Jurnal Penutup & Jurnal Pembalik | Pengantar Akuntansi

Summary

TLDRThis video tutorial introduces the concepts of closing entries and reversing entries in accounting, focusing on the processes carried out at the end of an accounting period. It explains the purpose of closing entries, including zeroing out temporary accounts like revenues and expenses, and preparing for the next period. It also covers the importance of reversing entries to simplify journalizing transactions in the new period. The video details common examples, such as adjusting for accrued expenses or prepaid items, and emphasizes the role of these entries in ensuring accurate financial reporting.

Takeaways

- 😀 Jurnal penutup is made at the end of an accounting period to close nominal accounts such as revenue and expenses.

- 😀 The purpose of jurnal penutup is to reset the balances of nominal accounts to zero at the beginning of the new period.

- 😀 Jurnal penutup helps to separate the transactions of income and expenses, making it easier to calculate profits and losses.

- 😀 It ensures that the financial statements reflect accurate information by excluding previous period's revenues and expenses.

- 😀 Key components of jurnal penutup include entries for dividends, expenses, profit and loss summary, and revenue.

- 😀 A post-closing trial balance is created to ensure all real accounts are balanced after closing entries.

- 😀 Jurnal pembalik, or reversing entries, are created at the beginning of a new accounting period to reverse certain adjusting journal entries.

- 😀 The function of jurnal pembalik is to simplify recording transactions and avoid errors in the next accounting period.

- 😀 Accounts that require reversing entries include accrued expenses, prepaid expenses, unearned revenue, and receivables.

- 😀 Not making reversing entries could lead to incorrect financial statements, as it would duplicate or misstate transactions from the previous period.

Q & A

What is the purpose of closing journal entries (jurnal penutup)?

-The purpose of closing journal entries is to reset the balances of nominal accounts, such as revenue and expenses, to zero at the end of an accounting period. This ensures that these accounts reflect only the current period’s transactions and are ready for the next accounting cycle.

When are closing journal entries typically made?

-Closing journal entries are typically made at the end of the accounting period, often on December 31st, to close the nominal accounts and prepare the financial statements for the next period.

What are the main accounts affected by closing journal entries?

-The main accounts affected by closing journal entries are nominal accounts, including revenues, expenses, income summary (ikhtisar laba rugi), and dividends.

Why is it necessary to separate income and expense accounts with closing journal entries?

-It is necessary to separate income and expense accounts to avoid mixing the financial data of one period with the next. This ensures that the profit or loss for the current period is accurately reported and does not get carried forward to the following period.

What is a post-closing trial balance (neraca saldo setelah penutupan)?

-A post-closing trial balance is a list of all real accounts (assets, liabilities, and equity) after the closing journal entries have been made. Its purpose is to ensure that the books are balanced and that the closing process has been accurately completed.

What are reversing journal entries (jurnal pembalik), and why are they important?

-Reversing journal entries are made at the beginning of the next accounting period to reverse certain adjusting entries made in the previous period. They simplify the recording of transactions in the new period and prevent the risk of double-counting or errors.

Which accounts typically require reversing journal entries?

-Accounts that typically require reversing journal entries include prepaid expenses, accrued expenses, and accrued revenue. These accounts are adjusted during the period but need to be reversed to avoid misrepresentation in the new period.

What would happen if reversing journal entries were not made?

-If reversing journal entries are not made, accounts could double-count transactions, leading to errors in the financial statements. For example, payments or receipts could be recorded again as if they are new transactions when they are not.

Can you give an example of a closing journal entry for revenue?

-A closing journal entry for revenue would involve debiting the revenue account and crediting the income summary (ikhtisar laba rugi) account to clear out the revenue balance at the end of the period.

How does closing the accounts help in financial reporting?

