1. Concept of Indirect Taxes - Introduction | GST Lecture 1 | CA Raj K Agrawal

Summary

TLDRIn this informative lecture, CA Raj K Agrawal introduces students to the world of indirect taxes, focusing on GST (Goods and Services Tax). He explains the difference between direct and indirect taxes, highlighting how GST simplifies the tax system in India by replacing multiple taxes. The lecturer discusses the revenue generated from indirect taxes, with GST significantly outperforming income tax in terms of collections. The importance of understanding taxation, both for academic success and professional growth, is emphasized, alongside the potential benefits of GST for the government and the public.

Takeaways

- 😀 CA Raj K Agrawal, an experienced educator, introduces himself and explains his teaching background of over 15 years and his expertise in Income Tax, GST, and other accounting subjects.

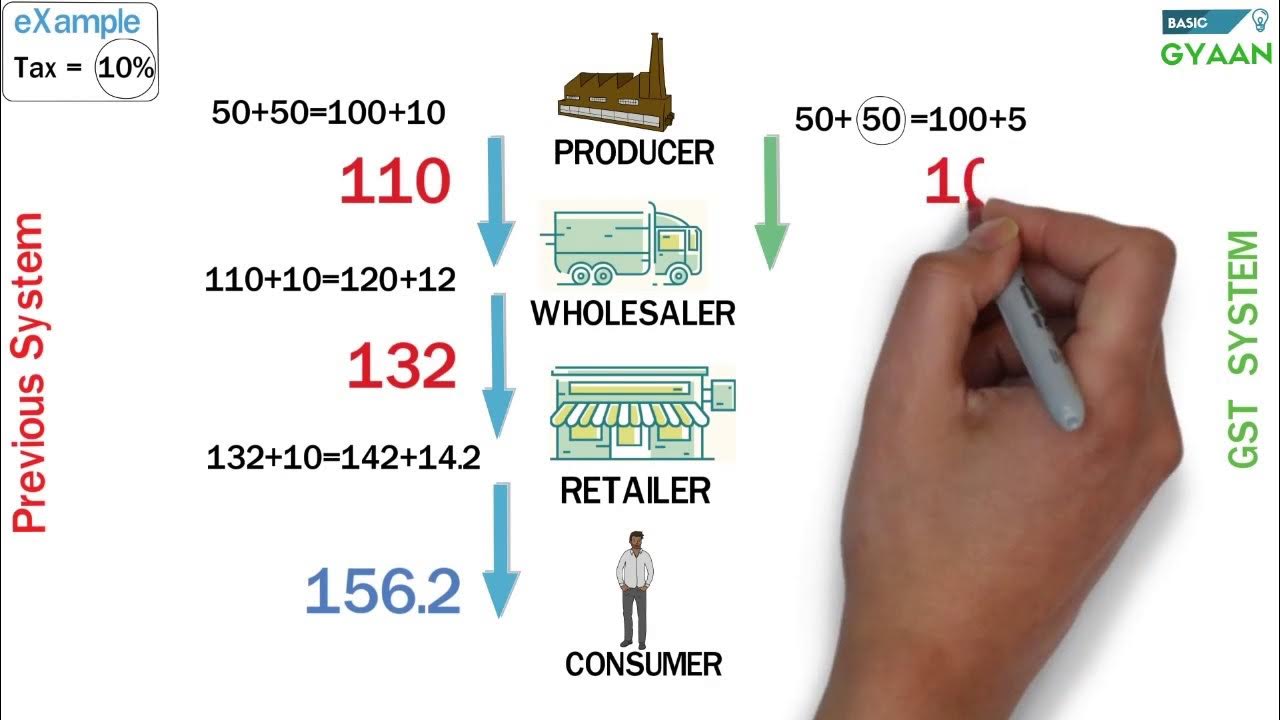

- 😀 The lecture begins with a discussion on the two types of taxes: Direct Tax and Indirect Tax, where Direct Tax is paid directly to the government (e.g., Income Tax), and Indirect Tax is paid through a third party (e.g., GST).

- 😀 Indirect taxes are less painful for the public compared to direct taxes, as people don’t directly feel the burden of taxes when buying goods and services.

