JURNAL PENCATATAN AKUNTANSI PEMERINTAH

Summary

TLDRThis video explains the government accounting cycle, focusing on the processes of recording financial transactions, budgeting, and generating reports. It covers the distinction between cash and accrual accounting methods, as well as the key financial reports produced in government accounting, such as the Realization of Budget Report and Balance Sheet. The script also highlights important documents like SP2D (fund disbursement orders) and SPJ (accountability statements), while emphasizing the roles of different government entities like the Bendahara Pengeluaran (cash disbursement officer). The discussion provides a clear overview of how public sector financial management works in practice.

Takeaways

- 😀 Governmental accounting differs from conventional accounting as it focuses on managing public finances, specifically in local government settings.

- 😀 The accounting cycle in government starts with document transactions (e.g., SP2D, SPJ), which are essential for tracking fund distribution and usage.

- 😀 The financial statements in governmental accounting include Laporan Realisasi Anggaran (LRA), Laporan Operasional, Neraca, and others, which track budget realization and government performance.

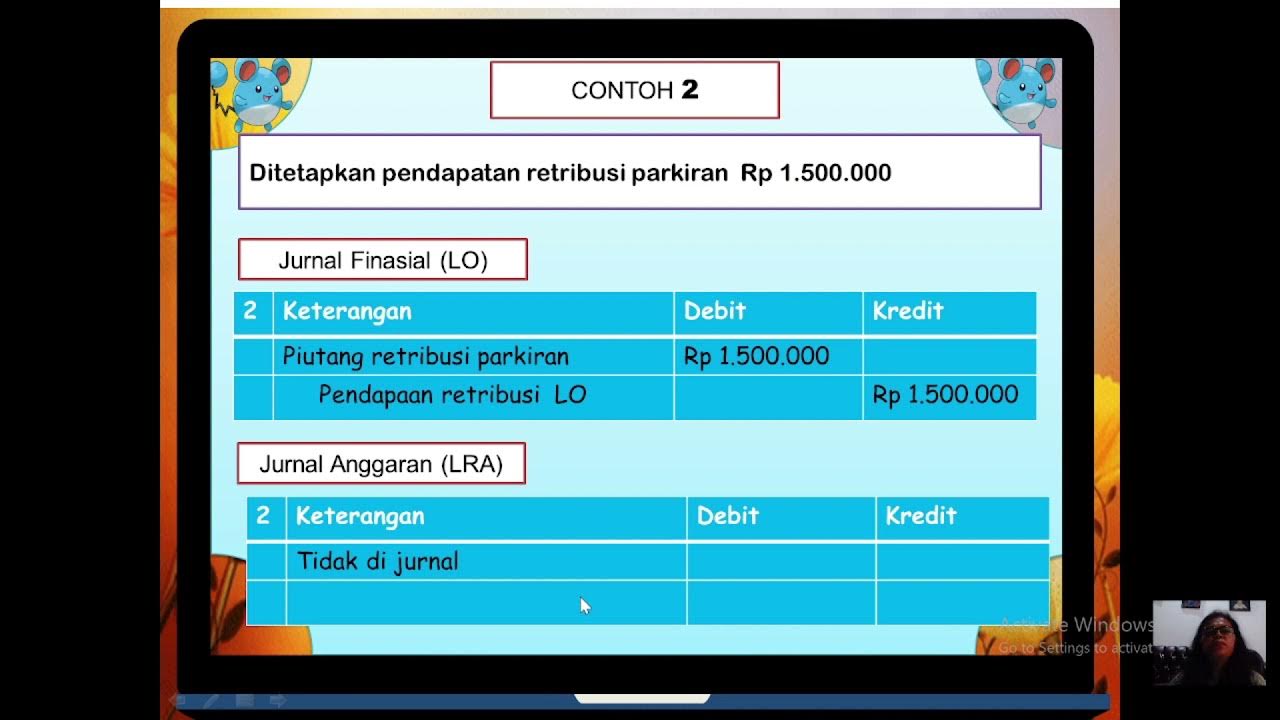

- 😀 Governmental accounting relies on two types of accounting methods: accrual basis (records transactions when they occur) and cash basis (records transactions only when cash changes hands).

