The Truth About Inducement In ICT Concepts

Summary

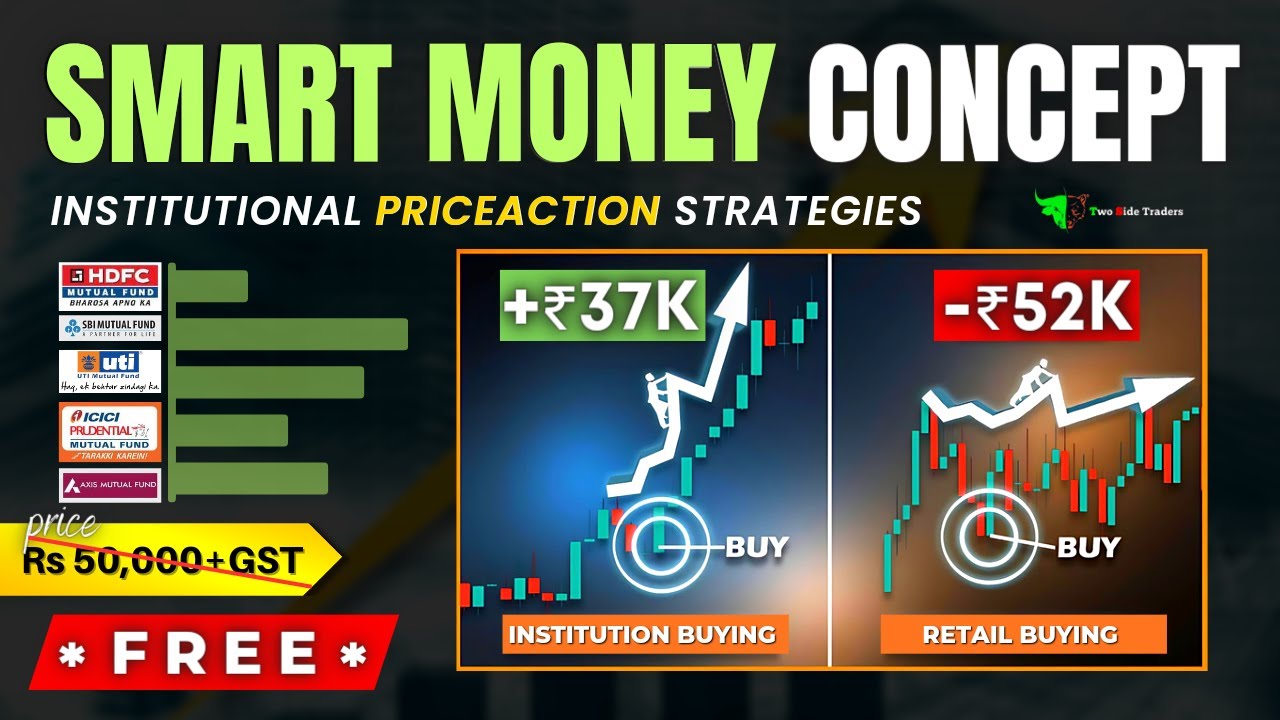

TLDRThis video explains the concept of inducement in trading, a strategy used by 'smart money' (institutional traders) to manipulate the market. The video highlights how retail traders are often induced to buy at high prices, only to have the market turn against them. Through visual examples, the presenter explains how patience and understanding market structures, such as waiting for price to reach discount areas, can help avoid inducement. By emphasizing the importance of waiting for the right entry points and using tools like Fibonacci retracement, traders can protect themselves from falling into this trap and trade more effectively.

Takeaways

- 😀 Inducement occurs when smart money manipulates the market to make traders enter at the wrong times and levels, leading to losses.

- 😀 Smart money refers to institutional investors who have more knowledge and resources than retail traders.

- 😀 A major cause of inducement is traders' impatience to enter the market too early without waiting for the right price levels.

- 😀 Traders often buy at high prices (premium areas) and end up selling at lower prices (discount areas), which is what smart money takes advantage of.

- 😀 The key to avoiding inducement is to wait for the market to reach the optimal price levels, like institutional reference points or discount zones.

- 😀 Price movements and market structures, such as breakouts and shifts in trend, are tools used by smart money to deceive retail traders.

- 😀 Patience is crucial in trading. Traders need to wait for the market to reach more favorable price points before entering a trade.

- 😀 Using tools like the Fibonacci tool can help traders identify premium and discount areas to enter the market at better prices.

- 😀 Inducement is a result of traders entering too early and not recognizing the bigger market trends that smart money is following.

- 😀 A typical scenario of inducement is when a trader buys at a high price, gets stopped out, and then the market reaches a more favorable price for smart money to enter.

- 😀 By understanding the behavior of smart money and staying patient, traders can avoid inducement and increase their chances of successful trades.

Q & A

What is the concept of inducement in trading?

-Inducement refers to a strategy used by smart money to manipulate the market, causing traders to make poor decisions, like entering trades too early or at the wrong price. It typically results in new traders getting stopped out before the price ultimately moves in the expected direction.

How do smart money traders use inducement to their advantage?

-Smart money traders manipulate price movements to create false signals that lead other traders to enter trades prematurely. They aim to buy assets at a cheaper price while others buy at a higher price, only to sell to these traders at a profit when the price reaches a premium.

What role does impatience play in inducement?

-Impatience is a major factor in inducement. Traders who rush into trades without waiting for optimal setups are more likely to fall for inducement, entering trades too early and getting stopped out before the market moves in their favor.

Why is it important to wait for the right price levels in trading?

-Waiting for the right price levels is crucial because it allows traders to enter the market at a price that aligns with smart money strategies, either at a discount (cheaper price) or premium (higher price). Entering too early or at the wrong price can lead to losses due to inducement.

What is a breaker block in the context of smart money trading?

-A breaker block is an institutional reference point where price shifts, typically signifying a change in market structure. It represents an area where traders should consider entering the market, as it often marks the point where smart money looks to buy or sell.

How can the use of Fibonacci tools help avoid inducement?

-Fibonacci tools can help identify premium and discount areas on the chart, allowing traders to make better decisions by entering trades at more favorable prices. This helps avoid entering at expensive price levels, where smart money is waiting to sell.

What does it mean to buy at a premium and sell at a discount?

-Buying at a premium means entering the market at a higher price, while selling at a discount means selling at a lower price. Smart money traders typically buy assets at discounted prices and sell them at higher prices, profiting from the price difference.

How does market structure influence inducement?

-Market structure plays a significant role in inducement. Smart money traders observe market shifts and structure changes to predict where the price will move. Traders who do not understand market structure may fall into inducement by entering trades at the wrong time or price.

What is the relationship between early trade entry and inducement?

-Early trade entry increases the likelihood of falling victim to inducement. By entering trades prematurely, traders often get stopped out before the price moves in their favor. Smart money uses this impatience to their advantage, manipulating the price to trap these early entrants.

What can traders do to avoid inducement in the market?

-To avoid inducement, traders should exercise patience, wait for the market to reach discount or premium areas, and ensure they enter trades based on proper technical analysis. Understanding smart money concepts like breaker blocks and using tools like Fibonacci retracement can help improve entry timing.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

Why You Fail With Smart Money Concept & ICT|Liquidity and Inducement Traps

Konsep Smart Money Untuk Pemula || Dasar Strategi Para Big Trader

C'est quoi le Smart Money Concepts en Trading ? | EP.1

Don't Be a Liquidity and Inducement

How Operator TRAPS New Traders | *FREE Advance Price Action Trading | Smart Money Concepts In Hindi

ICT Market Maker Model - Explained In-depth!

5.0 / 5 (0 votes)