- 😀 Indirect taxes are applied on goods and services, and individuals unknowingly pay taxes to the government via the sellers from whom they purchase products or services.

- 😀 Direct taxes, like Income Tax, are levied directly on individuals and often cause more discomfort because individuals have to give money to the government directly.

- 😀 GST, introduced in 2017, has replaced several indirect taxes, reducing the number of taxes in this category and simplifying the tax system.

- 😀 The government generates more revenue from indirect taxes like GST than from direct taxes like Income Tax, as people are more willing to pay indirect taxes without feeling the pain.

- 😀 The total revenue from indirect taxes, especially GST, is significant, with monthly collections ranging from ₹1.7 lakh crore to ₹2 lakh crore, totaling approximately ₹22 lakh crore annually.

- 😀 Income tax revenue has grown substantially over the past decade, from ₹6 lakh crore in 2014 to ₹19 lakh crore today, driven by increased compliance under the Modi government's policies.

- 😀 While 8 crore people file income tax returns in India, only about 1 crore businesses file GST returns, as GST is applicable only to those engaged in business with a certain turnover threshold.

- 😀 CA Raj K Agrawal encourages students to embrace learning GST, highlighting that understanding indirect taxes and GST will not only help in exams but will also provide practical knowledge for professional life.

Q & A

Who is the educator in the script and what is his background?

-The educator is CA Raj K Agrawal, a qualified Chartered Accountant with an All India Rank. He has been teaching for over 15 years and has instructed more than 1 lakh students in CA, CS, and CMA programs. He specializes in Income Tax, GST, Accounting, Cost Accounting, and Financial Management.

What is the main topic of the lecture in the script?

-The main topic of the lecture is GST (Goods and Services Tax) and the concept of indirect taxes. The educator introduces the audience to the fundamentals of indirect taxes and explains the importance of GST in the modern taxation system.

What are the two types of taxes mentioned in the script?

-The two types of taxes mentioned are Direct Taxes and Indirect Taxes. Direct taxes are paid directly to the government by individuals, while indirect taxes are paid to the government through intermediaries such as sellers.

What is the difference between Direct Tax and Indirect Tax?

-Direct tax is paid directly to the government by individuals, such as Income Tax. Indirect tax is paid by consumers through sellers, who then remit the tax to the government, such as GST on goods and services.

Why do people feel less pain when paying Indirect Taxes compared to Direct Taxes?

-Indirect taxes are embedded in the price of goods and services, so consumers do not feel the immediate impact of the tax. In contrast, direct taxes like Income Tax require individuals to pay a separate amount directly to the government, which causes more financial discomfort.

How does GST affect the collection of indirect taxes?

-GST has simplified the collection of indirect taxes by consolidating many taxes into one single system. This reduces the complexity of tax compliance and increases revenue for the government by making the process more efficient.

What is the government’s stance on indirect taxes versus direct taxes?

-The government focuses more on indirect taxes like GST, as they generate more revenue with less public resistance. The revenue from indirect taxes, especially GST, surpasses that of direct taxes, and there is potential for reducing direct taxes in the future.

How much revenue does the government earn from GST compared to Income Tax?

-The government earns approximately ₹22 lakh crore annually from GST, which is higher than the ₹19 lakh crore earned from Income Tax. GST has become a major source of revenue, surpassing traditional income tax collections.

Why do only a small number of people file GST returns compared to Income Tax returns?

-Only people who are in business and have a turnover above a certain threshold are required to file GST returns. In contrast, every person who earns income, whether through business or as a salaried employee, must file an Income Tax return.

What does the educator suggest about the future of Income Tax and GST?

-The educator suggests that the government may reduce reliance on Income Tax in the future and focus more on GST, as GST generates higher revenue and is less burdensome for the public. Some even propose the abolition of Income Tax in favor of a single tax system like GST.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

Understand GST in 10 minutes

The only TAX SYSTEM VIDEO you will ever need. | INDIAN TAX SYSTEM EXPLAINED | Aaditya Iyengar

Goods and Services Tax (GST) (Part-1) - Simplified | Drishti IAS English

GST Easy Explanation (Hindi)

Session 5 - 08 What is a BAS

What is GST? What Are The Types Of GST? Basics Of GST Lecture 1 By CA Rachana Ranade

5.0 / 5 (0 votes)