- 😀 Budgeting in governmental accounting is similar to personal budgeting, where funds are allocated for specific purposes and any surplus or deficit must be recorded.

- 😀 Accrual-based accounting is used for non-cash transactions, while cash-based accounting records transactions involving actual cash flow.

- 😀 Internal controls in governmental finance require the separation of accounts for cash receipts (bendahara penerimaan) and expenditures (bendahara pengeluaran) to ensure proper management and oversight.

- 😀 In governmental accounting, journal entries are made for both non-cash (accrual-based) and cash (cash-based) transactions, with the aim of accurately reflecting financial activity.

- 😀 The government must account for budget surpluses and deficits through journals, which detail the planned versus actual expenditures.

- 😀 Understanding how financial transactions are documented and reported in governmental accounting is essential for professionals working in public finance and administration.

Q & A

What is the main focus of government accounting as explained in the transcript?

-The main focus of government accounting in the transcript is the process of documenting and reporting financial transactions in government entities, particularly focusing on the creation of financial reports from documents, as well as the distinction between cash and accrual-based accounting methods.

What are the key financial reports mentioned in government accounting?

-The key financial reports in government accounting include the Realization Budget Report (Realisasi Anggaran), the Statement of Changes in Equity, the Operational Report, the Balance Sheet, the Cash Flow Statement, and the Notes to the Financial Statements (Catatan atas Laporan Keuangan).

What is the role of APBD in government accounting?

-APBD (Anggaran Pendapatan dan Belanja Daerah) is the regional government budget set by the local parliament (DPRD). It outlines the planned revenue and expenditure for the government entity and serves as the basis for budgeting and financial transactions.

What is the function of SP2D in government accounting?

-SP2D (Surat Perintah Pencairan Dana) is a document that authorizes the disbursement of funds in government accounting. It is crucial for ensuring that funds are allocated according to the approved budget and are properly recorded.

How does the accrual basis accounting differ from cash basis accounting in government accounting?

-In accrual basis accounting, transactions are recorded when they occur, regardless of whether cash has been exchanged. On the other hand, cash basis accounting only records transactions when cash is received or paid, focusing solely on the actual flow of money.

What types of transactions are recorded using cash basis accounting?

-Under cash basis accounting, only transactions that involve actual cash inflows or outflows are recorded. This means that non-cash transactions, such as accruing income or liabilities, are not recorded.

What is the purpose of budget surplus and deficit in government accounting?

-A budget surplus occurs when actual revenue exceeds the planned expenditure, while a deficit happens when the revenue falls short. Both surplus and deficit must be carefully monitored and recorded to ensure proper financial management and accountability in government operations.

Why is it important to separate cash in the 'bendahara' (treasury) into two categories?

-It is important to separate cash in the 'bendahara' into 'bendahara penerimaan' (cash receipts) and 'bendahara pengeluaran' (cash expenditures) to maintain proper internal control. This separation helps prevent misuse of funds and ensures transparency in financial operations.

What are the roles of SKPD and PPKD in government accounting?

-SKPD (Satuan Kerja Perangkat Daerah) is a local government unit responsible for implementing government activities, while PPKD (Pejabat Pengelola Keuangan Daerah) is the official in charge of managing local government finances. The PPKD has higher authority in financial management compared to SKPD.

What is the importance of adjusting entries (penyesuaian adjustment) in government accounting?

-Adjusting entries in government accounting are important for ensuring that financial records accurately reflect the actual financial position of the government. These entries are necessary to account for accruals, deferrals, and other adjustments needed for accurate financial reporting.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

5.0 / 5 (0 votes)