KONSEP BIAYA DAN KLASIFIKASI BIAYA (BAGIAN 1)

Summary

TLDRThis video provides an introduction to cost accounting, focusing on key cost concepts and classifications. It explains terms such as actual costs, budgeted costs, and cost objects, and introduces direct and indirect costs, including production costs like raw materials, direct labor, and factory overheads. The speaker also covers non-production costs, such as marketing and administrative expenses. Various cost behaviors, like fixed, variable, and semi-variable costs, are discussed, along with how they impact decision-making. The video concludes by highlighting the importance of understanding differential costs, opportunity costs, and sunk costs in business management.

Takeaways

- 😀 Cost is the resource sacrificed to achieve a specific goal, and can be categorized as actual costs (expenses that have occurred) or budgeted costs (anticipated future expenses).

- 😀 In cost accounting, direct costs are easily traceable to a product, such as direct materials and direct labor, whereas indirect costs (overhead) are allocated based on certain criteria.

- 😀 The three main components of production costs are direct materials, direct labor, and factory overhead.

- 😀 Direct materials (raw materials) are those that form a part of the final product, such as flour and sugar in a bakery, while indirect materials are not part of the final product but assist in production.

- 😀 Direct labor refers to the cost of workers directly involved in the production of goods, while indirect labor includes workers whose duties support production but are not directly involved.

- 😀 Factory overhead includes all other production costs, such as utilities, factory rent, maintenance, insurance, and depreciation of machines.

- 😀 Production costs are divided into direct costs (materials and labor) and indirect costs (overhead), which collectively make up the total cost of goods manufactured.

- 😀 Non-production costs include selling and marketing expenses, as well as administrative and general expenses.

- 😀 Inventory in manufacturing companies is more complex than in trading businesses and includes raw materials, work-in-progress, and finished goods.

- 😀 Costs can be classified based on behavior into fixed costs, variable costs, and semi-variable costs. Fixed costs do not change with production volume, while variable costs change in proportion to output.

- 😀 Semi-variable costs contain both fixed and variable elements, such as monthly administration fees plus a variable cost component based on usage, like electricity bills.

Q & A

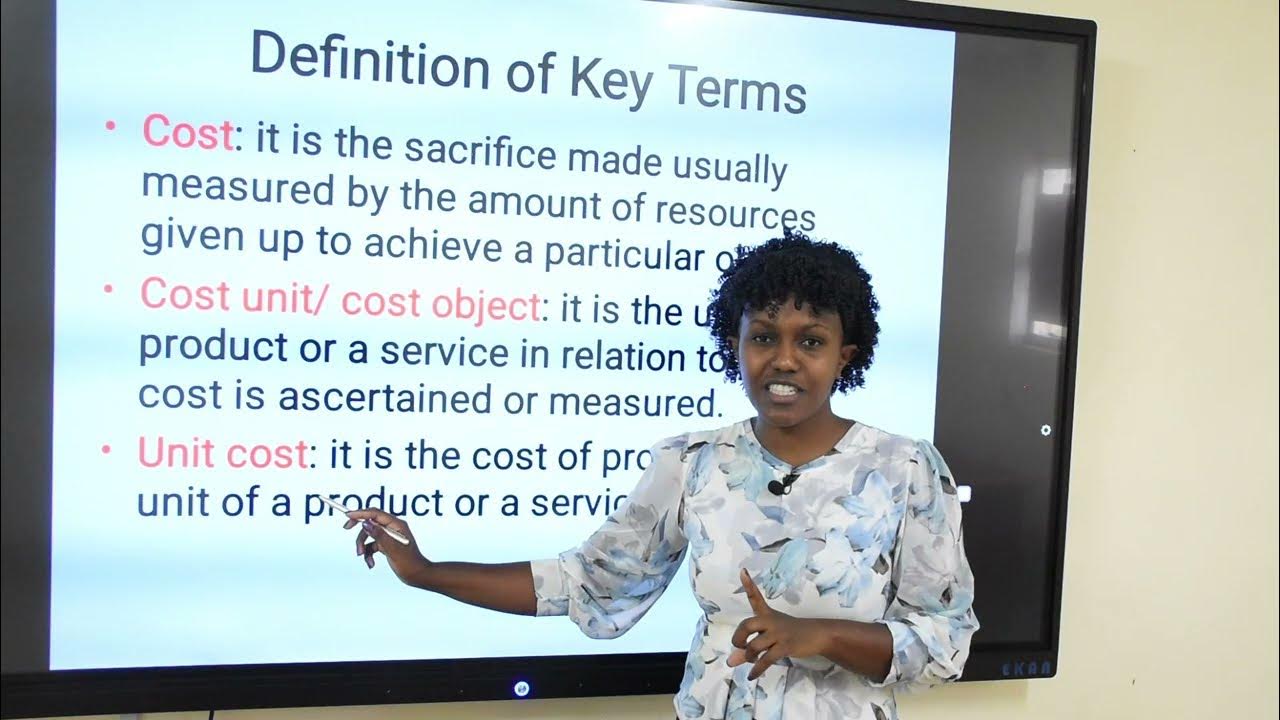

What is the definition of cost in cost accounting?

-Cost refers to the resources sacrificed or spent to achieve a specific goal or objective. It involves the expenditure of money, time, or materials to produce a product or service.

What is the difference between actual cost and budgeted cost?

-Actual cost refers to the expenses that have actually been incurred, while budgeted cost refers to the forecasted or estimated expenses for a future period.

What is the meaning of cost object in cost accounting?

-A cost object is anything for which a company wants to measure the cost. It can be a product, service, department, project, or any other entity that consumes resources.

What does cost accumulation refer to?

-Cost accumulation refers to the process of collecting and organizing cost data in a structured way for cost allocation and analysis.

What are the three main components of production cost?

-The three main components of production cost are direct materials, direct labor, and factory overhead.

What is the difference between direct materials and indirect materials?

-Direct materials are raw materials that are physically traceable and form a significant part of the product. Indirect materials, on the other hand, are materials used in production but not directly traceable to the final product, such as lubricants or cleaning supplies.

What is factory overhead and what costs are included in it?

-Factory overhead consists of costs that are not directly associated with direct materials or direct labor but are necessary for production. This includes indirect materials, indirect labor, factory rent, utilities, maintenance, insurance, and depreciation.

What is the difference between prime cost and conversion cost?

-Prime cost is the sum of direct materials and direct labor, representing the basic costs of producing a product. Conversion cost refers to the costs incurred to convert raw materials into finished products, which include direct labor and factory overhead.

What is the purpose of determining the completion percentage in production costs?

-The completion percentage helps to measure the progress of production and determine how much of each cost component, such as direct materials, direct labor, and factory overhead, should be allocated to the work in process at the end of a period.

What are the three types of costs classified by behavior, and how do they differ?

-Costs can be classified as fixed costs, variable costs, and semi-variable costs. Fixed costs remain constant regardless of the level of activity. Variable costs change proportionally with the level of activity. Semi-variable costs have both fixed and variable elements, where a base cost remains fixed, but additional costs increase with the level of activity.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Introduction to Cost and Management Accounting

2. Cost Accounting - Cost – Analysis, Concepts & Classifications

KONSEP BIAYA DAN AKUNTANSI BIAYA

Akuntansi Biaya Bab 1: Manajemen, Controller, dan Akuntansi Biaya

PENJELASAN MUDAH!!!! SIKLUS AKUNTANSI PERUSAHAAN DAGANG BAGIAN 1 (KELAS 12)

Basic Cost Concepts...with a touch of humor | Managerial Accounting

5.0 / 5 (0 votes)