Konsep HOBO (Home Office Branch Office) di Akuntansi Pemerintahan Daerah

Summary

TLDRThis educational video discusses the concept of Home Office Branch Office (HOBO) in local government accounting, focusing on the relationship between the central office (PPKD) and regional offices (SKPD). The presentation explains key concepts such as 'uang persediaan' (advance funds) and 'akun resiprokal' (reciprocal accounts), which are used to manage internal financial transactions. It outlines how funds flow between the offices, accounting for investments and returns, and how these transactions are reflected in the balance sheets of both entities. The goal is to help viewers understand governmental accounting processes and improve their grasp of internal financial controls.

Takeaways

- 😀 The concept of Hobo refers to Home Office (PPKD) and Branch Office (SKPD) structures, applicable both in private institutions and government bodies.

- 😀 Hobo is also used in local government accounting, where PPKD functions as the central office and SKPD operates as the branch office.

- 😀 Transactions between PPKD (central office) and SKPD (branch office) are internal, with examples like the provision of cash advances (UP).

- 😀 UP stands for 'Uang Persediaan' (cash advance), which is a prepayment for SKPD's operational expenses, managed by PPKD.

- 😀 Cash advances are not considered an expense or revenue for either PPKD or SKPD, as the funds are still within the same entity for accounting purposes.

- 😀 The reciprocal account (Akun Resiprokal) is used to track internal transactions between PPKD and SKPD, facilitating accurate accounting.

- 😀 The reciprocal accounts in the accounting system include KSCCB (SKPD's bank account) in PPKD and RK-PPKD (PPKD's account) in SKPD.

- 😀 In PPKD's balance sheet, the SKPD reciprocal account is classified under assets, while in SKPD’s balance sheet, the RK-PPKD is under equity.

- 😀 Internal transactions between PPKD and SKPD involve examples such as cash advances, SKPD spending, revenue deposits, and return of remaining advances.

- 😀 For example, when PPKD provides cash advances to SKPD, SKPD's asset (RK SKPD) increases, while PPKD’s equity (RK-PPKD) also increases as an investment.

- 😀 In reverse, when SKPD returns money to PPKD, the SKPD asset decreases and the RK-PPKD in PPKD's balance sheet is reduced, reflecting the return of the investment.

Q & A

What does the term 'HOBO' stand for in government accounting?

-HOBO stands for 'Home Office Branch Office,' which refers to the relationship between the central office (PPKD) and regional offices (SKPD) in government accounting. It involves the management and flow of funds between these offices.

Is the concept of HOBO applicable only to private organizations?

-No, the concept of HOBO is also used in government institutions, including local governments (Pemerintah Daerah), in managing internal transactions and funds.

What role does the PPKD play in the HOBO system?

-PPKD, or the central office, acts as the main entity in the HOBO system. It is responsible for providing funds (like UP) to regional offices (SKPD) and managing the financial transactions between the central and regional offices.

What is 'UP' in the context of the HOBO system?

-'UP' stands for 'Uang Persediaan' or money reserved for operational expenses. It is an advance given by PPKD to SKPD to fund its activities, which is then tracked within the reciprocal accounts.

How are internal transactions between PPKD and SKPD recorded in accounting?

-Internal transactions between PPKD and SKPD are recorded using reciprocal accounts, such as 'RK SKPD' (SKPD Reciprocal Account) and 'RK PPKD' (PPKD Reciprocal Account). These accounts reflect the flow of funds between the two entities.

What is the significance of reciprocal accounts in government accounting?

-Reciprocal accounts are used to track the movement of funds between PPKD and SKPD, ensuring transparency and proper accounting for internal transactions. They help in maintaining a balanced financial system within government institutions.

How does the transfer of UP from PPKD to SKPD affect the financial records?

-When PPKD disburses UP to SKPD, SKPD’s reciprocal account (RK SKPD) increases, reflecting the additional funds it has received, while PPKD’s reciprocal account (RK PPKD) increases, representing the investment made by PPKD into SKPD.

What happens when SKPD returns unused UP to PPKD?

-When SKPD returns unused UP, the financial records reflect a reduction in the SKPD's assets (cash), and the reciprocal account (RK SKPD) decreases. At the same time, PPKD's reciprocal account (RK PPKD) decreases as the investment is returned.

