The Impact of COVID 19 on E Commerce

Summary

TLDR在这段对话中,James Thompson,作为buy box experts的合伙人以及前亚马逊商业领导者和顾问,讨论了COVID-19对电子商务特别是亚马逊中心的电子商务世界的影响。Thompson指出,消费者现在在亚马逊上购买几乎所有商品,而沃尔玛在线杂货领域也在迅速增长。他提到,尽管亚马逊在杂货领域有所涉足,但沃尔玛在这一特定类别中占据领先地位。Thompson还强调了亚马逊品牌的强大吸引力,以及消费者在疫情期间首次体验在线购物,可能会长期继续使用亚马逊平台。此外,沃尔玛通过将Jet.com的身份整合到Walmart.com中显示出了其品牌信心。对话还涉及了在线杂货购物的便利性,以及“点击提货”或“在线订购后现场取货”的模式,Thompson对此表示了一定的保留意见。最后,Thompson讨论了小型电子商务商家如何通过解决最后一英里配送问题来成功进入市场,并强调了可扩展物流建设的重要性。

Takeaways

- 📈 **电商增长**:COVID-19疫情加速了电子商务的增长,消费者更多地在亚马逊和沃尔玛等平台上购物。

- 🏪 **实体转线上**:消费者开始在亚马逊上购买他们通常在实体店购买的所有商品。

- 🛒 **沃尔玛在线杂货业务**:沃尔玛在在线杂货领域领先,尽管亚马逊也有所涉足,但沃尔玛在这一特定类别中占据优势。

- 🔑 **亚马逊的吸引力**:亚马逊吸引了那些历史上不习惯在线购物的消费者,他们现在开始在线购买,并且很可能会持续使用亚马逊。

- 💡 **品牌忠诚度**:亚马逊的品牌忠诚度高,对于不熟悉网购的消费者来说,亚马逊往往是他们的首选。

- 📦 **物流挑战**:尽管面临物流挑战,亚马逊仍能够在美国大部分地区合理时间内交付产品。

- 👨👩👧 **不同客户群体**:沃尔玛和亚马逊服务的客户群体在社会经济层面上存在差异。

- 🍽️ **杂货购物习惯改变**:疫情期间,许多人首次尝试在线购买食品,并发现这非常方便。

- 🛵 **点击提货/现场取货**:尽管有人使用并首次体验了点击提货模式,但有些人更喜欢直接送货到家的服务。

- 🚚 **最后一公里配送**:小型电商企业要想成功,需要解决最后一公里配送问题,这可能需要与物流合作伙伴建立关系。

- 📊 **电商模式可扩展性**:随着越来越多的人发现电商的便利性,物流扩展将成为关键,这可能需要昂贵的投资和商店改造。

Q & A

COVID-19对电子商务产生了哪些影响?

-COVID-19导致消费者更多地在亚马逊等在线平台上购物,同时沃尔玛在在线杂货领域也取得了领先。

亚马逊在COVID-19期间的增长主要体现在哪些方面?

-亚马逊的增长主要体现在消费者开始在亚马逊上购买他们通常在实体店购买的几乎所有商品。

沃尔玛在电子商务领域的表现如何?

-沃尔玛在在线杂货领域表现突出,尽管亚马逊也有一定的杂货业务,但沃尔玛在这一特定类别中占据了领先地位。

小型电子商务玩家在当前市场环境下如何保持增长?

-小型电子商务玩家通过建立自己的网站并能够持续吸引顾客访问他们的购物车来实现增长,这可能包括Shopify或BigCommerce等平台。

COVID-19如何改变了消费者对在线购物的态度?

-COVID-19促使那些历史上不习惯在线购物的消费者开始尝试网上购买产品,并且可能会在疫情结束后继续使用这一渠道。

亚马逊品牌对消费者有何吸引力?

-亚马逊品牌因其广泛的商品选择、通常较低的价格以及在满足挑战后仍能快速交付产品的能力而对消费者具有吸引力。

沃尔玛如何增强其电子商务竞争力?

-沃尔玛通过将Gedcom身份整合到Walmart.com中,显示出其对品牌竞争力的信心。

在大流行期间,杂货和食品在线购买有何变化?

-许多人首次尝试在线订购食品,并发现这非常方便,这可能导致他们之后继续使用这项服务。

点击提货(Click and Collect)模式在当前环境下的接受度如何?

-尽管点击提货模式在某些情况下很方便,但有些人可能更喜欢直接送货上门的服务,因为它避免了额外的出行。

小型电子商务商家如何成功地进入市场?

-小型电子商务商家可以通过与最后一公里配送伙伴建立合作关系,快速将产品送到顾客手中,从而成功进入市场。

电子商务在COVID-19之后的趋势如何?

-电子商务在COVID-19之前就一直在稳步增长,疫情可能会加速这一趋势,使其以更永久的方式发展。

对于小型零售商来说,实现电子商务的关键是什么?

-对于小型零售商来说,实现电子商务的关键在于建立自己的购物网站和购物车,并且拥有最后一公里配送能力。

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

348: How COVID Changed Last Mile Delivery Forever, with SEKO

Tendencias en Operaciones, Logística y Cadena de Suministro. EGADE Future Forum

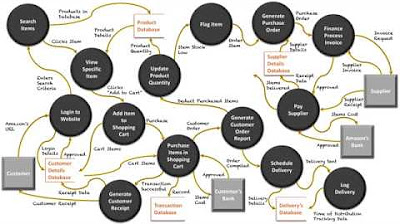

Context & Data Flow Diagram Request: Amazon

🔴 Wait...What? Is Cameco Trying To Kill The Uranium Spot Price?? 🤯 | Terry Papineau #video

Professional English On The Telephone - 38 Useful Phrases

Panel 3 | Digitalización de la cadena de suministro en el nuevo escenario económico

5.0 / 5 (0 votes)