-Closing the accounts ensures that only real accounts, like assets and liabilities, carry forward balances into the next period. It also ensures that the income and expenses from the current period do not mix with those from the following period, giving a clear and accurate view of the company's financial position.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

Neng Ida Soniawati–Ekonomi XII-SMAN 1 Babakan Madang-Jurnal Penutup & Pembalik – Nov2022#pgtkjabar

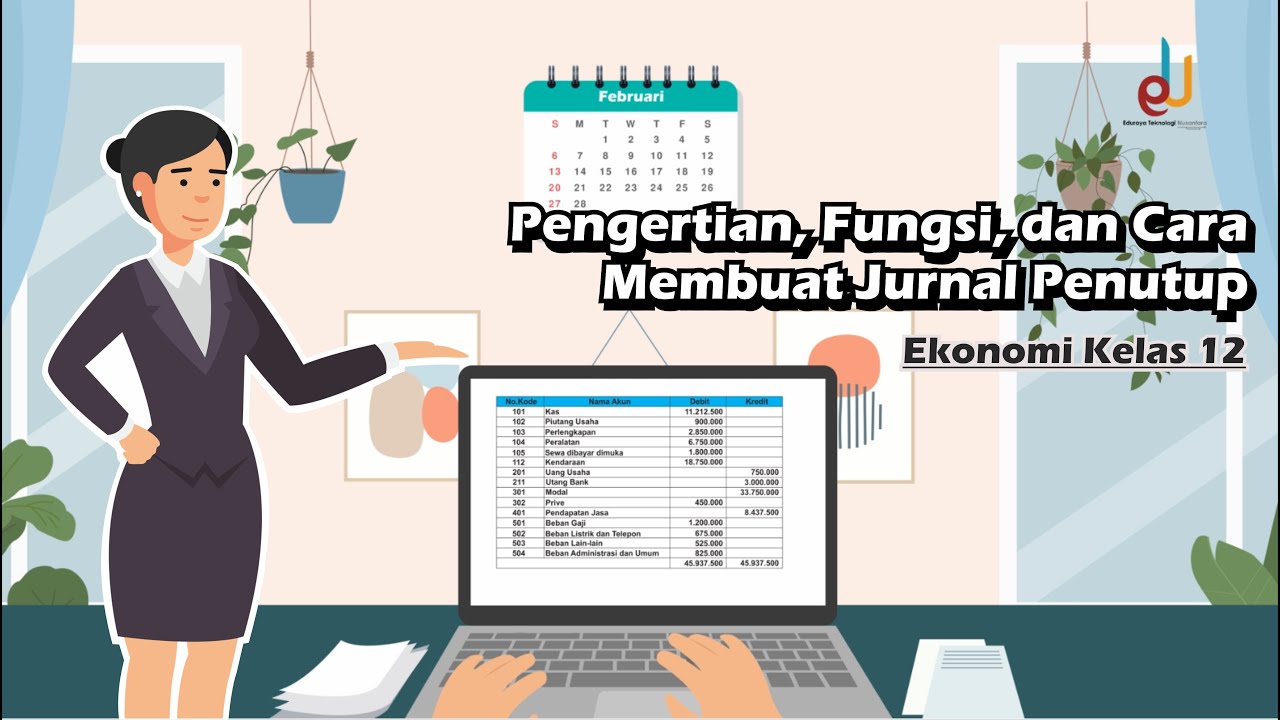

Pengertian, Fungsi, dan Cara Membuat Jurnal Penutup | Ekonomi Kelas 12 - EDURAYA MENGAJAR

Jurnal Penutup, Buku besar setelah penutupan, Neraca saldo setelah penutupan | PART 3

Belajar Akuntansi Dengan Mudah - Piutang Wesel & Hutang Wesel ( Wesel Tagih dan Wesel Bayar )

Lecture 05: Adjusting Entries Concept. Accounting Cycle. [Fundamentals of Accounting]

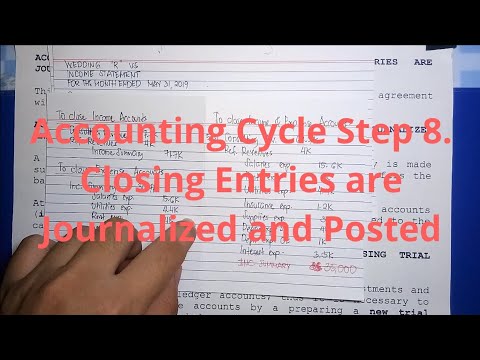

Basic Accounting | Accounting Cycle Step 8. Closing Entries are Journalized and Posted (Part 1)

5.0 / 5 (0 votes)