The ORB Strategy (High Odds Breakout Technique)

Summary

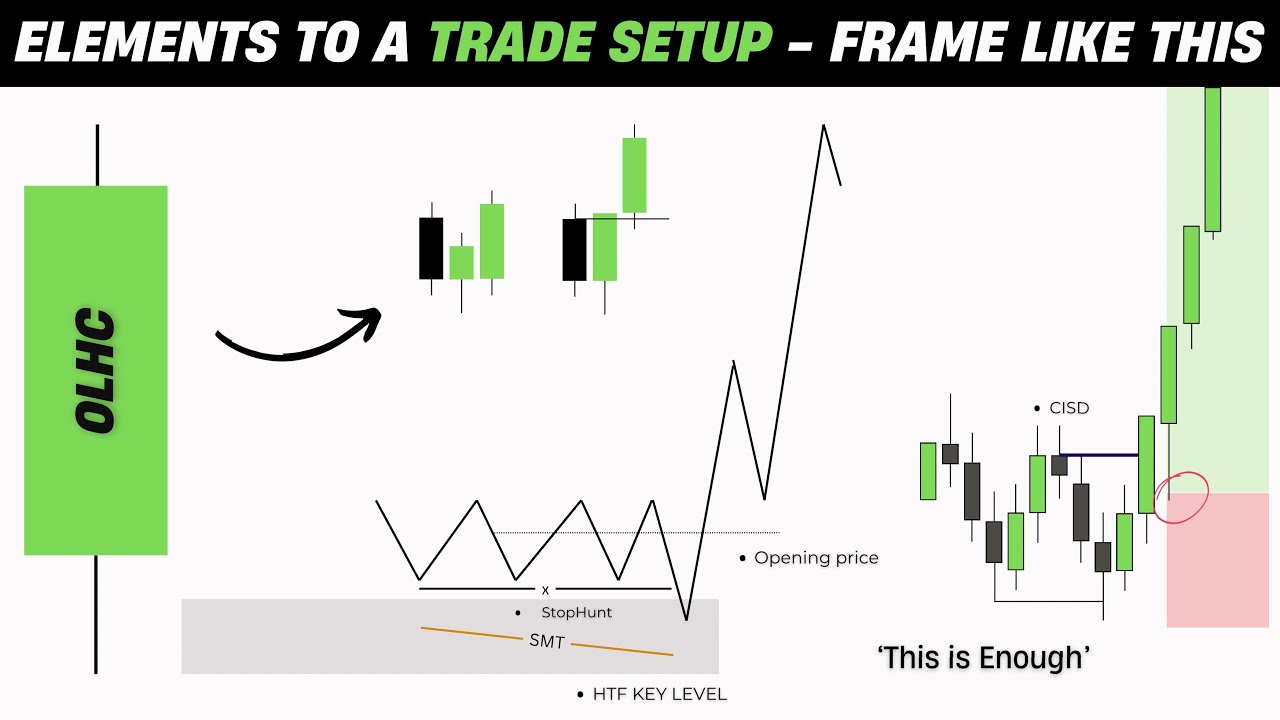

TLDRIn this video, the speaker walks through a detailed breakdown of the opening range break trade strategy, emphasizing the importance of key patterns, higher time frame alignment, and volume confirmations for successful trading. The speaker also highlights various methods for locking in profits, including trend breaks, trailing stops, and ATR-based moves. With a focus on continuous training and skill development, the video introduces SMB Capital, a top trading firm offering traders the opportunity to trade with firm capital while benefiting from coaching and resources. It's a great opportunity for ambitious traders to take their skills to the next level.

Takeaways

- 😀 Higher time frame alignment is crucial when identifying key market trends and patterns.

- 😀 Volume confirmations play a key role in validating trading signals and setups.

- 😀 The opening range break trade is a strategy based on breaking and retesting key market levels.

- 😀 Combining multiple take-profit methods, such as trailing stops or measured moves, can be effective for locking in profits.

- 😀 Some traders use trend breaks via EMAs (9 and 21) as part of their profit-taking strategy.

- 😀 Using a two-minute bar trailing stop can help in taking sales into momentum for better profit management.

- 😀 Different situations may call for different profit-taking methods, and flexibility in approach is important.

- 😀 Traders at SMB Capital train like professional athletes, continually honing their trading skills.

- 😀 Elite traders at SMB Capital make substantial profits, with some earning millions in a single year.

- 😀 SMB Capital hires and develops traders who can trade both in-house and remotely using the firm's capital.

- 😀 To become a trader at SMB Capital, applicants need to meet criteria such as being highly ambitious and fitting the firm’s culture.

Q & A

What is the opening range break trade setup discussed in the script?

-The opening range break trade setup involves identifying a price range formed during the initial minutes of trading and then trading in the direction of the breakout once the price breaks above or below this range. Key elements include high timeframe alignment, volume confirmations, and pattern recognition.

How does volume play a role in the opening range break trade setup?

-Volume is a critical confirmation tool in the opening range break trade. Higher volume during the breakout indicates stronger momentum, which increases the likelihood of a successful trade. Low volume may suggest a lack of conviction in the price movement.

What are the key patterns that traders should look for in the opening range break trade?

-Traders should look for wedge patterns, where the price consolidates before a breakout. A wedge pattern typically precedes a strong move, signaling that a trend may emerge after the breakout.

What is the 'SMB Big Dog Trade' mentioned in the script?

-The 'SMB Big Dog Trade' refers to a trade setup where the price breaks out of a wedge and begins to trend upward, offering a significant move to the upside. This setup combines the opening range break with a clear pattern of price action and momentum.

What methods do traders use to take profits in the discussed trading strategy?

-Traders use various methods to lock in profits, such as trend breaks via the 9 and 21 EMAs, using a two-minute bar trailing stop, or targeting a measured move based on ATR (Average True Range). Often, traders combine multiple methods to secure profits.

Why is higher timeframe alignment important in the opening range break trade?

-Higher timeframe alignment ensures that the trade is in sync with the broader market trend. By confirming the direction of larger timeframes, traders increase the probability of success in their trades and avoid going against the market's overall trend.

What do traders look for when drawing a wedge pattern?

-Traders look for a consolidation phase where the price narrows and forms a triangle or wedge-like shape. This pattern signals a potential breakout. When the price breaks above the upper boundary of the wedge, it is considered a strong buying signal.

What is the significance of SMB Capital’s approach to training and hiring traders?

-SMB Capital emphasizes intensive training and skill development, likening their traders to pro athletes who continuously work to improve. They look for ambitious, determined traders who fit their culture, offering them the opportunity to trade firm capital and develop their skills without risking personal funds.

What are the criteria for getting an interview at SMB Capital?

-SMB Capital looks for traders who are highly ambitious, determined, and fit the firm’s culture. Importantly, they are open to molding traders who may not yet be profitable, focusing on developing their skills with the firm’s coaching and resources.

What is the opportunity presented to traders by SMB Capital in this script?

-SMB Capital offers traders the chance to use their firm's capital to trade without risking personal money. Traders can also work remotely and potentially make up to seven figures by trading firm capital, all while receiving coaching and mentorship from the firm.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

Smart Money NY Session Trade | ICT Concepts + FVG + Order Block Precision | BREAKDOWN

How To Use Balanced Price Range with IPDA Times

Trading Against Order Flow Using MMSM (Trade Breakdown)

ICT Market Structure Simplified!

ICT Concepts - Elements To A Trade Setup

Make $10,000/Month with This Simple ICT Inversion Strategy

5.0 / 5 (0 votes)