MINÉRIO DE FERRO CAINDO FORTE. VALE3 PODE CAIR AINDA MAIS. O QUE FAZER NESSE MOMENTO COM AS AÇÕES?

Summary

TLDRIn this YouTube video, the host discusses the investment potential of Vale, a prominent mining company, despite its association with commodities and market volatility. They caution against over-concentration in one stock, even if it offers good dividends like Vale. The host highlights the importance of portfolio diversification to manage risks and emotional impacts of market fluctuations. They also mention the impact of China's economic slowdown on iron ore prices and Vale's stock performance, suggesting that while the company may face short-term challenges, it remains an attractive investment opportunity for long-term investors.

Takeaways

- 😀 The speaker introduces a new video on their YouTube channel discussing Vale, a company known for its good results and potential dividends, but cautions that it is a commodity-linked company with inherent volatility.

- 🚫 The speaker emphasizes the importance of not having a highly volatile company like Vale as the majority of one's retirement portfolio due to the risk of reduced dividends.

- 📈 The speaker mentions a masterclass they are hosting, which is an opportunity for viewers to understand the current market situation and identify emerging opportunities.

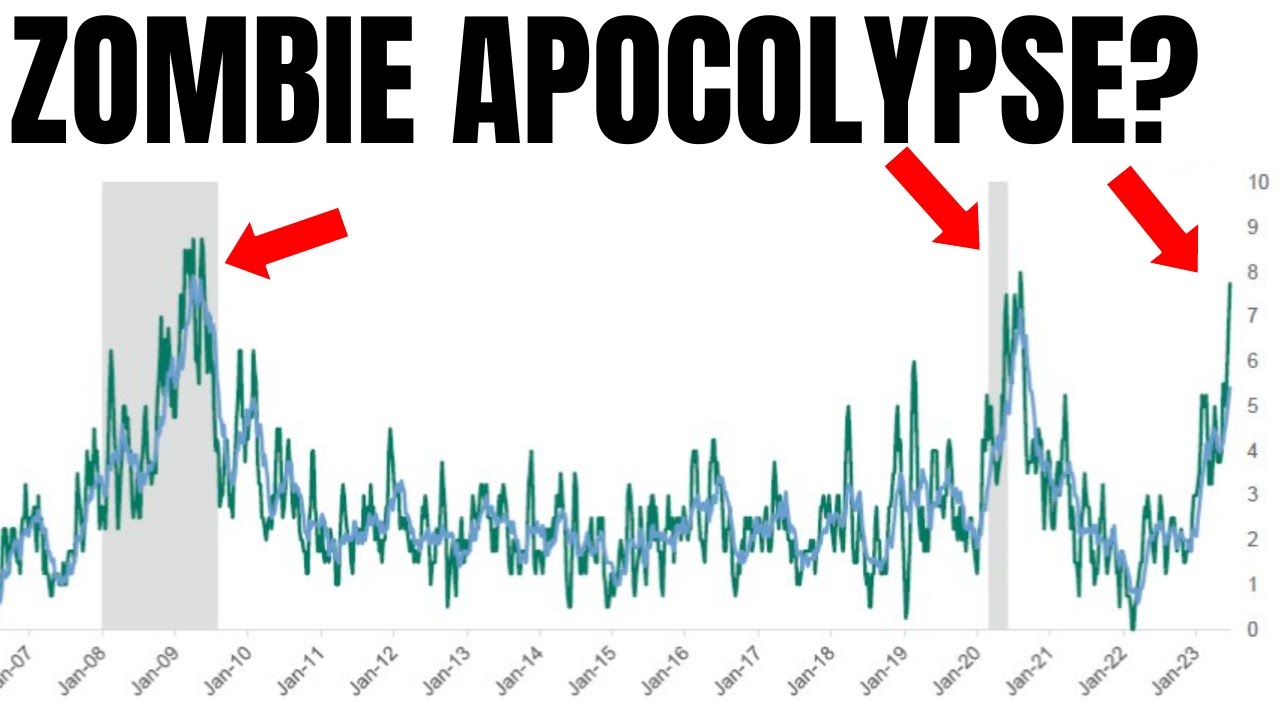

- 📉 The script discusses the impact of weak Chinese data on iron ore prices, which has led to a pessimistic outlook on Vale's stock, as China is a significant consumer of iron ore.

