Materi Siklus Akuntansi Pemerintah Daerah ~ Kelas 11 ~ Praktikum Akuntansi Lembaga (Part 2)

Summary

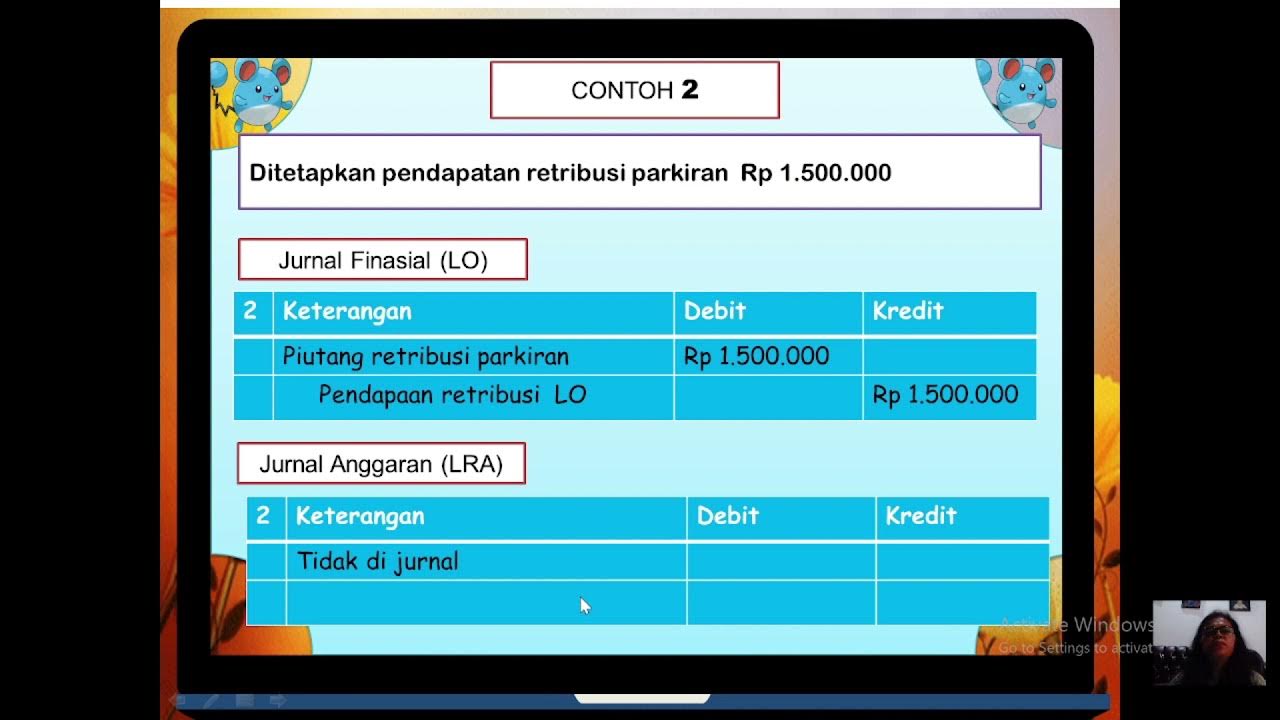

TLDRThis video tutorial focuses on governmental accounting, specifically for local governments and their respective regional work units (SKPD). It explores the processes of budget planning (APBD) and the execution of public sector expenditures, such as the documentation of financial transactions, including SPP (payment request letters). Key topics include handling smaller and larger financial transactions, budgeting for contingencies, and the different types of payment mechanisms such as money advances (UP) and urgent payment needs (TPU). The session also covers how these transactions are recorded in the accounting system for SKPDs, aiming to ensure financial transparency and accuracy in local government operations.

Takeaways

- 😀 The video focuses on government accounting, particularly the local government accounting cycle and the importance of SKPD (Satuan Kerja Perangkat Daerah) in the accounting process.

- 😀 The main objective of the lesson is to help students understand the preparation and implementation of accounting for SKPD, starting with the understanding of the APBD (Anggaran Pendapatan dan Belanja Daerah) or Regional Revenue and Expenditure Budget.

