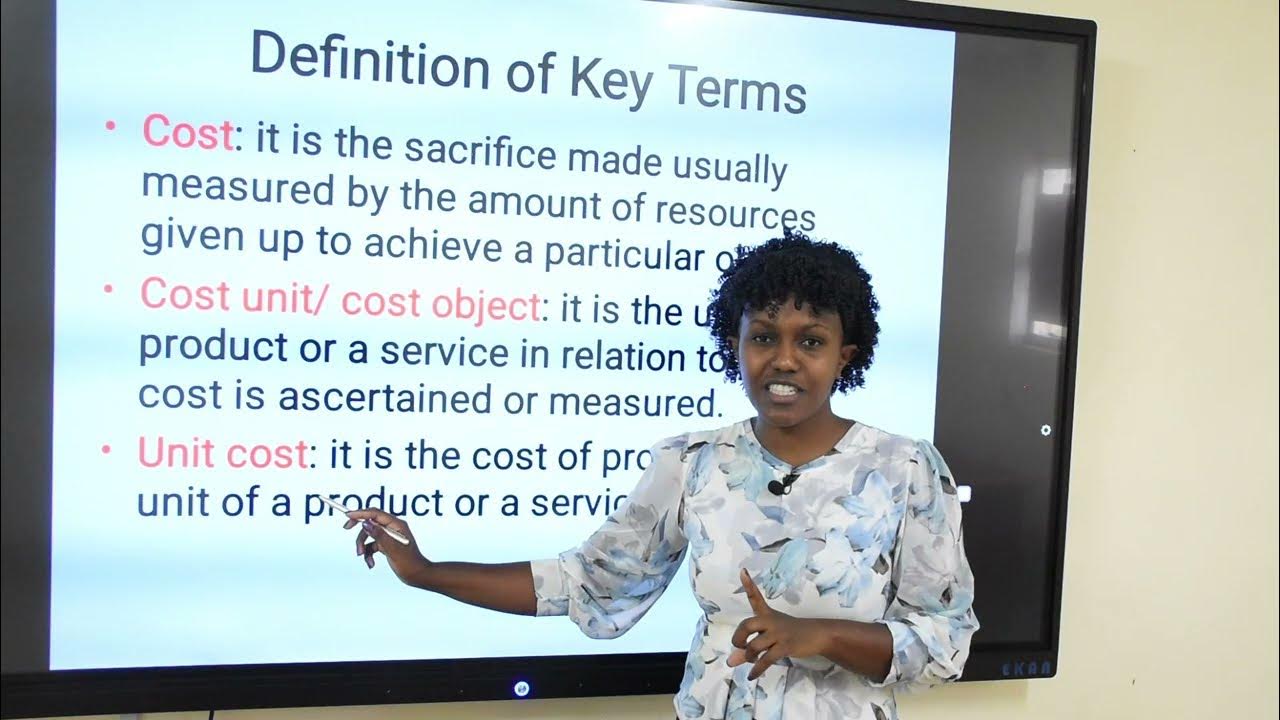

2. Cost Accounting - Cost – Analysis, Concepts & Classifications

Summary

TLDRThis video provides a comprehensive introduction to cost accounting, explaining the fundamental concepts of costs and their classifications. It details direct and indirect costs, overheads, and the importance of prime costs in understanding production expenses. The video emphasizes the significance of accurately calculating the cost of production and the total cost of sales for effective financial management. Engaging with these concepts is crucial for anyone involved in managing business finances, making this a valuable resource for students and professionals alike.

Takeaways

- 😀 Cost accounting is essential for understanding and managing expenses in a business.

