Financial Derivatives Explained

Summary

TLDRThis video introduces financial derivatives, explaining their basic concept and usage. A financial derivative is a contract whose value is based on an underlying asset like stocks, bonds, or commodities. Derivatives serve two main purposes: hedging risk (protecting against price fluctuations) and speculation (seeking profit from price movements). The video highlights the four primary types of derivatives: forwards, futures, options, and swaps. Each type is briefly described, with the focus on how they can be used to either minimize risk or speculate on market changes. Stay tuned for deeper dives into each derivative type in future videos.

Takeaways

- 😀 Derivatives are financial contracts whose value is derived from an underlying asset like stocks, bonds, or commodities.

- 😀 The main purpose of derivatives is to either hedge risk or speculate on price changes.

- 😀 Hedging is used to minimize risk exposure, as seen in the example of wheat producers and cereal manufacturers locking in future wheat prices.

- 😀 Speculation, unlike hedging, is driven by profit opportunities from price fluctuations in the market.

- 😀 Derivatives can be used to manage price risks in markets that experience significant volatility, like agriculture.

- 😀 A forward contract is a customized agreement between two parties to buy or sell an asset at a future date for a specific price.

- 😀 Futures contracts are similar to forwards but are standardized and regulated, allowing them to be traded on exchanges.

- 😀 Options contracts give the holder the right, but not the obligation, to buy (call) or sell (put) an asset at a predetermined price.

- 😀 Swap contracts involve exchanging one financial asset for another, often based on different financial conditions or terms.

- 😀 Financial derivatives provide both a risk management tool for businesses and an opportunity for speculative profit in various markets.

Q & A

What is a financial derivative?

-A financial derivative is a contract whose value is based on the value of another asset, known as the underlying asset. Common underlying assets include stocks, bonds, commodities, currencies, interest rates, and market indexes.

What is the primary purpose of derivatives?

-The primary purpose of derivatives is to manage financial risk, either by hedging against potential price fluctuations or by speculating on price movements for profit.

What is the difference between hedging and speculation in derivatives?

-Hedging is used to reduce or manage risk, usually to protect against adverse price movements. Speculation, on the other hand, is driven by the potential to profit from predicting price changes in the market.

How does hedging work with derivatives? Can you provide an example?

-Hedging with derivatives allows parties to lock in prices and reduce risk exposure. For example, a wheat producer might use a forward contract to secure the price of wheat and protect against price drops, while a cereal manufacturer might use the same contract to guard against price increases.

What is a forward contract?

-A forward contract is a customized agreement between two parties to buy or sell an asset at a specified price on a future date. It is not traded on exchanges and is unregulated.

What is the key difference between forwards and futures contracts?

-The key difference is that forwards are non-standardized and unregulated, while futures are standardized, regulated, and traded on exchanges, making them more liquid and accessible for speculation.

What are options in the context of derivatives?

-An options contract gives the holder the right, but not the obligation, to buy (call) or sell (put) an underlying asset at a specified price before or on a specific date.

What are swaps in financial derivatives?

-A swap is a contract where two parties exchange one asset or cash flow for another, typically based on different variables or conditions, such as interest rates or commodity prices.

What are the most common types of derivatives?

-The most common types of derivatives are forwards, futures, options, and swaps. Each serves different purposes, such as hedging, speculation, or exchanging financial products.

Can derivatives be used for both hedging and speculation at the same time?

-Yes, derivatives can be used for both hedging and speculation, depending on the needs of the parties involved. A company might hedge risk while an investor could speculate on price movements using similar derivative products.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