- 💰 Despite the lower iron ore prices and potential decrease in results, Vale continues to generate good cash flow, which is a crucial point for investors considering a mining company.

- 📊 The speaker highlights the importance of diversification in a portfolio to manage risks and emotional impact, especially when investing in volatile sectors like commodities.

- 📉 The speaker reports that iron ore prices have reached a 14-month low, influenced by China's economic slowdown and reduced demand for steel and iron ore.

- 📉 The investment in China's real estate sector, a major consumer of steel, has also seen a decline, which affects the demand for iron ore.

- 🤔 The speaker suggests that while there may be more room for iron ore prices to fall, the demand for iron ore is still high and is not expected to cease in the foreseeable future.

- 💹 The speaker shares their personal investment strategy with Vale, mentioning that they are buying shares below a certain reference price and maintaining a position in their portfolio, despite the current market situation.

- 📝 The speaker advises caution when investing in Vale or similar companies, emphasizing the need for a rational approach to building a diversified portfolio to avoid significant losses in certain scenarios.

Q & A

What is the main topic of the video?

-The main topic of the video is discussing the investment opportunity in Vale, a Brazilian multinational corporation engaged in metals and mining, particularly iron ore.

What is the speaker's opinion on Vale's performance and dividends?

-The speaker acknowledges that Vale has good performance and potential dividends, but advises caution due to its connection to commodities and the associated volatility.

Why does the speaker suggest being careful with investing in Vale?

-The speaker suggests being careful because Vale is a commodity-linked company, which can be highly volatile, and one should not rely heavily on its dividends for retirement planning.

What is the speaker's view on the importance of diversification in a portfolio?

-The speaker emphasizes the importance of diversification to avoid risks associated with heavily concentrated investments, especially in volatile commodity markets.

What is the event the speaker is promoting in the video?

-The speaker is promoting a masterclass that will be held as a live event on YouTube, scheduled for 7:30 PM on September 1st.

What does the speaker mention about the iron ore market and its impact on Vale?

-The speaker mentions that the iron ore market has reached a 14-month low due to weak data from China, which negatively impacts Vale's performance.

How does the speaker describe the current trend of iron ore prices?

-The speaker describes the current trend of iron ore prices as bearish, with the price dropping below $1 per ton.

What is the speaker's strategy for investing in Vale?

-The speaker's strategy is to buy Vale shares when they are attractively priced, specifically below R$70, and to maintain a diversified portfolio to manage risks.

What percentage of the speaker's portfolio is Vale?

-Vale represents 11.35% of the speaker's portfolio.

What is the speaker's perspective on Vale's future and the iron ore market?

-The speaker believes that despite the bearish trend for iron ore, Vale continues to generate good cash flow and remains an attractive investment opportunity, especially if the company decides to repurchase shares.

What advice does the speaker give to investors who are heavily invested in Vale and facing losses?

-The speaker advises such investors to consider their overall portfolio strategy and the importance of diversification to manage emotional stress and potential large losses.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

A VERDADE SOBRE INVESTIR EM VALE3

3 AÇÕES BARATAS pagando GRANDES DIVIDENDOS em FEVEREIRO

Summary of Cryptoassets by Chris Burniske and Jack Tatar | Free Audiobook

TRUMP ANUNCIOU as 5 CRIPTOS que vai COMPRAR para os ESTADOS UNIDOS

המניה הזאת טסה 55% ביום אחרי הדו"חות שלה - מה אמרנו עליה רגע לפני שזה קרה? 🤯

2024 Is Set To Break Another Stock Market Record...

5.0 / 5 (0 votes)