Simple Interest Formula

Summary

TLDRThis video explains how to use the simple interest formula, I = P * R * T, to solve various word problems. Viewers learn to calculate interest earned over time, find the total savings balance, and determine the time needed to reach a savings goal. The video covers step-by-step examples, from basic interest calculations to determining annual interest rates and time periods for given savings goals. Additionally, the instructor offers an overview of an algebra course available on Udemy, covering arithmetic, fractions, equations, functions, and more advanced topics, complete with quizzes to reinforce learning.

Takeaways

- 💡 The simple interest formula is I = P * R * T, where I is interest, P is principal, R is the interest rate, and T is the time in years.

- 📊 John invests $5,000 at a 7% annual interest rate for 5 years and earns $1,750 in interest, with a total account value of $6,750 after 5 years.

- ⏳ Sally invests $8,000 at an 8.7% annual interest rate and earns $4,875 in interest over 7 years.

- 🔢 The decimal form of an interest rate is found by dividing the percentage by 100 (e.g., 7% becomes 0.07).

- 📈 To calculate the annual interest rate, you can rearrange the simple interest formula to solve for R (e.g., Mary earns $768 in interest on $3,000 over 4 years, so the rate is 6.4%).

- 🕰️ James invests $25,000 at 8% interest, and it takes 9 years for his account to reach $43,000, with $18,000 in total interest earned.

- 🔄 To solve for the number of years in an investment, rearrange the formula to solve for T, dividing total interest by the product of principal and rate.

- 💼 Understanding how to calculate simple interest is crucial for solving various types of financial problems involving investments and savings.

- 🧮 The video provides multiple real-world examples of how to use the simple interest formula in different scenarios, such as calculating total interest, principal, rate, or time.

- 📚 The video concludes with a recommendation for an algebra course on Udemy, covering topics like arithmetic, fractions, linear equations, and quadratic functions, with quizzes to reinforce learning.

Q & A

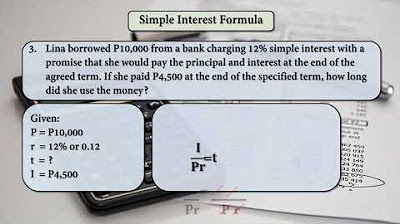

What formula is used to calculate simple interest?

-The formula used to calculate simple interest is I = P * R * T, where I is the interest, P is the principal amount, R is the annual interest rate (in decimal form), and T is the time in years.

How do you calculate the interest John earned on his investment?

-John invested $5,000 at an annual interest rate of 7% for 5 years. Using the formula I = P * R * T, we multiply 5,000 * 0.07 * 5 to get $1,750 in interest.

What is John's total account value after 5 years?

-John's total account value after 5 years is the sum of his initial investment and the interest earned, which is $5,000 + $1,750 = $6,750.

How long will it take Sally to earn $4,875 in interest if she invests $8,000 at 8.7% annual interest?

-Using the formula I = P * R * T, we know that I = 4,875, P = 8,000, and R = 0.087. Solving for T, we calculate T = 4,875 / (8,000 * 0.087), which gives us 7 years.

What is the annual interest rate for Mary's investment if she earns $768 in interest after 4 years on a $3,000 investment?

-Using the simple interest formula, we know I = 768, P = 3,000, and T = 4. To find R, we calculate R = 768 / (3,000 * 4), which gives R = 0.064 or 6.4% annual interest.

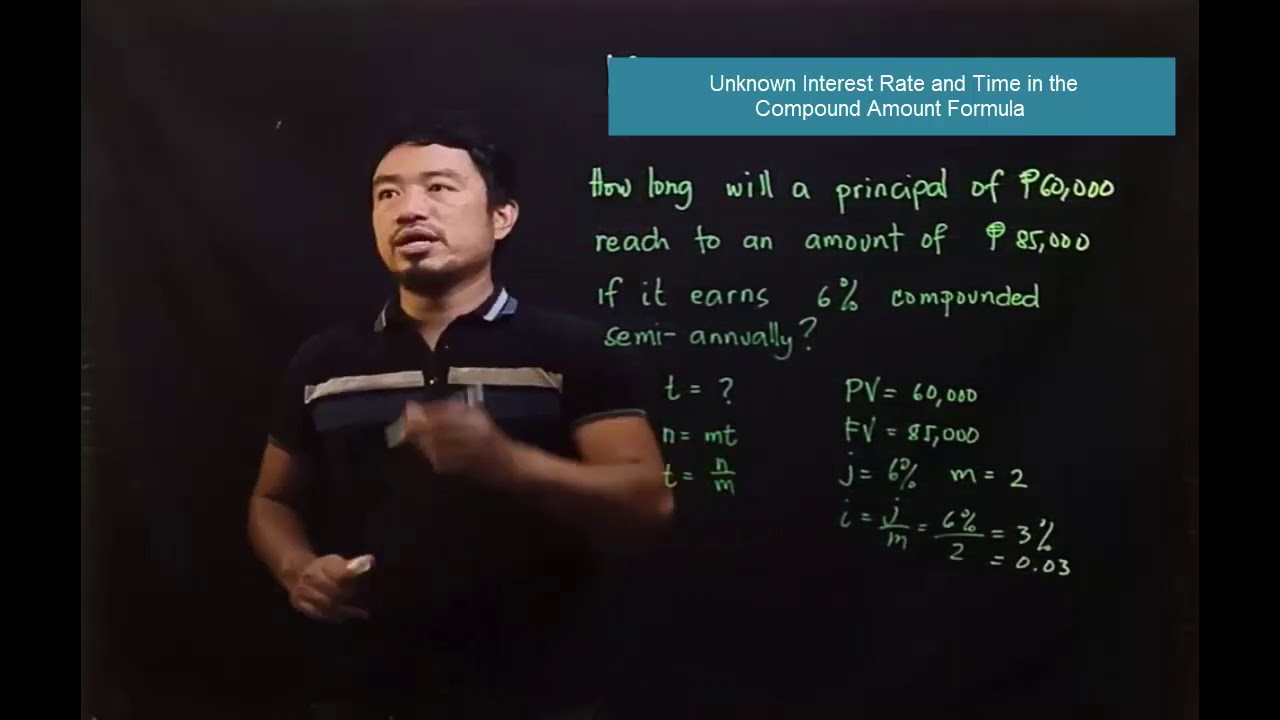

How long will it take for James' account to grow from $25,000 to $43,000 at an 8% annual interest rate?

-First, calculate the interest earned: $43,000 - $25,000 = $18,000. Using the formula I = P * R * T, we know I = 18,000, P = 25,000, and R = 0.08. Solving for T, we calculate T = 18,000 / (25,000 * 0.08), which gives 9 years.

How do you convert a percentage to a decimal for the simple interest formula?

-To convert a percentage to a decimal, divide the percentage by 100. For example, 7% becomes 0.07 when converted to decimal form.

What steps are involved in finding the number of years it takes to earn a certain amount of interest?

-First, apply the simple interest formula I = P * R * T. Then, isolate T by dividing the total interest (I) by the product of the principal (P) and the interest rate (R).

How do you determine the final account balance after interest is applied?

-To find the final account balance, add the interest earned to the initial principal. For example, if the principal is $5,000 and the interest earned is $1,750, the final balance is $5,000 + $1,750 = $6,750.

What is the decimal form of an 8.7% interest rate?

-The decimal form of an 8.7% interest rate is 0.087, which is calculated by dividing 8.7 by 100.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

5.0 / 5 (0 votes)