BITCOIN NÃO CONSEGUE SUBIR: 58K! E AGORA? - Análise Técnica/Sentimento

Summary

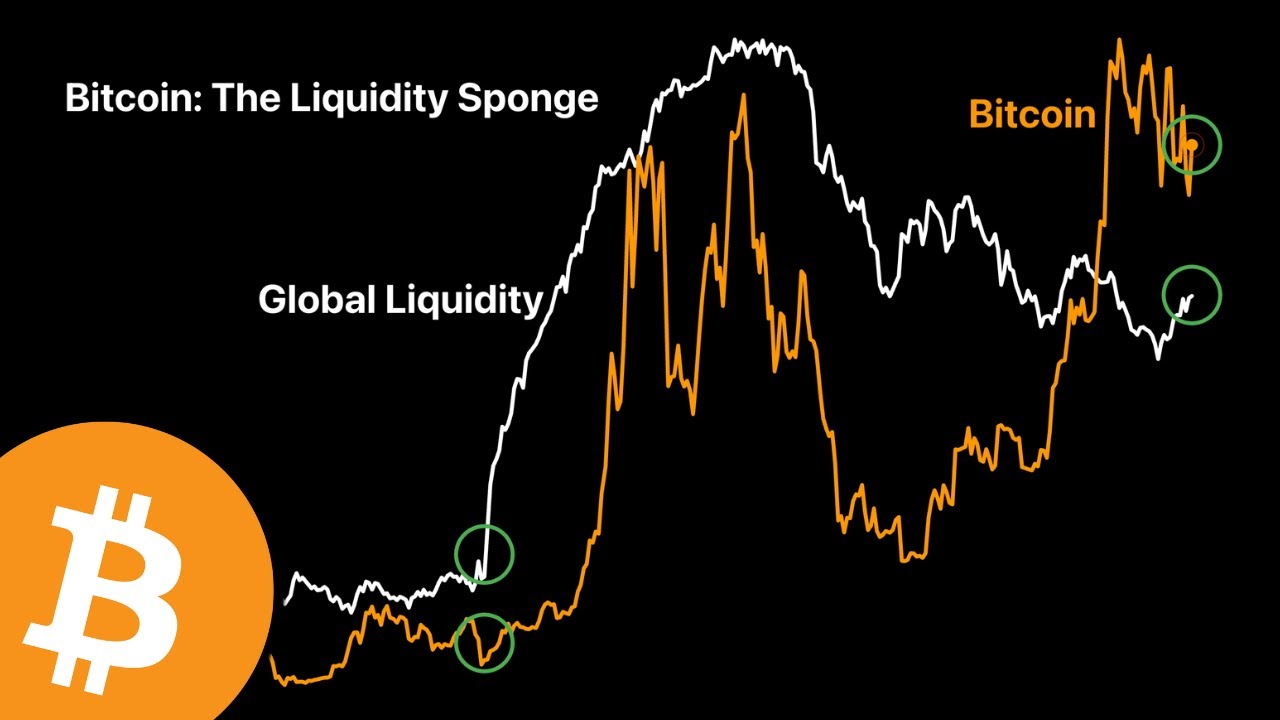

TLDRIn this video, the host discusses the recent weak performance of Bitcoin after the monthly close, noting it as an interesting development with significant liquidity captured. Despite a poor weekly close, the host sees a consolidation period with potential for a bullish breakout. They highlight the importance of the $57,000 support level and suggest it as a good entry point for accumulation. The sentiment indicators, including the historically low CVD, signal a bullish divergence, hinting at a significant price increase ahead. The host encourages viewers to accumulate assets at current prices, anticipating a strong market rebound.

Takeaways

- 📈 The speaker believes Bitcoin is currently weak but sees potential for a breakout upwards, suggesting it's a good time for accumulation.

- 📉 The monthly close for Bitcoin was the worst since January 2024, but the speaker interprets it as an interesting close that captured liquidity.

- 🔍 The speaker discusses the weekly chart, indicating a poor close but sees it as a sign of consolidation rather than a bearish trend.

- 💡 The speaker highlights a significant 'shadow' on the chart, suggesting it represents a large amount of selling at the low point in August, which could be an opportunity.

- 📊 The speaker notes that the long short rate is still high, indicating that a move above $60,000 could be a positive sign for Bitcoin's short-term trend.

- 📉 The speaker points out that the market is in a consolidation phase and suggests that a break above $65,000 could lead to a rapid increase in price.

- 📈 The speaker is optimistic about the potential for a significant upward movement in Bitcoin's price, based on the current market patterns and indicators.

- 📊 The speaker discusses the Coin Days Destroyed (CDD) indicator, which is at a historical low, suggesting a bullish divergence and a good sign for accumulation.

- 💰 The speaker mentions that there has been significant selling in the market, but the open interest and long short rate need to change for a better short-term outlook.

- 🌐 The speaker briefly touches on the impact of the US holiday on the market and the potential for the Bitcoin price to react once the markets open.

Q & A

What was the main objective of the video?

-The main objective of the video was to update the situation of Bitcoin, showing what the speaker hopes for in the next hours and days, and discussing their current strategy.

How did the speaker describe the monthly close of Bitcoin?

-The speaker described the monthly close of Bitcoin as interesting, despite it being the worst close in price since January 2024, as it left a significant shadow indicating a large amount of selling at the bottom.

What is the speaker's opinion on the current Bitcoin situation?

-The speaker believes that the current situation is a consolidation phase and that Bitcoin is likely to break upwards soon, considering the continuation pattern of the uptrend.

What is the significance of the shadow left by the monthly close?

-The shadow left by the monthly close signifies a period of despair where most people sold at the bottom, which according to the speaker, indicates a potential area for accumulation.

What does the speaker suggest about the weekly chart of Bitcoin?

-The speaker suggests that the weekly chart shows a poor close, engulfing the previous week's gains, indicating a consolidation phase rather than a sustained uptrend.

What is the speaker's view on the short-term price action of Bitcoin?

-The speaker views the short-term price action as a consolidation with a slight bearish bias, but believes that any drops are opportunities for accumulation.

What is the speaker's stance on the current sentiment indicators?

-The speaker considers the current sentiment indicators, particularly the low CVD, as a bullish divergence, suggesting that the market is setting up for a significant upward movement.

What historical comparison does the speaker make to support their bullish view?

-The speaker compares the current market conditions to the period between March and October 2023, highlighting the increased selling volume without a corresponding drop in price as a sign of accumulation.

What advice does the speaker give regarding accumulation opportunities?

-The speaker advises that the current market conditions present a great opportunity for accumulation, especially as the market consolidates and the CVD continues to drop.

What does the speaker suggest about the institutional orders in the market?

-The speaker notes that there are not many institutional orders, with some significant ones around the $57,000 to $58,000 range, suggesting that these levels could be potential accumulation points.

What is the speaker's outlook for the upcoming week in the markets?

-The speaker anticipates that the upcoming week could be positive, with the potential for the S&P 500 to reach new all-time highs, and advises to watch for the Dollar Index and Bitcoin's reaction to it.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenant5.0 / 5 (0 votes)