REKONSILIASI BANK

Summary

TLDRThe video lesson focuses on the importance and process of bank reconciliation in accounting. It explains the common reasons behind discrepancies between a company's cash records and the bank's records, highlighting factors such as unrecorded deposits, bank fees, errors in entries, and outstanding checks. The lesson emphasizes the need for accurate record-keeping to ensure the cash balance is correctly aligned between the company and the bank. It concludes with a reminder about assignments and encourages students to review and complete the task as per instructions.

Takeaways

- 😀 Bank reconciliation is a process to match the company's cash records with the bank's records.

- 😀 Discrepancies can arise due to various factors, which should be identified during the reconciliation process.

- 😀 The reconciliation process helps identify differences between the bank statement and the company's records, which should be adjusted.

- 😀 Some common factors that increase the company’s cash balance include receivables, interest income, and service fees.

- 😀 Common factors that reduce the company's cash balance include bank fees, collection charges, and returned checks.

- 😀 Factors that increase the bank's cash balance include deposits in transit and errors in recording transactions.

- 😀 Factors that reduce the bank's cash balance include outstanding checks and errors in deposit or withdrawal records.

- 😀 Bank reconciliations often involve adjusting for timing differences, such as checks that have been written but not yet processed by the bank.

- 😀 It is essential to review the company's accounting for mistakes like recording errors or missing deposits.

- 😀 A common cause of discrepancies is a failure to account for bank fees or interest on the company’s side.

- 😀 The bank reconciliation process can identify errors and ensure the company’s cash records are accurate before finalizing financial statements.

Q & A

What is the main purpose of bank reconciliation?

-The main purpose of bank reconciliation is to compare and adjust the records of the company with the bank’s records to identify discrepancies and ensure that both sets of records match.

What are some factors that increase the cash balance according to the company's records?

-Factors that increase the cash balance in the company's records include receivables like notes, interest income, and service fees, among others.

What types of costs or fees can decrease the company's cash balance?

-Costs such as bank administration fees, dishonored checks, and check returns can decrease the company's cash balance.

What are 'deposits in transit' and how do they affect the bank's cash balance?

-Deposits in transit refer to funds that have been deposited by the company but have not yet been processed by the bank. They increase the bank's cash balance.

How can recording errors impact the reconciliation process?

-Recording errors, whether in the company's or the bank's records, can cause discrepancies in the cash balance, either by overstating or understating income or expenditures.

What is the role of outstanding checks in the reconciliation process?

-Outstanding checks are checks that the company has issued but have not yet been processed or cleared by the bank. These decrease the bank's cash balance.

What does 'penerimaan yang terlalu kecil' (small underpayments) refer to in the context of bank reconciliation?

-It refers to instances where the company receives a smaller payment than expected, which can increase the company's cash balance when recorded accurately.

What is the significance of 'kesalahan pencatatan' (recording errors) in bank reconciliation?

-'Kesalahan pencatatan' (recording errors) can either lead to overstatements or understatements of income or expenses, which causes discrepancies between the company’s and bank’s cash balances.

What is the next step after completing the bank reconciliation process, as mentioned in the lesson?

-After completing the bank reconciliation, students are expected to work on exercises provided by the instructor, which are shared in the class's communication group (WA group).

What should students do with the bank reconciliation exercises given by the teacher?

-Students should complete the bank reconciliation exercises in their designated notebook (buku polio), as instructed by the teacher.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

How To Do A Bank Reconciliation (EASY WAY)

How to Import Bank Statement in Tally Prime | Auto Bank Reconciliation | Excel to Tally Prime |

How To Close The Books For Dummies. Financial Close In 15 Steps

AKM 1 - Bab 7. Kas & Rekonsiliasi Bank

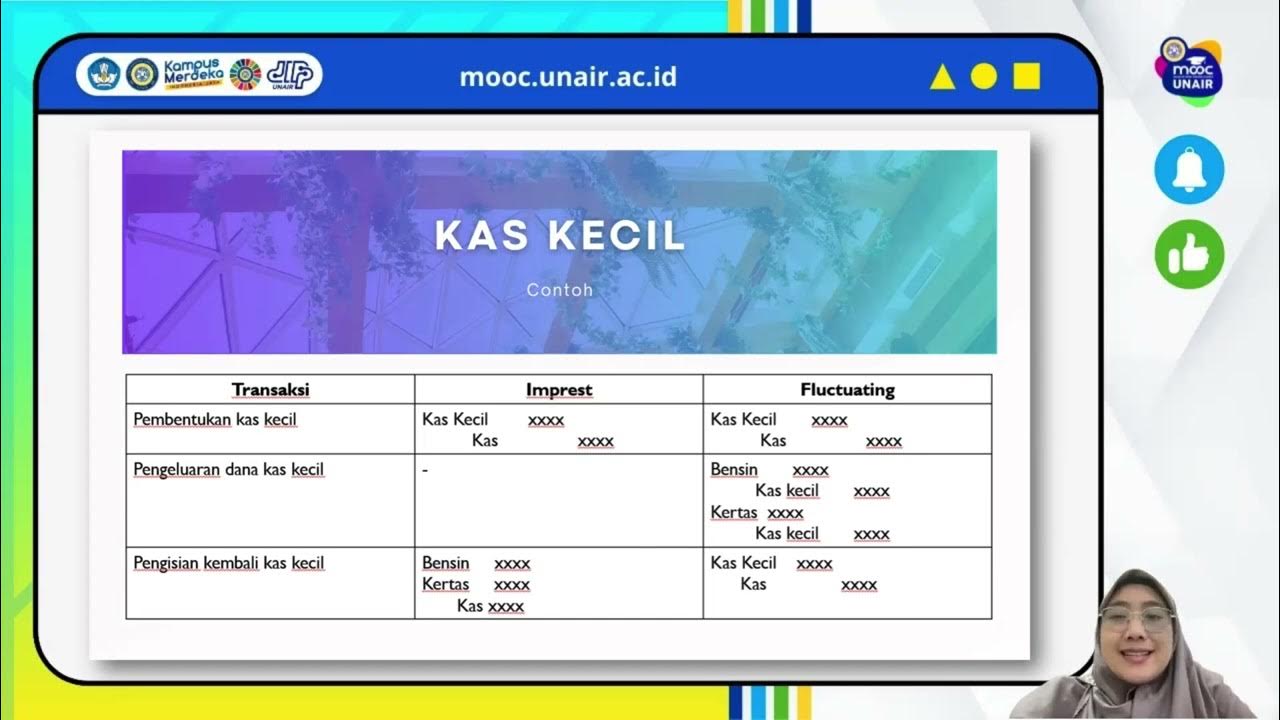

Rekonsiliasi Bank | Adhelia Desi Prawestri, S.Pd., M.Akun.

Kas & Setara Kas | MOOC | Materi Akuntansi Perpajakan Seri 2

5.0 / 5 (0 votes)