Gold as a Strategic Asset

Summary

TLDRThis presentation offers a comprehensive look at gold as both a consumption and investment asset, exploring its role in the global market. It discusses the factors driving demand for gold, including economic growth, geopolitical risk, and inflation. The analysis covers gold's performance in portfolios, highlighting its returns, diversification benefits, and liquidity. Gold's unique role in both strategic and tactical demand, especially in emerging markets like India and China, is examined. The speaker also touches on portfolio construction, with gold improving risk-adjusted returns. With strong central bank buying and positive market trends, gold is poised for strong performance in 2025.

Takeaways

- 😀 Gold is a membership-driven organization offering free data, research, and insights via their website, gold.org.

- 😀 Gold has been a valuable asset for centuries, with above-ground stocks estimated at 212,000 tons, 45% of which are in jewelry.

- 😀 47,000 tons of gold are held in gold-backed ETFs, while central banks, including the RBI, hold around 36,000 tons.

- 😀 Gold is used in a variety of industries, including technology, medical devices, and AI systems, making up 15% of total gold demand.

- 😀 The proven underground reserves for gold are estimated at 59,000 tons, indicating its scarcity but large financial market.

- 😀 Gold demand is driven by both strategic factors (economic expansion, geopolitical uncertainty) and tactical factors (opportunity costs, momentum).

- 😀 Emerging markets, especially India, China, and Southeast Asia, account for 71% of global gold demand, with 29% from developed countries.

- 😀 In India, the demand for gold is primarily for jewelry, but investment demand in the form of bars, coins, and ETFs is also rising.

- 😀 Long-term demand for gold is influenced by income growth, while short-term fluctuations depend on factors like monsoons, government taxes, and inflation.

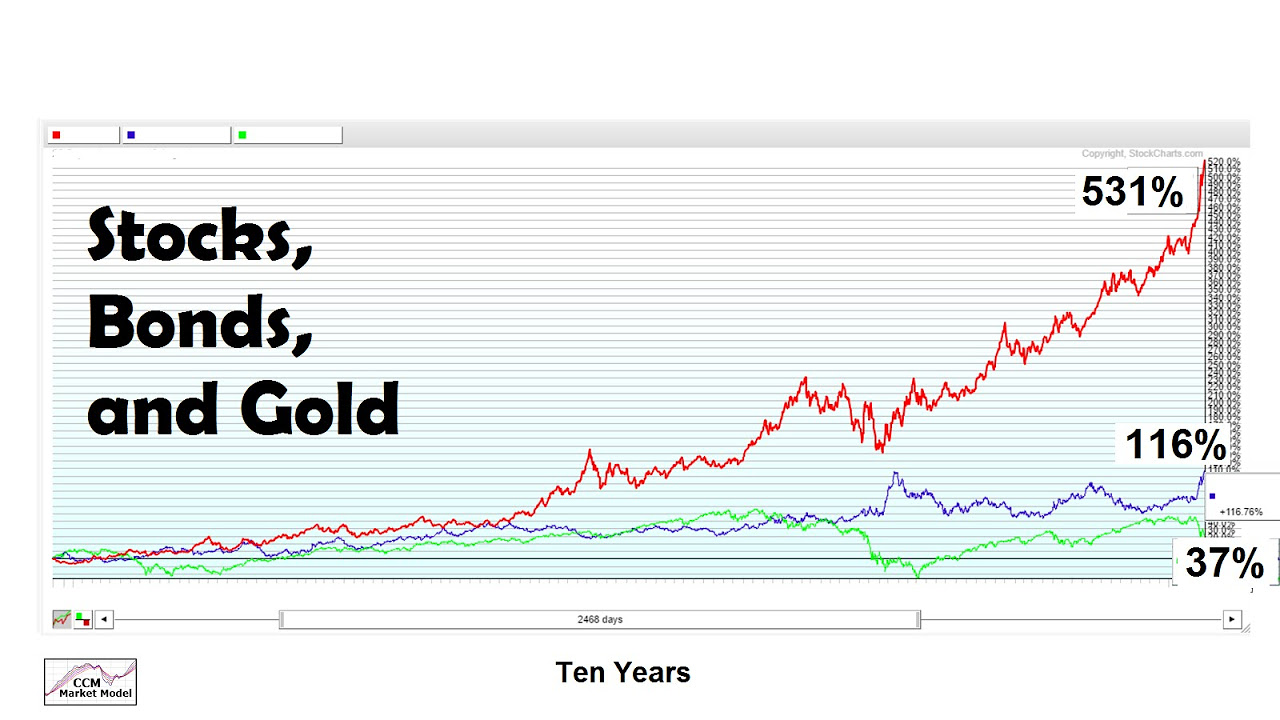

- 😀 Gold’s role in a portfolio includes generating competitive returns (10-15%), offering diversification (especially against equities), and maintaining liquidity, with over $120 billion traded in 2023.