- 😀 The cycle of government accounting involves the creation of documents like the Document of Budget Implementation (BPA) that includes income and expenditure records used by SKPD for their budgeting activities.

- 😀 Transactions are recorded and supported by proof of transaction documents, which include vouchers for expenditure such as the SPP (Surat Permintaan Pembayaran).

- 😀 The SPP has two categories: SPP for large expenditures (SPP AL) and small expenditures (SPP UP) that are supported by the Treasury or SKPD.

- 😀 SKPD has a budget allocation for the year that needs to be used appropriately, and the expenditure process is tracked and recorded carefully using the SPP.

- 😀 The UP (Uang Persediaan) is a small cash fund that SKPD manages for day-to-day operational needs, while TPU (Tambahan Uang) is used for urgent expenditures.

- 😀 Expenditures for urgent needs are processed through TPU, which involves a separate mechanism for requesting funds from the regional treasury.

- 😀 For larger expenditures, such as payroll or significant purchases, the SKPD handles payments directly using SPP AL, which doesn't involve the public treasury.

- 😀 The session will continue with hands-on exercises in journaling transactions for SKPD, helping students apply theoretical concepts to practical accounting tasks in government settings.

Q & A

What is the main focus of the video lesson?

-The video lesson focuses on government accounting at the local level, specifically for regional government agencies (SKPD), and the processes of budget execution, expenditure documentation, and journalizing transactions.

What is the role of the APBD in the accounting process?

-The APBD (Anggaran Pendapatan dan Belanja Daerah) is a key budget document used in local government accounting. It outlines the revenue and expenditure plans, which are then implemented by SKPD for their financial activities.

What types of expenditure documentation are used in local government accounting?

-Expenditure documentation in local government accounting includes SPP (Surat Permintaan Pembayaran) for payment requests and UP (Uang Persediaan) for small-scale payments. There are also other documents like TPU (Tambahan Uang) for urgent payments.

What is the difference between SPP and SPP-UP?

-SPP (Surat Permintaan Pembayaran) is used for larger payments and direct expenditures, such as salaries or major purchases, while SPP-UP is used for smaller, routine transactions, often managed through a petty cash system.

What is the function of UP (Uang Persediaan) in government accounting?

-UP (Uang Persediaan) is money allocated by the government to SKPD to cover minor expenses during the fiscal year. It acts as a form of petty cash, which can be used to cover expenditures that were not originally budgeted.

How does TPU (Tambahan Uang) differ from UP?

-TPU (Tambahan Uang) is allocated for urgent, unforeseen needs, such as large-scale expenses that are not planned for. It is a mechanism for obtaining additional funds quickly when required for emergency payments.

What is the importance of journalizing transactions in local government accounting?

-Journalizing transactions ensures that all financial activities are accurately recorded and documented. This is essential for transparency, accountability, and effective financial management within local government agencies.

What happens after the financial transactions are recorded in the journal?

-Once transactions are journalized, they are then posted to the general ledger, which aggregates all financial activities and provides a clear overview of the financial situation of the SKPD.

What does the term 'BPA' refer to, and how is it used in the accounting process?

-BPA (Dokumen Pelaksanaan Anggaran) refers to the Budget Implementation Document. It is used to track the actual spending of funds by SKPD, and serves as a guide for expenditure based on the APBD.

What will be covered in future lessons according to the video?

-Future lessons will focus on practical exercises, specifically on how to journalize transactions that occur within SKPD, allowing learners to gain hands-on experience in government accounting.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Akuntansi Pemerintahan Daerah (gambaran umum)

Materi Akuntasi Pemerintah Daerah Kelas 11 Praktikum Akuntansi Lembaga

Dokumen Perencanaan Pembangunan Daerah #Sesi Pengantar

[MEET 8-1] - AKUNTANSI SEKTOR PUBLIK - TRANSAKSI BELANJA & BEBAN SKPD

Konsep HOBO (Home Office Branch Office) di Akuntansi Pemerintahan Daerah

JURNAL SKPD AKUNTANSI PEMERINTAHAN

5.0 / 5 (0 votes)