How does the deposit of revenue from SKPD to PPKD affect their accounting?

-When SKPD deposits revenue to PPKD, SKPD’s cash decreases, and its reciprocal account (RK PPKD) decreases, indicating the return of investment. PPKD’s cash increases, and its reciprocal account (RK SKPD) decreases, showing the return of funds to the central office.

Why is it important for government entities to use reciprocal accounts for transactions?

-Reciprocal accounts ensure accurate and transparent tracking of funds between PPKD and SKPD. They help maintain the integrity of financial reporting by clearly showing how internal transactions affect both the central and regional offices’ assets and equity.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

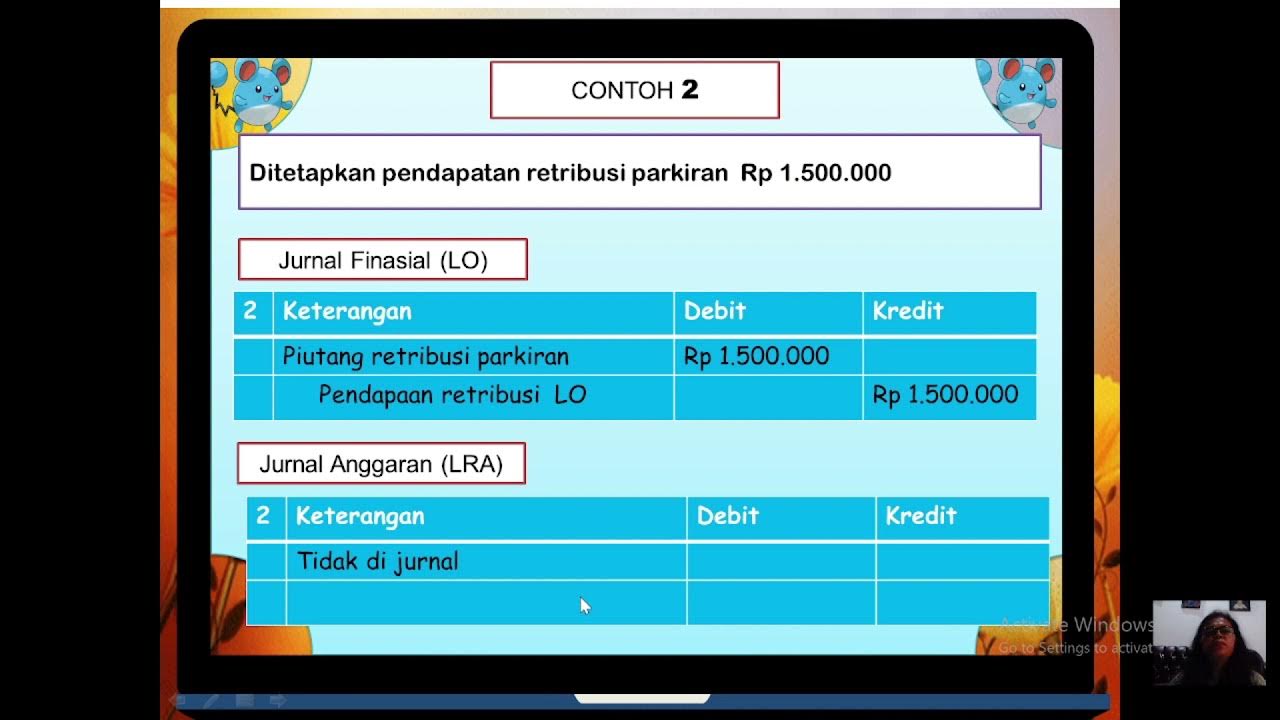

Materi Akuntasi Pemerintah Daerah Kelas 11 Praktikum Akuntansi Lembaga

JURNAL SKPD AKUNTANSI PEMERINTAHAN

LAPORAN KEUANGAN KONSOLIDASI PUSAT DAN CABANG

AKUNTANSI KANTOR PUSAT DAN CABANG: TRANSFER KAS DAN BARANG ANTAR CABANG

AKUNTANSI PUSAT DAN CABANG: Pengiriman harga di atas harga pokok

Akuntansi Pemerintahan Daerah (gambaran umum)

5.0 / 5 (0 votes)