Q & A

What is the role of the organization behind the data and insights shared in the transcript?

-The organization is a membership-driven entity that produces data, research, and insights about gold. They offer free access to this information on their website, gold.org, where users can log in and use various tools for analysis and understanding of gold's performance.

What is the current estimate of above-ground gold stocks, and what forms do these stocks take?

-The estimated above-ground gold stocks are around 212,000 tons. A significant portion of this is in the form of jewelry (45%), while 47,000 tons are held in bars, coins, and gold-backed ETFs. Central banks hold about 36,000 tons, and 15% is categorized as 'other,' including gold used in technology, medical devices, and various other sectors.

How do central banks, like the RBI, impact global gold demand?

-Central banks, including the RBI, significantly contribute to global gold demand. The RBI has been purchasing gold in recent years, adding to the overall demand from central banks, which accounted for around 19% of annual gold demand.

What are the two main categories driving gold demand, and what factors contribute to each?

-Gold demand is driven by strategic and tactical factors. Strategic demand includes economic expansion, periods of risk and uncertainty (such as financial crises and geopolitical events). Tactical demand is driven by factors like opportunity cost (interest rates, currency values) and momentum (price changes and volatility in other asset classes).

What role does gold play in a portfolio, and what are the key aspects considered?

-Gold plays a key role in portfolio diversification, providing returns, reducing risk, and increasing liquidity. Gold is seen as a hedge during times of inflation and economic downturns. Key aspects include its potential for returns, its role in portfolio diversification (especially during market crashes), and its high liquidity, especially in the form of ETFs and other trading products.

What historical patterns have been observed in gold's performance during periods of economic and geopolitical uncertainty?

-Gold performs well during periods of economic uncertainty, financial crises, and geopolitical events. Historical examples, such as the Gulf War, 9/11, Brexit, and the COVID-19 pandemic, show a trend where gold prices rise due to increased investment during such times of systemic risk and uncertainty.

How does gold correlate with other assets like equities and bonds in a portfolio?

-Gold has a negative correlation with equities, meaning it tends to perform well when stock markets are underperforming. In contrast, gold has a positive correlation with bonds during times of risk and uncertainty. This makes gold an important asset for diversifying risk in a portfolio, particularly in volatile market conditions.

What impact does adding gold to an investment portfolio have on returns and risk?

-Adding gold to an investment portfolio improves risk-adjusted returns. Analysis has shown that portfolios with gold have lower volatility and higher reward-to-risk ratios compared to portfolios without gold. However, adding more than 15% gold to a portfolio does not result in significantly higher returns.

What are the potential risks and benefits of investing in gold?

-Gold is a relatively stable asset with lower volatility compared to equities, but it does not provide regular income (such as dividends or interest). The main risks include its lack of yield and the fact that traditional valuation methods may not fully capture gold’s value. Despite this, gold has been a strong performer in terms of returns, especially during times of inflation and economic downturns.

What are some ways to invest in gold in India, and how do these options cater to different needs?

-In India, people can invest in gold through jewelry, bars, coins, or ETFs. Gold ETFs, launched in 2007, are a popular option, allowing for small investments starting from as little as 0.1g of gold. Multi-asset funds and gold funds of funds are also available for those who do not have a demat account. These options cater to both physical gold buyers and investors looking for easier storage and liquidity.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

Global Gold Market and the Strategic Case for Gold as an Asset Class

Investment Case for Gold - John Reade

Lendas do Mercado - Episódio 1: BlackRock

This BROKE The Market But It's Also What Made Me RICH (Here's How)

Gold Can Add Value To A Stock/Bond Portfolio

Silver To 9x Gold?? Ray Dalio’s Shocking Prediction For Investors 2026

5.0 / 5 (0 votes)