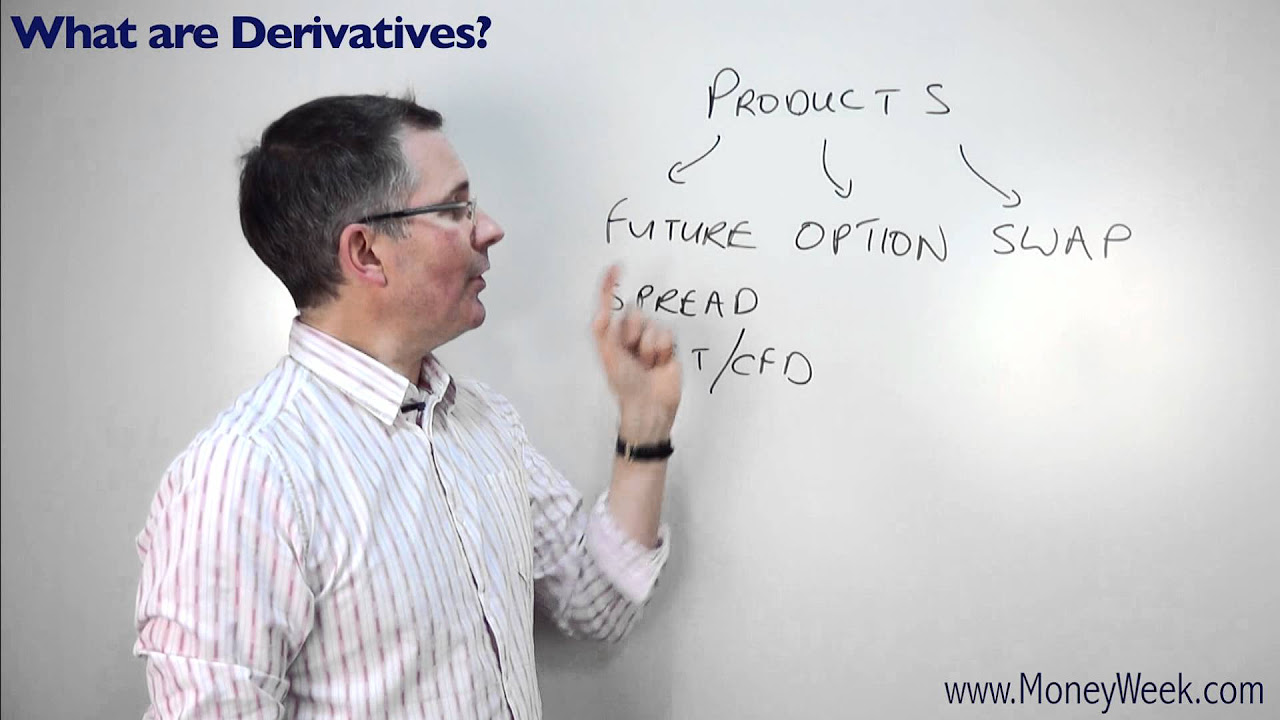

What are derivatives? - MoneyWeek Investment Tutorials

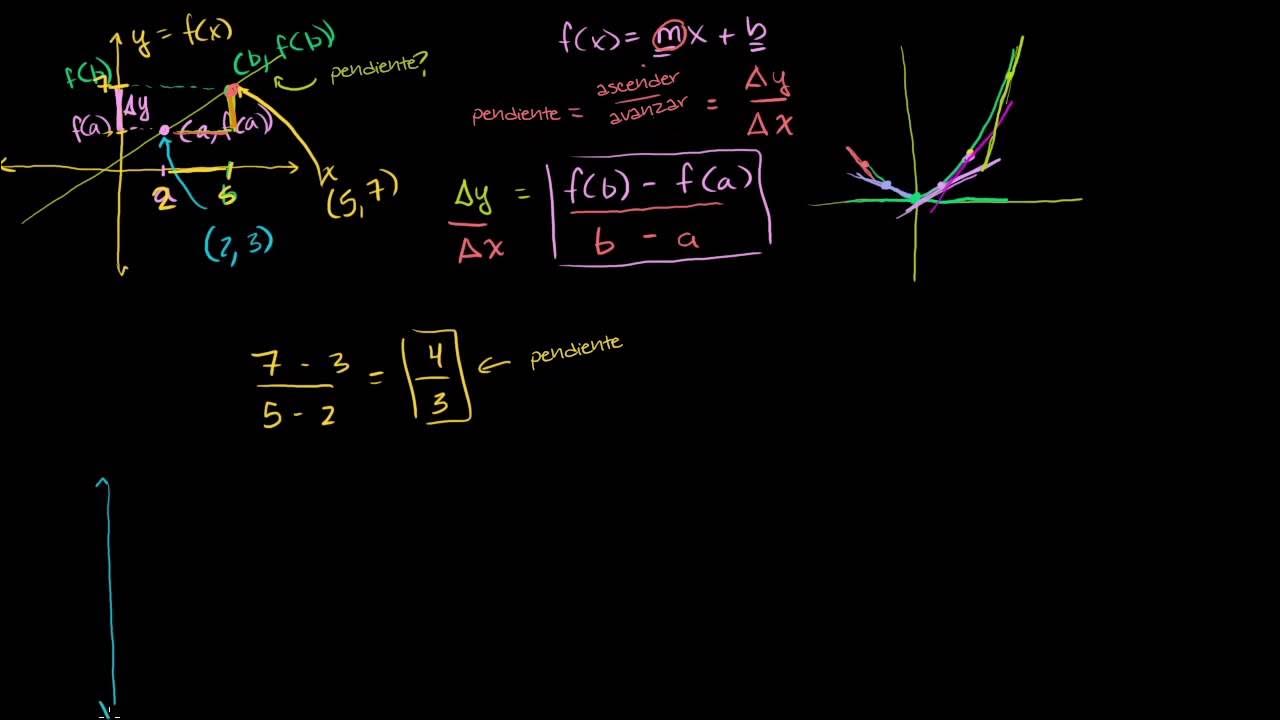

Cálculo: Derivadas 1 (nueva versión HD)

ĐẠO HÀM và ý nghĩa hình học (Derivative Intro) | Vật Lý Chill

1. Options, Futures and Other Derivatives Ch1: Introduction Part 1

Persamaan Diferensial Parsial (Pengertian, Definisi, dan Klasifikasi)

KALKULUS | TURUNAN | APA ITU TURUNAN?

5.0 / 5 (0 votes)