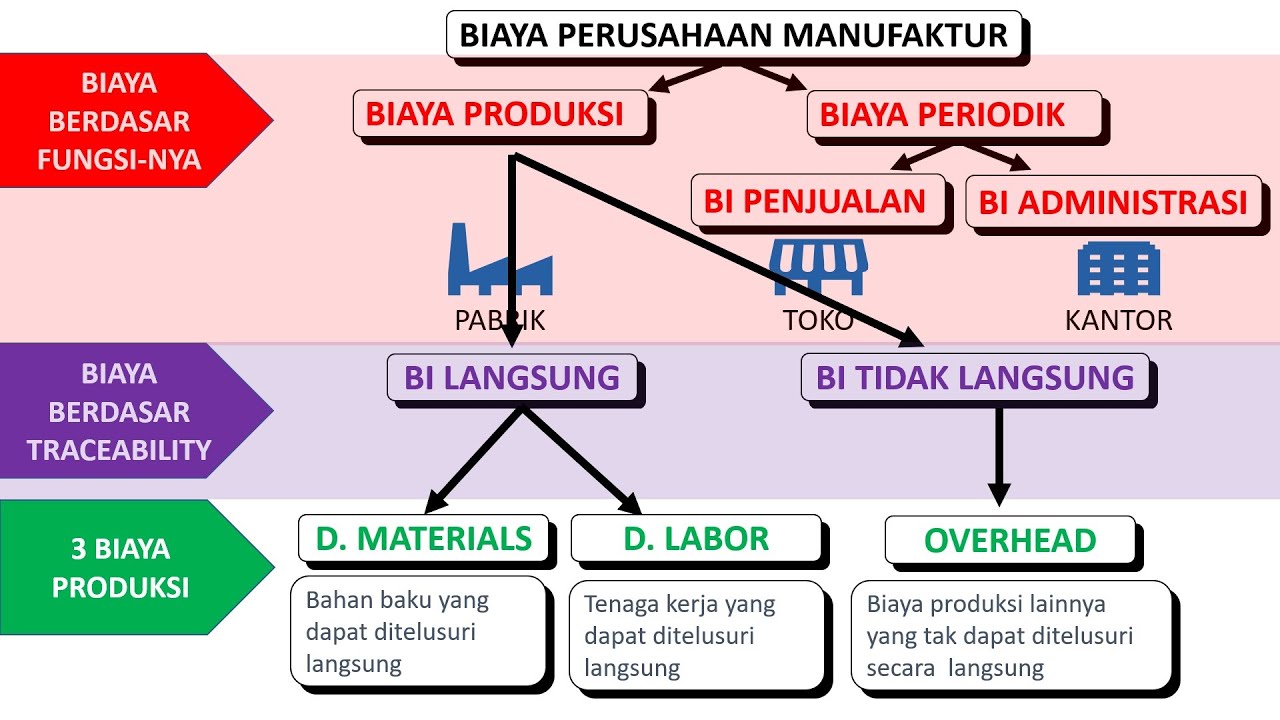

- 💡 Costs are classified into three main categories: direct materials, direct labor, and indirect expenses.

- 📊 Direct materials are raw materials that can be traced directly to the production of goods.

- 👷 Direct labor refers to labor costs that are directly associated with the manufacturing process.

- 🏭 Indirect expenses include overhead costs that cannot be directly linked to specific products, such as factory rent and utilities.

- 🔍 Overheads are categorized into production overheads and administrative overheads, each serving different functions in cost accounting.

- 💰 Prime cost is calculated as the sum of direct materials and direct labor, providing a clear view of manufacturing costs.

- 📈 Understanding the total cost of sales is crucial for assessing the overall financial health of a business.

- 🔧 The cost of production encompasses all expenses related to manufacturing, which is key for accurate financial reporting.

- 📚 Effective cost classification aids in better decision-making and enhances operational efficiency in business management.

Q & A

What is the primary focus of the video?

-The video primarily focuses on cost accounting, explaining various classifications of costs involved in production.

How are costs categorized according to the video?

-Costs are categorized into three main parts: direct materials, direct labor, and indirect costs.

What is meant by 'direct material'?

-Direct material refers to raw materials that are directly used in the manufacturing of products.

Can you explain what 'indirect costs' are?

-Indirect costs are expenses that cannot be directly attributed to a specific product, such as administrative overheads and factory utilities.

What components make up the 'prime cost'?

-Prime cost is made up of direct materials and direct labor costs.

Why is understanding prime cost important?

-Understanding prime cost is crucial for pricing strategies and profitability analysis, as it helps businesses determine the cost to produce their goods.

What is the relationship between production costs and selling costs?

-The total cost of production includes not only the prime cost but also overheads, and it's essential to consider selling and distribution expenses to calculate the total sales costs accurately.

How does the speaker encourage viewer engagement?

-The speaker encourages viewer engagement by asking them to subscribe to the channel for more educational content and by prompting them to interact with the video.

What are administrative overheads?

-Administrative overheads are costs associated with the general management and administration of a business, such as salaries, office supplies, and utilities.

What is the significance of classifying costs in accounting?

-Classifying costs in accounting helps businesses analyze expenses, manage budgets effectively, and improve decision-making related to pricing and profitability.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)