ICT Forex - The ICT London Close Killzone

Summary

TLDRThis video script discusses the 'London Close Kill Zone' in forex trading, a period between 10 a.m. and noon New York time when major currency pairs often set up optimal trade entry patterns. It explains how this time frame can offer short-term trading opportunities of 10-20 pips and emphasizes the importance of understanding daily price action for both day traders and swing traders. The script also highlights how the London close can act as a continuation point for trends into the New York afternoon session.

Takeaways

- 🕒 The London Close Kill Zone is a specific time frame between 10 a.m. and noon New York time when the market often sets up an optimal trade entry pattern.

- 🌐 This time frame is significant for major currency pairs, especially those involving the US dollar.

- 📈 The London Close often marks the high or low of the day, providing a clear range for traders to work with.

- 📊 The price action during the London Close typically sees a retracement off the high of the day on bullish days and off the low on bearish days.

- 🔍 Traders should monitor the market closely during this time for potential short-term trades of 10 to 20 pips.

- 📉 The London Close can also create continuation points for swings that may extend into the New York afternoon trading session.

- 🔄 It's important to note that the London Close can sometimes reverse the trend, indicating a change in direction for the rest of the day.

- 📋 The information from the London Close is useful for both entry points and managing positions, providing a better understanding of price movement.

- 🚫 The London Close Kill Zone strategy may not be effective during sideways or highly volatile, non-trending days.

- 📝 Understanding the characteristics of the London Close is crucial for defining the daily range and the key price points of accumulation, manipulation, and distribution.

Q & A

What is the ICT London Close Kill Zone?

-The ICT London Close Kill Zone is a specific time frame between 10 a.m. and noon New York time when the market often sets up an optimal trade entry pattern that can offer 10 to 20 pips for a scalp.

Why is the London Close Kill Zone significant for Forex traders?

-The London Close Kill Zone is significant because it often encapsulates the daily range of major currency pairs, providing traders with potential entry points for short-term trades.

What is the typical time frame for trades set up during the London Close Kill Zone?

-Trades set up during the London Close Kill Zone are typically very short-term in nature, with moves ranging from 10 to 20 pips.

How does the market behavior differ during the London Close Kill Zone compared to other times?

-During the London Close Kill Zone, the market often sees a retracement off the high of the day on bullish days and off the low on bearish days, which can lead to optimal trade entry setups.

What is the importance of the 5-minute chart when analyzing the London Close Kill Zone?

-The 5-minute chart is crucial for analyzing the London Close Kill Zone because it provides the necessary detail to identify optimal trade entry points on a short-term basis.

Can the London Close Kill Zone create continuation points for longer-term trades?

-Yes, the London Close Kill Zone can create continuation points that can extend well into the New York afternoon hours, providing opportunities for longer-term trades.

How does the London Close Kill Zone interact with the New York session?

-The London Close Kill Zone can influence the New York session by setting the high or low of the day, which can then lead to continuation of the trend seen in the London session.

What is the significance of the daily high or low forming during the London Close Kill Zone?

-The formation of the daily high or low during the London Close Kill Zone is significant as it can indicate the overall sentiment of the market for the day and potentially set the stage for the rest of the trading session.

What are the characteristics of a London Close that indicates a bullish day?

-A bullish day is indicated when the London Close forms the high of the day between 10 o'clock and noon New York time, suggesting an up-close day.

What should traders be cautious about when trading the London Close Kill Zone?

-Traders should be cautious that not all days will form a clear London Close Kill Zone pattern. Days with low volatility or 'seek and destroy' days may not follow the typical patterns, making trades less predictable.

How does understanding the London Close Kill Zone contribute to overall trading strategy?

-Understanding the London Close Kill Zone contributes to overall trading strategy by providing insights into short-term price movements and potential entry and exit points, which can be integrated into both day trading and longer-term trading strategies.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

The only 15 min London killzone trading strategy you need to watch

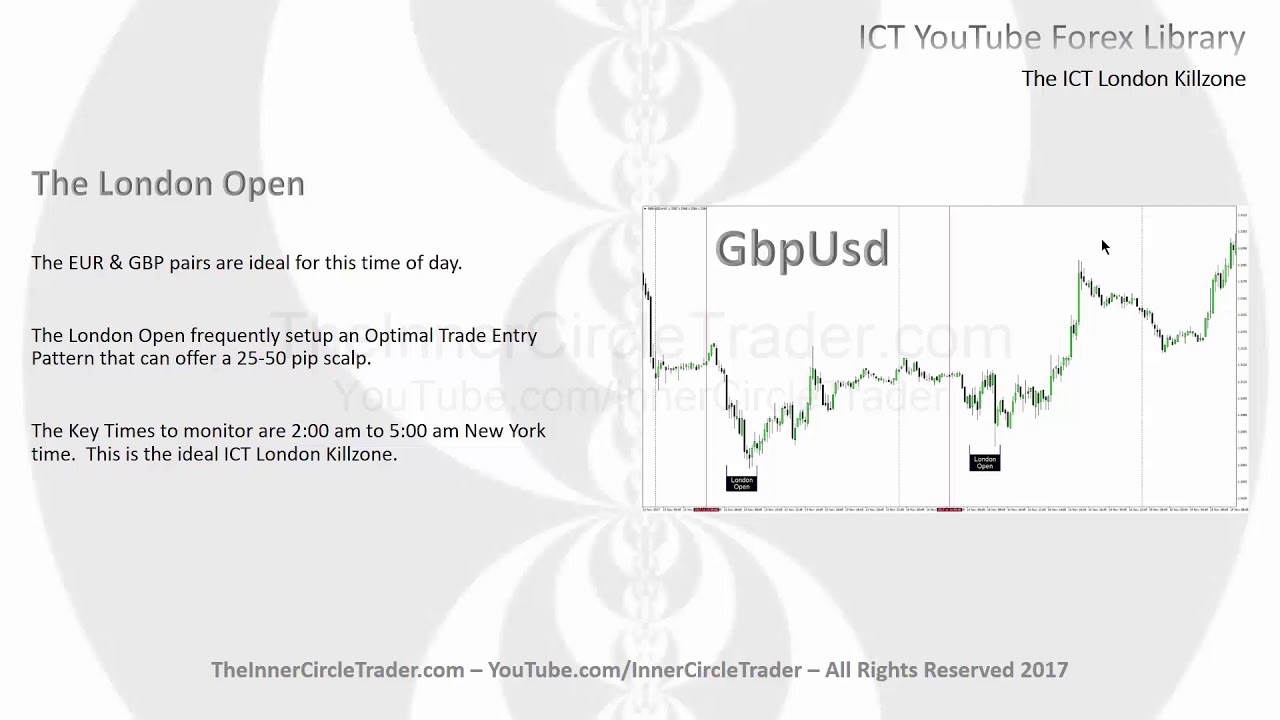

ICT Forex-The ICT London Killzone that confirms Daily Bias.

ICT Forex - The ICT London Killzone

ICT Mentorship Core Content - Month 08 - Defining The Daily Range

ICT SESSION & KILLZONES | Top Tier SMC | Hindi

Breaking Down ICT Macros From This Week

5.0 / 5 (0 votes)